PBOC:Urban Depositor Survey Report

Download → Urban Depositor Survey Report (Q4 2022).pdf

In Q4 2022, the People’s Bank of China (PBC) conducted a survey of 20,000 depositors in 50 cities across the country. The survey findings are as follows:

I. Income Sentiment Index

The income sentiment index for this quarter stood at 43.8 percent, down 3.2 percentage points from the previous quarter. Specifically, 10.8 percent of respondents saw income rise, down 1.3 percentage points from the previous quarter; 65.9 percent felt no big change in income, down 3.8 percentage points from the previous quarter; and 23.3 percent reported a decline in income, up 5.2 percentage points quarter on quarter. The income confidence index registered 44.4 percent, down 2.1 percentage points from the previous quarter.

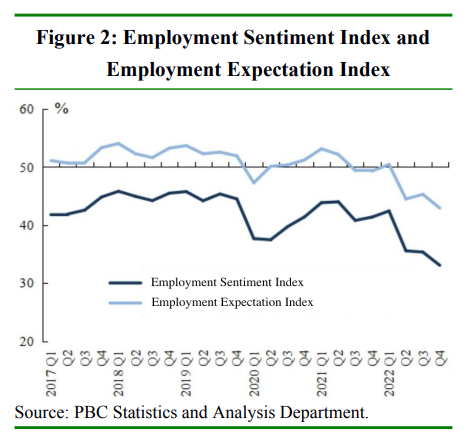

II. Employment Sentiment Index

This quarter’s employment sentiment index fell by 2.3 percentage points from the previous quarter to 33.1 percent. Specifically, 8.9 percent of respondents were positive about the employment situation and felt finding a job was easy; those reporting just the opposite or feeling unsure accounted for 49.1 percent; and 42.0 percent indicated “so-so”. The employment expectation index, at 43.0 percent, was down 2.4 percentage points from the previous quarter.

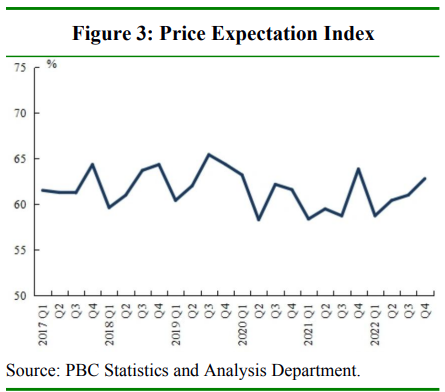

III. Price and House Price

The price expectation index for the next quarter rose by 1.8 percentage points from the previous quarter to 62.8 percent. Specifically, 31.2 percent of respondents expected prices to rise in the coming quarter; 48.1 percent anticipated little change; 8.7 percent said prices will go down; and 12.1 percent were unsure.

With regard to house prices in the coming quarter, 14.0 percent of respondents expected an uptrend; 53.7 percent said there will be little change; 18.5 percent anticipated a fall; and 13.8 percent were unsure.

IV. Willingness to Consume, Save and Invest

Of the people surveyed, 22.8 percent preferred more consumption, basically the same as the previous quarter; 61.8 percent were in favor of more savings deposits, up 3.7 percentage point quarter on quarter; and 15.5 percent were inclined to make more investment, down 3.7 percentage points from the previous quarter. Of the preferred investment vehicles, the top three were wealth management products of banks, securities firms and insurance companies, products of fund companies and trust companies, and stocks, picked by 44.1 percent, 20.4 percent and 14.7 percent of respondents, respectively.

Regarding items on which they plan to spend more over the next three months, the picks, in descending order of preference, were health care (29.6 percent), education (27.9 percent), social, cultural and recreational activities (18.5 percent) , big-ticket items (18.5 percent), house purchase (16.0 percent), insurance (15.0 percent), and tourism (13.3percent).

First, please LoginComment After ~