The role of the Registered Auction Agent in the Private Securities Market

The Private Securities Market will bring a new era for the secondary liquidity of private company shares. Making use of the government’s Private Intermittent Securities and Capital Exchange System (PISCES) legislation, our new market will enable the trading of private company shares through the London Stock Exchange, using features from both public and private markets.

The market gives intermediaries like banks, brokers and investment platforms the opportunity to expand their service offering to help investors access this new opportunity to buy or sell private company shares. The role of Registered Auction Agent (RAA) is critical to the London Stock Exchange’s Private Securities Market and helps ensure that the market will reach the broadest set of eligible investors.

Learn more about the benefits of the Private Securities Market and how it will work.

Who can be an RAA?

An RAA is a type of London Stock Exchange member firm that has agreed to the rules set out for RAAs. Their clients are investors, either buyers or sellers of private company shares wishing to invest through the Private Securities Market.

Some RAAs, like banks, may choose to provide a full-service offering of advisory services to a company in addition to their role as an RAA. Other firms like execution brokers, investment platforms, or wealth management arms of brokers may focus solely on providing investor access or executing investment orders.

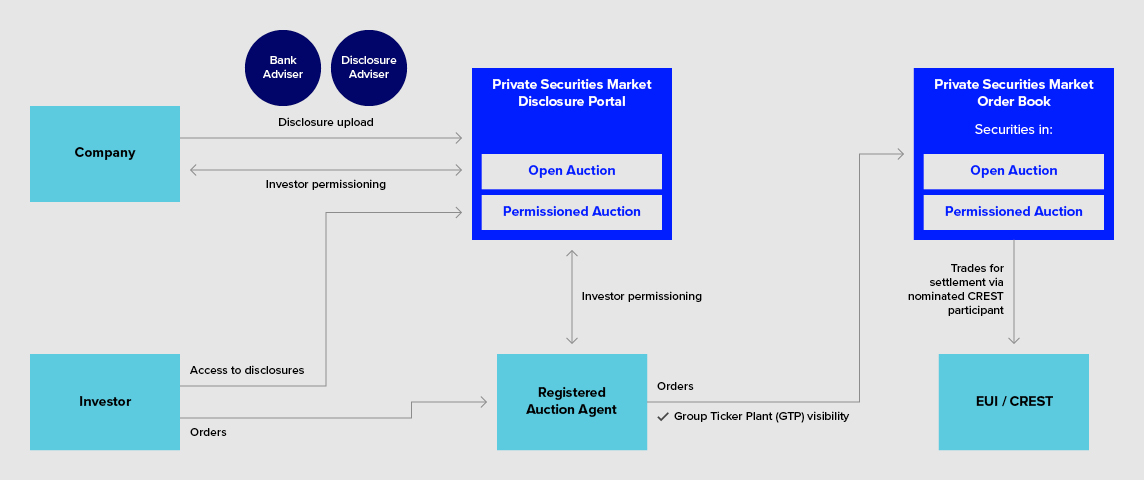

The Private Securities market will use the existing public markets technology for trading, including the London Stock Exchange Order Book and CREST settlement system. This will be complemented by some features from private markets, for example, company information being uploaded to a Disclosure Portal hosted by London Stock Exchange which will only be accessible to eligible investors. This gives control to companies around which investors can view their information and enables them to choose who can invest in their shares. The disclosure requirements set by the FCA are intended to be proportionate to and reflect that the companies using Private Securities Market will be private.

Figure 1: How users of the Private Securities Market interact

What does an RAA do?

As the Private Securities Market will use an intermediated model, investors will have to employ the services of an RAA to be able to invest through the market - whether that’s to buy or to sell shares.

An RAA will perform some or all the below responsibilities:

- Ensure that only eligible investors get access to the market. Investors eligible to buy shares must meet the requirements set out in the legislation, which in summary are those defined as professional investors, high net worth investors (HNWIs), sophisticated investors, or any existing private company employees. Any existing private company shareholders can sell shares.

- Provide investors with access to disclosure. When investors request access to company disclosures in our Disclosure Portal, RAAs will need to confirm their eligibility and approve their access via the Disclosure Portal.

- Transmit orders from eligible investors to the order book. If an investor chooses to place a buy or sell order in a Private Securities Market company auction, the RAA can either place it directly on to the Order Book (if it has access to the Order Book) or pass on this order to another RAA who has access to execute orders.

The RAA role therefore focuses on interactions with investors. This is distinct from the advisory role that firms may play in preparing companies for the venue, though it is possible that some RAAs may choose to perform both roles.

Types of auctions

In open auctions, all investors that are eligible according to the PISCES legislation can place orders to buy or sell shares, and RAAs with access to the Order Book are able to place orders on behalf of these investors.

In permissioned auctions, companies can place additional controls on who can invest in their shares for legitimate business reasons, for example, to prevent competitors from participating or certain types of investors. They need to set out their permissioned criteria ahead of the auction and are responsible for checking that investors meet these criteria. RAAs will be responsible for only placing orders from investors that have been approved by the company in the Disclosure Portal and those that are eligible investors in accordance with the PISCES legislation. RAAs will have a dashboard in the Disclosure Portal showing which of their clients have been approved by the company and will also receive an email notification confirming these investors ahead of the auction.

How you can get involved

The Private Securities Market will bring a new era of private company liquidity. Banks, brokers and investment platforms will be integral to its success through their role as RAAs, providing investors with efficient access to trade in private company shares. To learn more about becoming an RAA, please get in touch with our team.

First, please LoginComment After ~