Optimism Still in Fashion: The 2025 HKTDC CENTRESTAGE Survey

The 10th anniversary of CENTRESTAGE, Asia’s fashion spotlight organised by the Hong Kong Trade Development Council, serves as a trade and exchange platform for local, Asian and international fashion brands and professionals. Held on 3 6 September this year, CENTRESTAGE showcased more than 260 brands from 25 countries and regions, attracting over 10,000 global buyers.

To keep track of the current state of the garment and fashion industry and the latest views on market prospects, the HKTDC conducted a survey involving 405 buyers and exhibitors at the event. The overall sentiment among respondents is positive, with 56% respondents expecting sales growth over the next 12 to 24 months.

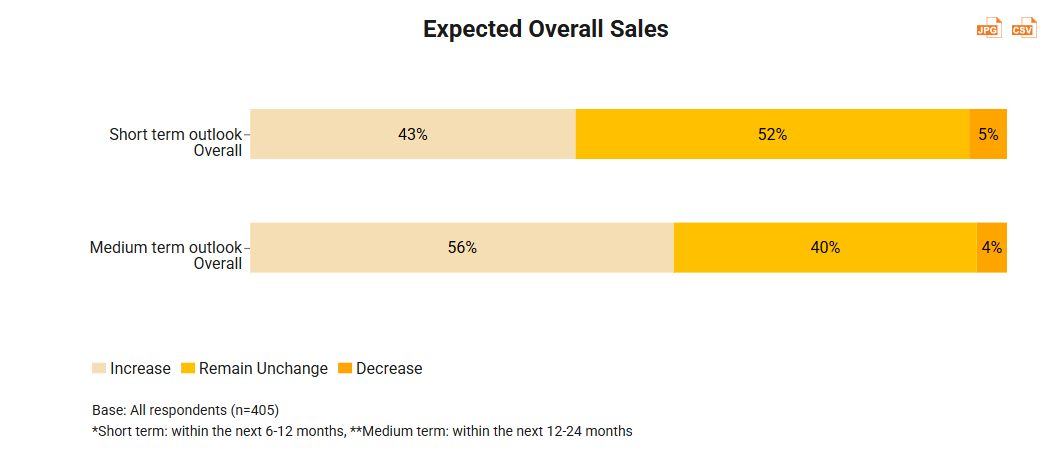

Slightly optimistic in short and medium-term outlooks

When it comes to short term sentiment, the majority of respondents believe overall sales are likely to remain stable for the next six to 12 months, with 43% believing there will be an increase in sales during that period. The overall outlook appears promising, with 56% of respondents expecting growth in overall sales over the next one to two years. Across both timeframes, less than 5% of respondents expressed the expectation of a decline in sales, reflecting an overall neutral to positive sentiment in the industry.

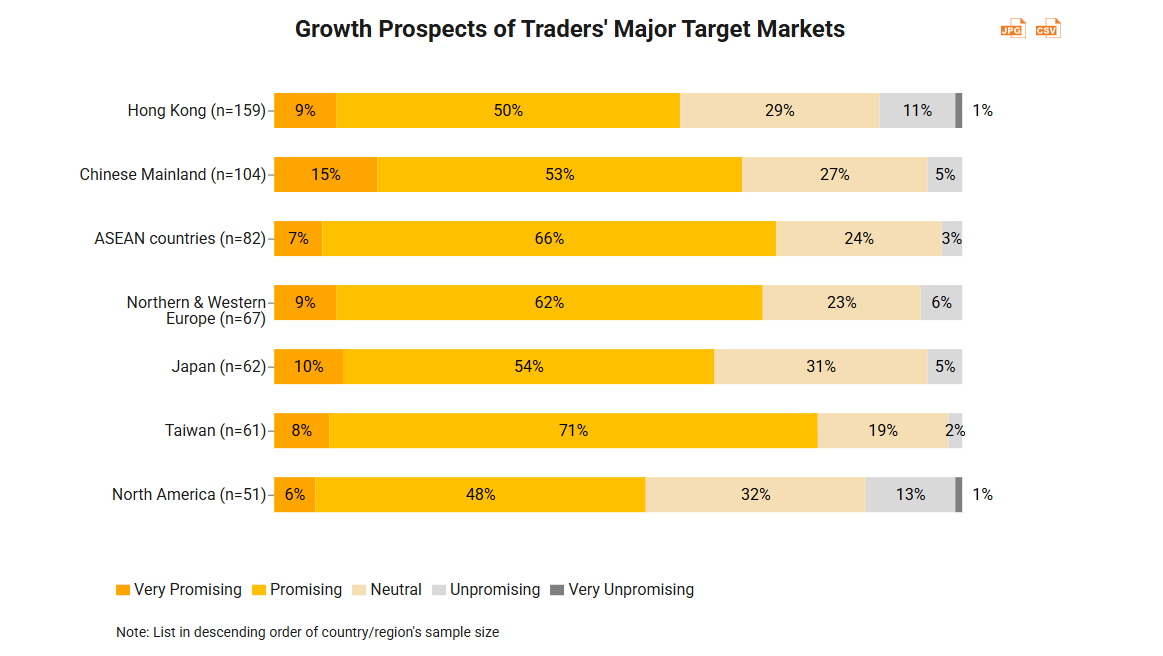

Hong Kong, Chinese Mainland and the ASEAN countries have emerged as the primary target markets for traders. This year, companies are demonstrating greater optimism regarding growth prospects across different markets. More than half of respondents believe that the outlook for all key selling markets is either promising or very promising, suggesting this positive sentiment is widespread rather than limited to specific regions. However, when it comes to North America, traders tend to adopt a more neutral perspective, with optimism likely tempered by the ongoing US tariffs policy.

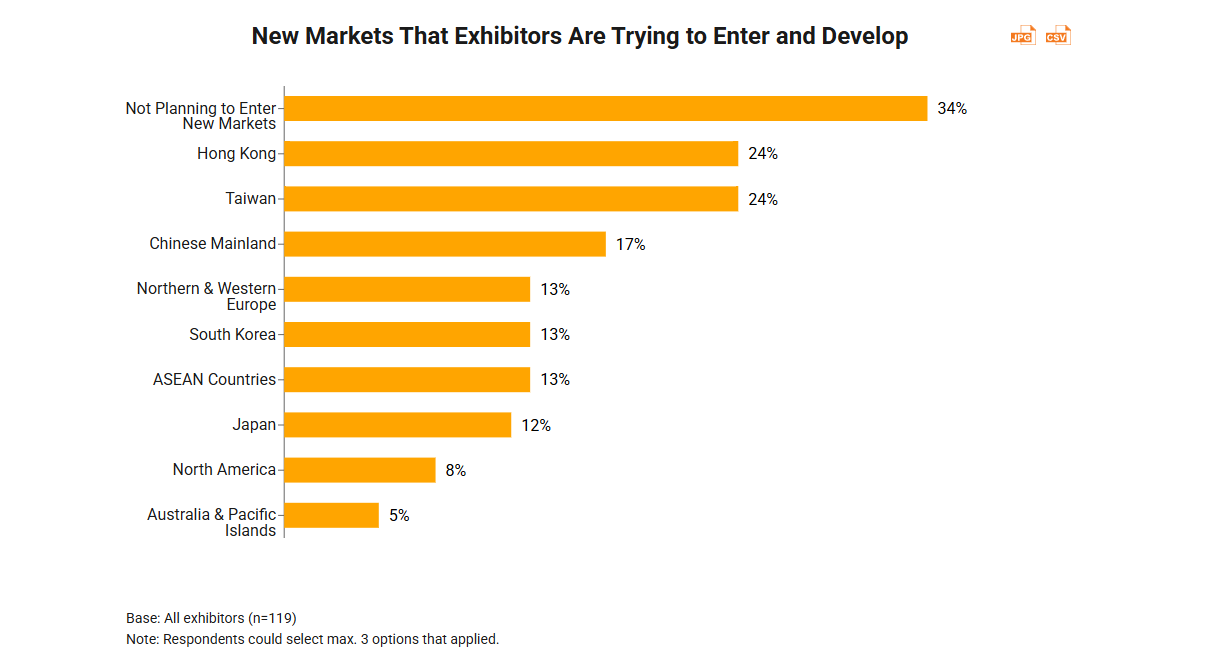

Amid slow global economic growth and heightened trade policy uncertainty, exhibitors are proceeding cautiously with their market expansion plans. Survey results indicate that 34% of respondents have no intention of exploring new markets. However, Hong Kong (24%), Taiwan (24%), and Chinese Mainland (17%) emerged as the top three destinations where exhibitors expressed interest in pursuing market development. Typically, Europe, Japan and the Americas are the usual new markets of interest for exhibitors. However, this shift in preference may be attributed to the increased presence of international brand exhibitors at this year’s event, many of which are not established in the Chinese market.

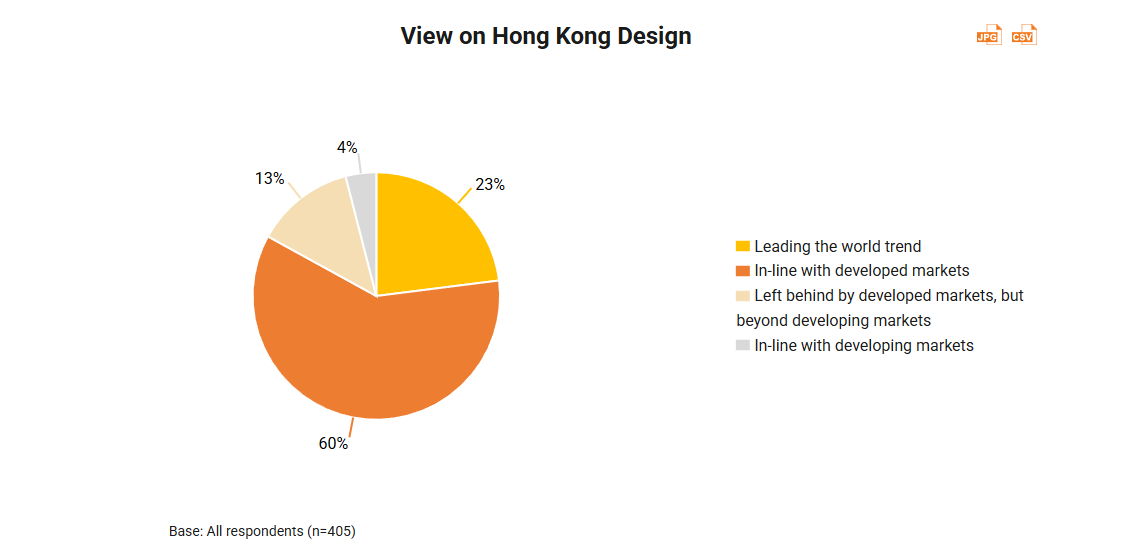

Overall, industry players are positive towards Hong Kong‑designed fashion products. While 60% of the respondents indicated that Hong Kong designs are on a par with those from developed markets, 23% revealed that these products are at the forefront of global trends. This reflects strong confidence in Hong Kong's fashion design sector and suggests it is steadily progressing towards becoming a global trendsetter.

Industry and product trends

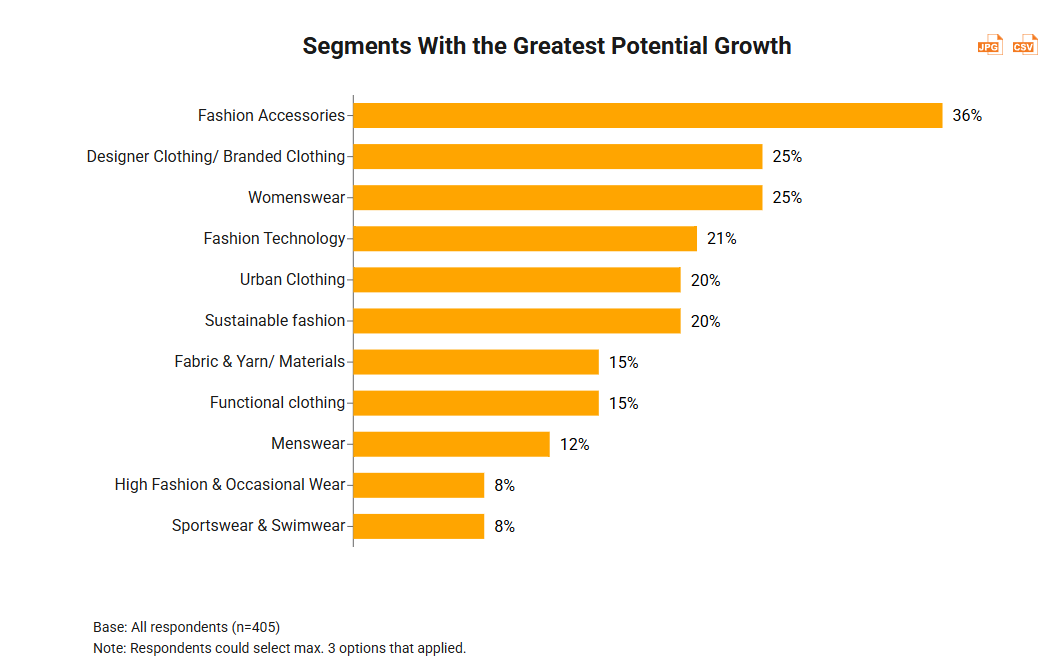

When respondents were asked which product category held the greatest potential for growth, fashion accessories emerged as the top choice, selected by 36% of participants. This continued preference underscores the enduring appeal of accessories, with consumers consistently seeking new ways to enhance their personal style and express their individuality.

Designer and branded clothing, along with womenswear, each accounted for 25% of responses, reflecting the rising number of brand conscious consumers worldwide. This trend is fuelled by a growing awareness of style and reputation, as well as ongoing technological advancements that continue to shape and redefine the fashion industry.

First, please LoginComment After ~