Post-Pandemic GBA Market: Technological Collaboration Drives Growth of Auto Parts Business

Interview with Ricky Chan, CEO of Jing Mei Automotive Limited

The automotive industry is currently focusing on the development of new‑energy vehicles and related technology. Meanwhile, suppliers of auto parts are keeping an eye on the development of the global automotive supply chains, as they tend to site their production activities close to automotive assembly plants. This allows them to tie their operations in with the technological requirements of automotive production, and meet stringent delivery requirements by minimising shipping time under the “just‑in‑time" model.

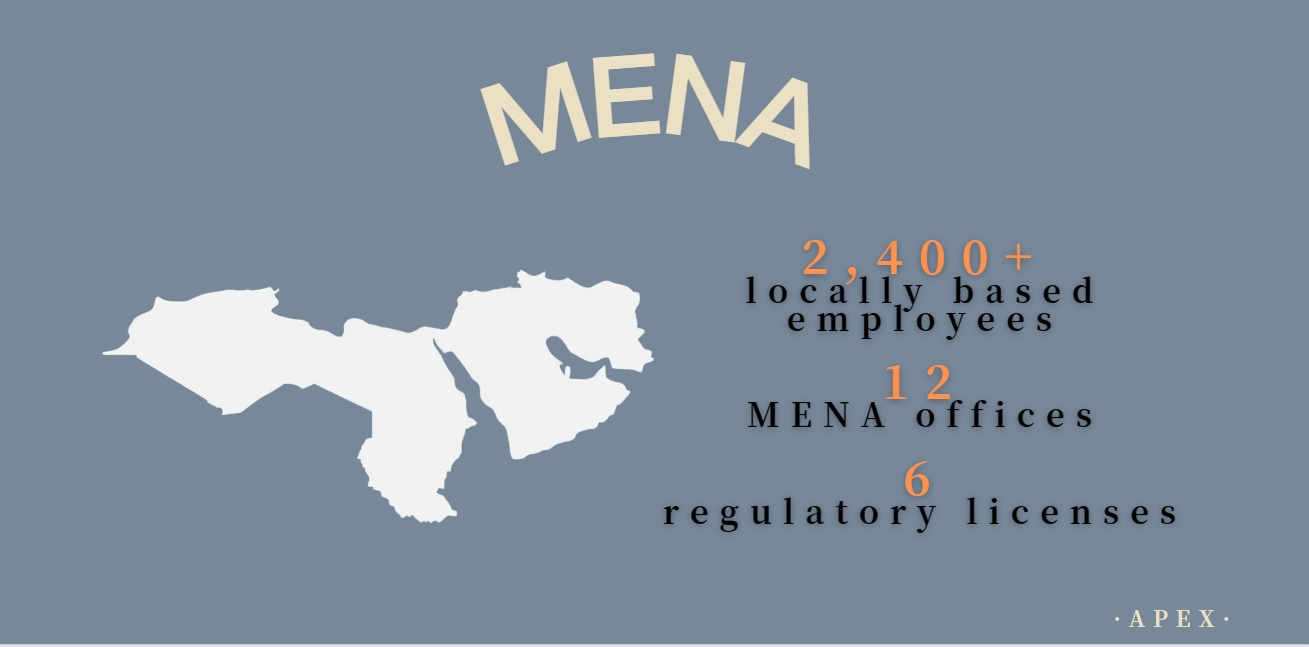

Against this background, it might be thought that the development plan for the Guangdong‑Hong Kong‑Macao Greater Bay Area (GBA) would be unlikely to have an apparent impact on the operational strategies of auto parts suppliers. However, Ricky Chan, the CEO of Hong Kong‑based Jing Mei Automotive Limited (JMA), believes otherwise. He points out that although proximity to automotive assembly plants is very important to the development of the auto parts sector, access to technology is also an influential consideration. The GBA development plan emphasises the importance of technological collaboration in order to promote the growth of Hong Kong’s innovation and technology sector, as well as providing support for the joint development of the Hong Kong-Shenzhen Innovation and Technology Park in the Lok Ma Chau Loop. Hong Kong suppliers of auto parts should make use of this to help them tap into the auto parts markets of Guangdong province and beyond.

Technology applications

In a recent interview with HKTDC Research, Chan pointed to the importance of technology in the auto parts industry, saying: “The automotive industry has very stringent requirements regarding product quality and reliability. Since a defect in the quality or the late delivery of even a tiny component may affect the smooth operation of the entire supply chain, auto parts suppliers must possess reliable production technology to ensure product quality and meet the delivery requirements of their clients.”

JMA is both a Tier 1 and Tier 2 supplier in the automotive supply chain. Over the years, it has successfully tapped into the auto parts market through its plastic electroplating technology. It produces door handles and various accessories, not only for the automotive assembly lines in mainland China, but also those in overseas markets including Europe, the US and Japan. However, the auto parts produced by its Guangdong and Hubei plants are mainly supplied to clients in Guangdong and Hubei due to geographic considerations.

Expounding on the need for auto parts businesses to stay abreast of technological developments, Chan said: “The long‑term development of a company hinges more on its application of technology. For example, the mainland China government has, as well as promoting the use of electric cars, drawn up plans for vehicles powered by other forms of new energy, such as hydrogen. As these measures will affect the road ahead for the automotive industry, Hong Kong companies should keep track of policy development in the country through the GBA. They should look to collaborate with mainland partners in order to commercialise Hong Kong’s scientific research achievements in metal treatment, micro‑electronics applications and so on. They need to do this in order to capture the business opportunities offered by the automotive supply chain on the mainland."

Cost control through e-commerce

National policy will affect the road ahead for the automotive industry. (Photo provided by JMA)

While online shopping is popular in the consumer market, the auto parts industry – which mainly sells to automotive assembly plants – seldom uses e‑commerce channels to develop retail business. JMA relies more on e‑commerce solutions, including electronic data exchange and materials management systems, to work with upstream suppliers and/or downstream clients, as well as automotive assembly plants. The company uses such e‑commerce means to strengthen the management of materials, production, transportation, warehousing and other supply chain elements, in order to improve efficiency and lower its overall operating costs.

Chan explained that the current economic situation has made the need to focus on efficiency even more important, saying: “We have had to cope with the serious disruption in shipping logistics caused by Covid-19, the global chip shortage crisis experienced by the automotive industry and the inflation pressures on the global economy arising from the energy and food shortages triggered by the Russia‑Ukraine war. Coupled with the gradual credit squeeze and rising interest rates in Europe and the US, not only are funding costs at stake, but consumers’ spending appetite has also been dampened. With Hong Kong companies facing the scenario of sluggish market demand amid rising costs, they should make greater use of e‑commerce to enhance their production and operational efficiency and control their inventory so as to lower the related financial costs."

Adapting to mainland business environment

On the other hand, the Covid-19 pandemic has also made it harder to trade with the mainland. Measures to control Covid-19 outbreaks have disrupted cross‑border travel and workforce mobility between Hong Kong and the mainland, which not only makes it more difficult for Hong Kong companies to manage their production activities on the mainland, but also impedes their business contacts with mainland clients. In Chan’s view, Hong Kong companies should approach mainland clients through popular mainland applications and channels, and take part in mainland marketing activities through online and offline platforms. They should also increase their investment in equipment and software in order to be ready to explore domestic sales opportunities in mainland China through multiple channels.

Accounts receivable risk is a major challenge faced by many Hong Kong companies when selling on the mainland. Generally speaking, Hong Kong companies tend to engage professional services providers to assess the credit standing of mainland clients and to control risks through related financial services. Noting the need to adapt to varying business environments, Chan said: “Before seeking the related services, Hong Kong companies should first understand the business environment and commercial practices on the mainland, which are quite different from those of Hong Kong and overseas markets. This will help them identify suitable services for tackling the risks of mainland sales operations. Take financing for example. Mainland clients treat it as a way of funding their general operation, whereas most Hong Kong companies with sound operation record only resort to financing to support long‑term investment and development projects. Even for Hong Kong enterprises and mainland GBA enterprises that run similar businesses, it is very likely that their credit backgrounds will be distinctly different. In light of this, Hong Kong companies should look for client credit services that cater for the mainland market, so as to control risks effectively and minimise any bad debts or debt arrears that may arise from accounts receivable.”

“While mature overseas automotive and auto parts markets are mainly driven by replacement needs, the demands of the mainland automotive market (which is the biggest in the world) are derived from the purchase of new cars. From the rising number of mainland consumers considering buying their first new car, we can see that the mainland China is an exceptionally huge market. That is why, even though GBA cities and other regions on the mainland are different from Hong Kong in terms of their business environment, Hong Kong companies should nevertheless strive to overcome all difficulties and actively explore the business opportunities presented by the mainland market.”

Author

First, please LoginComment After ~