Research Series: China S Fund Market Analysis

The overall market situation of S funds

01

Features of China S Fund

1)Insufficient buyers, S funds are difficult to land

First of all, the participation of LPs in China is not high. According to the survey conducted by the FOF Research Center, nearly 60% of the Chinese FOF management institutions interviewed said that they would not consider participating in S funds for the time being. Even if they choose to participate in S funds, they would only consider participating in private equity funds. Share transactions, other transaction types are less involved. The lack of willingness of buyers is mainly due to two factors. On the one hand, there is information asymmetry. Compared with foreign private equity secondary markets, LPs are mostly large financial institutions. There are too many retail investors in the Chinese market, and the share they own is relatively small. And scattered, many GPs and LPs don't know much about the way of using S funds as an exit path, so it has not yet formed a large-scale continuous effect; Sex is still in doubt, it will take time to prove it.

Specifically, there is a lack of good second-hand shares in the trading market, and more relatively poor projects that are difficult to recycle are transferred, so buyers also do not buy it. Due to the lack of a normalized trading mechanism, merely serving as an exit mechanism will make it more difficult for S funds to be promoted on a large scale and difficult to implement.

2)Low transaction efficiency

Due to the high degree of asymmetry of information, the information between buyers and sellers cannot be effectively transmitted, there is no channel to sell the seller's share, and the buyer's demand cannot be resolved. At present, there is no channel to cover the information transmission needs of the entire equity investment industry in the country, which makes intermediaries occupy more of the market and bid on both sides, which delays transaction efficiency to a certain extent.

It is also difficult to achieve direct transactions between buyers and sellers to avoid intermediaries. When transferring LP shares, S Fund hopes to re-adjust the original GP's investment portfolio, but at present, some GPs in China are unwilling to disclose their investment portfolio and investment strategy to others, so there is a problem of due diligence in the transaction . Even if the original GP is willing to cooperate with the evaluation, the S Fund may only have a short time to review these projects when transferring transactions, and there is a high degree of information asymmetry.

3)Different transferors have great influence on price and landing

Since the current domestic S fund industry is still immature and at an early stage, it is difficult to judge its value. Valuation is like a game of beating drums and passing flowers, passing through multiple rounds to the securities market. The valuation of the secondary market has the concept of fair value, but for the transfer of the company before listing, including the transfer of LP shares, there is a lot of controversy about the valuation at this time. It is difficult to clearly define the valuation of the primary market. Many listed companies go bankrupt as soon as they go public, which is the reason for the overvaluation of the primary market. Therefore, different transferors have very different valuations for the same asset or share, which makes it difficult for the industry to reach a consensus on transactions without a unified pricing mechanism. A unified pricing mechanism has a great impact on transaction efficiency and validity, and different pricing ideas of various parties in an immature market environment have affected the implementation of S fund transactions.

4)Governments around the world are exploring the establishment of S fund exchanges

In the "toddler" private equity secondary market in China, information asymmetry makes it difficult to distinguish between good and bad commodities, and they are only willing to pay the average price. Although there have been some rudiments of private equity fund second-hand share trading platforms in China, these trading platforms provide additional channels for the disclosure of transaction information, which is essential for the actual completion of private equity fund second-hand share transactions and the ultimate realization of investment income. , the effect is limited. In other words, professional investment institutions with high professional quality and intermediary agency platforms are still an indispensable part of the development of S funds, and the S fund industry urgently needs an open trading platform.

02

China's S Fund Development Status

At present, my country's industrial structure is in a period of adjustment, and the overall asset target is switching. In the past 10 years, China's VC/PE market has exploded, and the total amount of funds deposited in it is beyond imagination. According to the China Foundation Association, as of November 2022, the scale of private equity asset management business will be about 16.07 trillion yuan. In such a huge business scale, many funds will end their duration and face the test and problems of centralized exit. S fund has become one of its important exit channels, which will generate a broad demand for S fund transactions and contain huge investment opportunities.

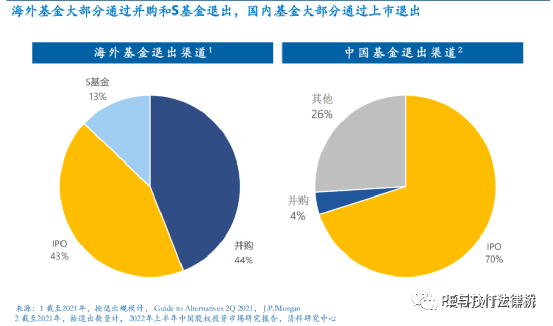

According to public information, domestic S funds have been gradually developed since 2013, but the development speed has been slow and the market has little impact. Private equity fund managers mainly want to exit through IPO or M&A in order to obtain a relatively high premium. However, since 2017, with the gradual tightening of IPOs and the decline of A-share stock prices, PE/VC private equity funds have encountered great difficulties in both raising and exiting, and S funds have gradually begun to attract the attention of the private equity industry.

In view of the rapid development of the S fund market in the past two years, the person in charge of a certain S fund believes that this year's market environment is relatively poor, but it is a good time for S fund investment. From 2015 to 2017, many funds were established in the market. Judging from the term of the fund, it has reached the stage of liquidation and there is a large demand for exit. For LPs, it is the transfer of fund shares; from the perspective of GPs, there are two ways, one is to sell the assets, and the other is to continue the project if it feels good. It is expected that there will be more such projects this year and next. The transaction is more difficult than the transfer of fund shares because it involves a wider range of factors.

Relevant data show that compared with other private equity strategies, private equity secondary market funds have a relatively stable risk-reward ratio. According to data, in the private equity strategy, the median net internal rate of return of S funds is around 14%, which is lower than that of early-stage investments, but its risk is lower than that of M&A funds, growth funds, venture capital (except early-stage), and early-stage investments. Judging from the losses of different types of funds in the past 30 years, 26% of venture capital funds are in losses, while the loss ratio of S funds is only 1%.

From the perspective of the industry track where the transaction target is located, the underlying projects involved in the S transaction in 2021 are generally balanced, covering major industries and hot tracks in the primary market, including medical health, enterprise services, manufacturing, advanced manufacturing, and artificial intelligence. Top five. The Zhizhong questionnaire survey found that compared with TMT and consumer products, technology and medical products are more concerned by S traders, which is mainly related to the current national policy of encouraging technological innovation. At the same time, compared with the TMT and new consumer industries that are mainly listed overseas, the exit policies and return expectations of the hard technology and medical health industries in the domestic capital market are also clearer and more recognized by investors.

Differences in the Chinese market

01

Different types of funds

02

Different exit pipes

03

Private equity funds have different investment objectives

Unique Transaction Costs in the Chinese Market

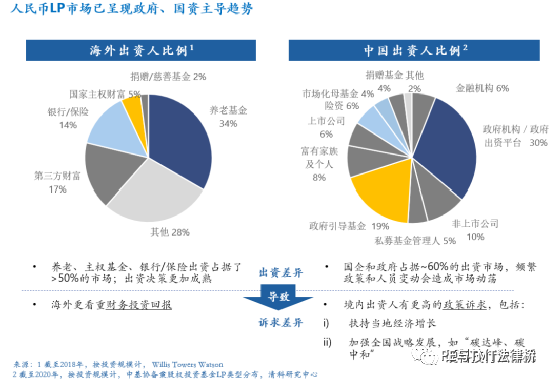

In view of the above-mentioned differences in means (investment types), methods (growth investment), and goals (guidance-based), the logic of private equity investment in the Chinese market is bound to be different from overseas. Lack of patient sources of funds has resulted in GP/LP partnerships being more affected by short-term market fluctuations, and short-term returns and benefits are more important than establishing long-term cooperation. Lacking a stable cornerstone of cooperation, buyers and sellers are like players on a seesaw, weighing the risks and benefits of their respective positions.

China's LP market lacks long-term capital, and investment focuses more on short-term strategic adjustments and industrial demands. Naturally, it lacks such strategic demands. This is also the main reason for the difficulty in investment management of RMB S funds. The S-funds that have been established in China generally have a size of 500-300 million, which is at the same level as venture capital/growth funds, and it is still a drop in the bucket to meet the liquidity needs of top 10 billion-scale PE funds. However, the scale of overseas S funds can be equal to the scale of large M&A funds (about 20 billion US dollars). Difficulties mainly include: 1) Lack of high-quality assets. The number of listed companies in China is less than 5% of the overall PE market each year. The limited number of core high-quality assets narrows the scope of S Fund investment targets; S Fund returns cannot surpass direct investment strategies in overseas markets. In China, it is also limited by the laws of the underlying assets; 2) Non-financial appeals, domestic buyers and sellers have more non-financial interest appeals for transactions, which makes it difficult to negotiate asset valuation and pricing in late trading; 3) Low execution efficiency, large platforms Large-scale institutions or sellers have state-owned and government-funded attributes. Under the historical law of asset judgment efficiency in the first stage of S fund market development, non-market-oriented decisions lengthened the decision-making process, and asset price fluctuations during the exit period hindered the conclusion of transactions. .

In addition to the common J-curve effect and liquidity costs in the global market, China's S-trading market also has two distinctive transaction costs for the seller: the difference in valuation between buyers and sellers and the buyer's high return expectations.

Valuation differences between buyers and sellers: Most projects need to go through several different types of cycles from investment to exit, and are affected by short-term fluctuations. On the other hand, GPs need to constantly pay attention to fundraising, which creates room for improvement in the completeness, timeliness, and accuracy of LP information disclosure by GPs in my country compared with overseas mature markets.

On the one hand, this gap is due to the completeness, timeliness, and accuracy of information disclosure mentioned above. In particular, over-dispersed assets, in addition to the difficulty of due diligence and GP valuation adjustments, will also cause problems in communication with counterparties. Many difficulties. On the other hand, while S fund investors provide liquidity for the market, they also bear a certain degree of long-term macro uncertainty risk, which makes the buyer's valuation of assets more conservative. For example, the listing of overseas assets or policy changes in the industry will cause catastrophic risks to the underlying assets with a high degree of industry concentration. Third, since the underlying assets of S have often passed the period of rapid growth, S Fund’s judgment on asset quality is closer to the prediction logic of the current secondary market, unlike the primary market that focuses on growth. However, in 2021, the first-day breakout rate of domestic and overseas IPOs of Chinese companies will be 10%, and it will reach 25% in the first half of 2022, which is 3-8 times that of 3% in 2017. The buyer will not give a higher asset price because of listing expectations. valuation.

Overview of S Fund Institutions in China

01

Status quo

At present, there are relatively few S-fund institutions in China. According to the incomplete statistics of the Fund of Funds Research Center, as of August 31, 2021, the total scale of China’s S-funds that have invested and not invested is about 47.6 billion yuan. According to the initial statistics of the Fund Research Center at the end of 2019, it was 31 billion yuan, an increase of 53.55%. Although the growth rate is fast, the total scale base is still small, even lower than the scale of a fund of some large institutions. The proportion of investors withdrawing through "S Fund" does not exceed 5%, which is far from IPO, equity transfer, mergers and acquisitions, etc. Judging from the current investors participating in S funds, among the LPs of RMB S funds, high-net-worth individuals account for a relatively large proportion. Most of them have participated in single-project direct investment, or invested in some direct investment funds, and have experience. These LPs started to test the water from a few million at the beginning, and gradually found that the cash return of this strategy was faster than other equity funds, and began to increase their positions to tens of millions or over 100 million investments, becoming a large LP of S funds, but this is not the case. It is a relatively slow and gradual process of development, and on the whole, large and medium-sized institutions invest relatively little in S funds.

From the perspective of scale distribution, the management scale of more than half of S fund institutions does not exceed 1 billion yuan, and it is difficult to effectively change the current investment ecology. This also confirms that the current proportion of funds exiting through S funds is extremely low. The status quo of industry development is far from mature. The scale of the top three leading institutions has reached nearly one-half of the entire industry. The industry concentration is very high, and the number of institutions in the industry is far below the effective level. Long-term development is still needed to mature.

02

Rapid development

Entering the fourth quarter of 2022, S funds have been deployed in many places. Recently, the science and technology industry FOF group was launched in Changping District, Beijing, and will build a product matrix including early and mid-term FOFs, mid-to-late FOFs, industry-guided FOFs, and self-managed sub-funds. Among them, the mid-to-late stage FOF will establish Changping Second-hand Share S Fund. Currently, Beijing Changping Science and Technology Park Development Co., Ltd. is working with Everbright Sun Life Insurance and Everbright Holdings to create a second-hand share S fund.

On November 17, a number of S fund institutions and Wuxi Shangxian Lake Digital Economy Fund of Funds launched a PE secondary market alliance in Wuxi, Jiangsu.

There are various signs that various sources of funds, including government guidance funds, market funds of funds, trusts, and insurance, have rushed to the S fund market. For example, the Shanghai S Fund Alliance, which was unveiled in September this year, has gathered national funds of funds, well-known market-oriented funds of funds at home and abroad, local guiding funds, insurance companies, securities companies, banks and other financial institutions.

CICC Capital established a special S fund this year, which is the first S fund of a securities firm. Zhou Zhihui, managing director of CICC Capital, said that the fund has entered the investment stage and "has already invested in two bids, and is still looking at some other bids."

The "2022 China Private Equity Secondary Market White Paper" released by Zhizhong shows that in 2021, there will be a total of 353 transactions in China's private equity secondary market. The growth rate reached 47%.

The Challenges and Directions of China's S Fund Market Development

01

Main challenge

1)The domestic S fund has just started, the scale is small, and it has not yet become the mainstream exit method

2)There is a shortage of domestic S-fund talents, and the investment strategy is relatively simple

3)The growth rate of S fund management scale cannot keep up with the growth of market demand

4)The valuation mechanism of domestic S funds is unclear

02

Direction of development

In the long run, the development of S Fund will be more diversified. It is necessary to establish an overall industry ecosystem, improve the early publicity and promotion work, and help LPs understand the benefits of the private equity secondary market and help the industry develop. It is also necessary to strengthen the space for intermediary service providers to play. Now the domestic market is developing relatively slowly, and intermediaries play a limited role in improving transaction efficiency; as the market matures, the role of intermediary financial consultants will play a more active role to help the entire The industry is developing well and fast.

Generally speaking, with the improvement of the market, in the long run, the information disclosure, matching mechanism, liquidity, and valuation of S funds will become more mature and friendly in the future, so that more institutional investors can understand and enter the S fund industry, and jointly promote development of this industry. Judging from foreign experience, the S fund industry is an inevitable product of the PE/VC industry at a certain mature stage. After more than ten years of development, my country's PE/VC industry has gone a long way. It plays a particularly important role in the development of high technology. As mentioned above, my country’s PE/VC industry is difficult to exit, and most funds and projects cannot exit in time. The existence of S funds can effectively solve the exit problem and play a vital role in the development of the secondary market. We predict that in the next 3 to 5 years, local governments in China will set up more S-fund trading platforms and S-funds. However, in terms of the scale of S-funds, due to the small base, it is difficult to form a large amount in a short period of time. , but the growth rate will be very fast and the coverage will be wider.

Presiding lawyer: Yang Chunbao, first-class lawyer

Phone/WeChat: 1390 182 6830

Business contact and submission email:

chambers.yang@dentons.cn

Address: Floor 9/24/25, Shanghai World Financial Center, 100 Century Avenue, Shanghai

First, please LoginComment After ~