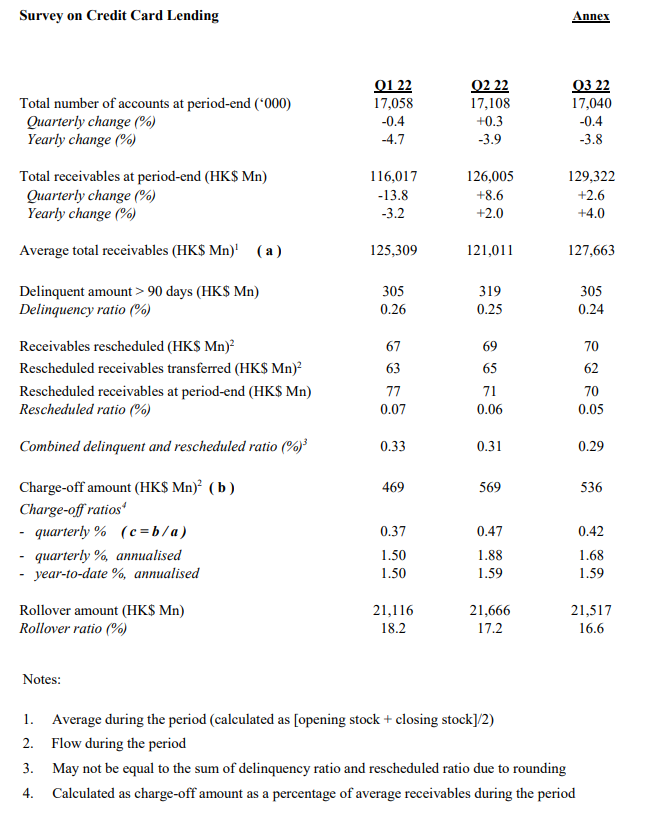

Credit Card Lending Survey Results for Third Quarter 2022

In the third quarter, total card receivables increased by 2.6% from the previous quarter to HK$129.3 billion at end-September 2022.

The combined delinquent and rescheduled ratio edged down to 0.29% at end-September 2022 from 0.31% at the previous quarter-end. The quarterly charge-off ratio dropped to 0.42% from 0.47% in the previous quarter.

Notes to the Press Release of the Credit Card Lending Survey

1. This survey covers authorized institutions (AIs) and some subsidiaries of AIs that are engaged in credit card business. It does not cover card issuers that are not AI-related.

2. Credit card receivables in the survey refer to credit card receivables from individual credit cardholders.

3. The delinquency ratio is measured by the total amount of credit card receivables overdue for more than 90 days and remaining unpaid at the last day of the reporting month as a percentage of total credit card receivables. Credit card receivables are classified as overdue when a payment is past due on the last day of the reporting month (see also Note 7 below). The delinquency ratio provides an early indication of the quality of the credit card portfolio.

4. Charge-off amount refers to the total amount of credit card receivables written off the loan book (including principal, interest and fees incurred of the charge-off accounts) during a period (irrespective of when a charge is made to the profit and loss account, which may be earlier if it is the institution’s policy to create provisions at an earlier time than the amount is written off). Charge-off policies vary from institution to institution. Normally, an account will be written off when the receivable has been overdue for more than 180 days or when the ultimate repayment of the receivable is unlikely (e.g. the cardholder is bankrupt or cannot be located). The quarterly annualised ratio foreshadows the extent of charge-offs that would be experienced if the current quarter’s charge-off ratio were to be sustained for the next three quarters. The year-to-date ratio tracks the actual charge-offs to date and is annualised for purposes of comparison.

5. The delinquency and the charge-off ratios are complementary to each other. The former takes into account those credit card receivables that at the reporting date had been overdue for more than 90 days but had not yet been written off. It is therefore an indicator of future charge-offs. The latter captures those receivables that were written off during the specified period because they were seriously overdue (e.g. for more than 180 days) plus those written off earlier than 180 days because they were considered irrecoverable (e.g. because the borrower has gone into bankruptcy).

6. The rescheduled ratio is measured by the amount of rescheduled receivables retained in the card portfolio which are not captured as delinquent at period-end as a percentage of total receivables. This ratio provides supplementary information on the quality of the credit card receivables. The rescheduled receivables at period-end is the amount of rescheduled receivables retained in the card portfolio which are not captured as delinquent at period-end.

7. Rollover amount, representing “borrowing”, is the amount within total receivables in respect of which the cardholder has not fully repaid the statement balance but has at least made the minimum amount of payment required by the AI. It does not include amounts that are overdue. An account is overdue when the minimum payment is not made upon the due date.

8. Rollover ratio refers to the percentage of total rollover amounts to total credit card receivables. While total receivables relate to the month-end position, total rollover amounts are based on balances recorded at the statement date

First, please LoginComment After ~