Monetary policy tightening and the financing of firms

Download → PDF full text

Introduction

I am grateful for the opportunity to contribute to this event, which marks 25 years of Enterprise Ireland. The ECB also turns 25 this year, as operations began in June 1998 ahead of the launch of the euro on 1 January 1999.

My aim today is to review the impact of rising interest rates on the financing of firms. It is strongly in the interests of the enterprise sector that inflation is low and stable over the medium term, since high and volatile inflation disrupts business operations by making it more difficult to execute basic tasks, including the setting of prices, the management of costs and the development of medium-term financial and operational plans. In response to the extraordinary surge in inflation since 2021, the ECB has been raising interest rates in order to make sure that inflation returns to our two per cent medium-term target in a timely manner. During this tightening cycle, firms must not only grapple with the inflation shock but also with the impact of the upward shift in interest rates that is necessary to make sure that inflation quickly subsides.

Higher interest rates affect firms through multiple channels. At a macroeconomic level, tighter monetary policy dampens consumption and investment, reducing demand for consumer and business products. All else equal, it also causes a currency to appreciate, posing challenges for exporters. My focus today is on the impact of tighter monetary policy on the financing conditions facing firms.

The economic outlook

To set the scene, I will first briefly review the economic outlook. The extraordinary adverse supply shocks associated with pandemic shutdowns, supply bottlenecks and the energy crisis are steadily reversing, providing the basis for a more optimistic outlook for the euro area economy compared to expectations last autumn. In particular, lower global energy prices and the easing of supply bottlenecks are boosting confidence and supporting incomes and business activity, while also reducing price pressures. Rising wages provide further support for demand.

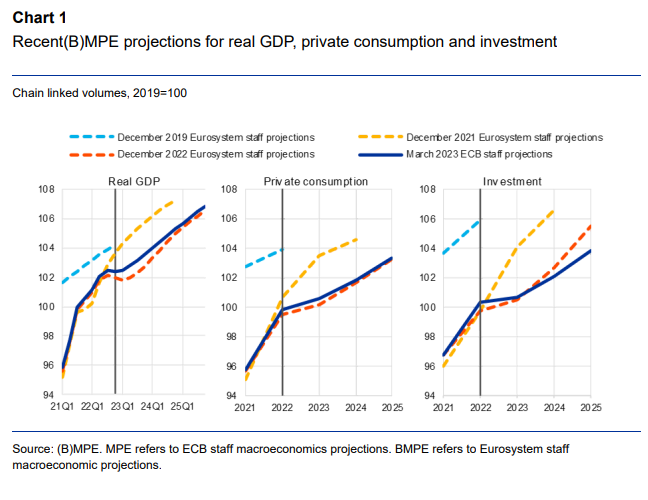

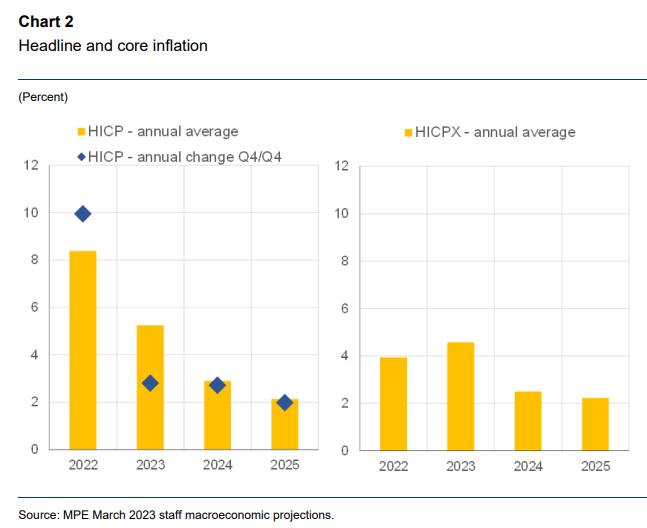

The ECB staff macroeconomic projections of March 2023 see economic activity rebounding over the course of the year, with growth expected to average one per cent in 2023, marking a significant upward revision to the near-term path for GDP compared to the December 2022 projections (Chart 1). At the same time, the continued tightening of financial conditions, the appreciation of the euro and the gradual withdrawal of fiscal support will weigh on aggregate demand over the medium term, with output now set to expand less rapidly in both 2024 and 2025 compared to previous expectations. The reversal of supply shocks, coupled with monetary policy tightening, means that the path for inflation has been revised down over the entire projection horizon, although − compared with the previous projection round − underlying inflation is now expected to be more persistent in the near term (Chart 2).

The ECB staff macroeconomic projections of March 2023 see economic activity rebounding over the course of the year, with growth expected to average one per cent in 2023, marking a significant upward revision to the near-term path for GDP compared to the December 2022 projections (Chart 1). At the same time, the continued tightening of financial conditions, the appreciation of the euro and the gradual withdrawal of fiscal support will weigh on aggregate demand over the medium term, with output now set to expand less rapidly in both 2024 and 2025 compared to previous expectations. The reversal of supply shocks, coupled with monetary policy tightening, means that the path for inflation has been revised down over the entire projection horizon, although − compared with the previous projection round − underlying inflation is now expected to be more persistent in the near term (Chart 2).

The tightening of financing conditions and stricter credit standards are expected to weigh more strongly on both residential and business investment over the coming quarters, compared with previous projection rounds. Banks – already before the recent financial market turmoil – reported substantial tightening in credit standards and lending conditions to firms through the ECB’s Bank Lending Survey (BLS). Over the medium term, investment in commercial real estate is expected to be hit particularly hard by the tighter lending conditions, while the sharp projected slowdown in house prices will reduce residential investment. By contrast, business investment is likely to recover more strongly on the back of rising demand and strengthening business confidence, also supported by the deployment of Next Generation EU funds.

Taking a longer perspective, Chart 1 also shows that the projected paths for output, consumption and investment remain well below the pre-pandemic trends. This explains why it is possible to combine significant growth in the coming years with projections of substantial disinflation (as shown in Chart 2): the supply capacity of the economy is set to recover from the pandemic-related damage and the war-amplified energy shock, with the tightening in monetary policy ensuring that demand is better aligned with supply.

Since the cut-off date for the March 2023 projections, the incoming data have been mixed. Both business and consumer confidence have recovered strongly since the start of the year, albeit possibly softened by the recent banking sector turmoil. Business activity has continued to rebound, despite moderating slightly in March. However, these overall patterns mask a continued divergence at the sectoral level. In particular, the expansion of services business activity is accelerating, supported by a continuation of strong reopening effects and rising incomes, whereas manufacturing output stagnated in the first quarter of the year. Finally, incoming survey indicators suggest that the steady improvement in business and consumer sentiment, which remains at low levels, may have stalled.

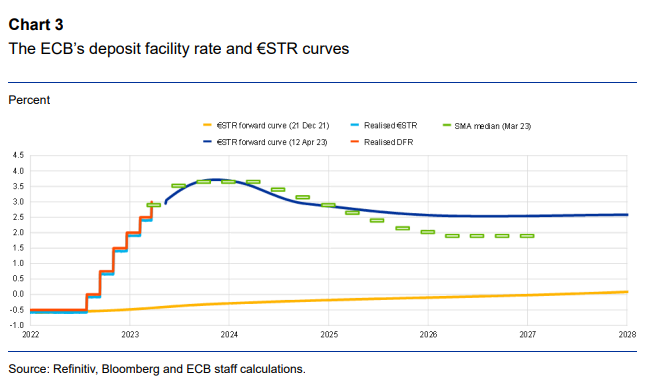

To make sure that inflation returns to our two per cent target in a timely manner, it has been necessary to increase the key policy rates by 350 basis points since last summer. If the baseline scenario underlying the March ECB’s staff macroeconomic projections persists, it will be appropriate to raise rates further. The ECB started to unwind its highly accommodative monetary policy in December 2021, when the Governing Council began reducing the pace of net asset purchases, followed by the decisions to end purchases under the pandemic emergency purchase programme (PEPP) and asset purchase programme (APP) in March and June of 2022 respectively. In July 2022, we began raising the key ECB interest rates, which markets had already begun pricing in at the end of 2021. Since the start of the tightening cycle, we have brought the deposit facility rate (DFR) – which, in the current conditions of ample excess liquidity, constitutes the main instrument for steering the monetary policy stance – from negative territory to three per cent today (Chart 3).

Both market pricing and our Survey of Monetary Analysts (SMA) foresee that the policy rate will rise further in the near term and will remain at elevated levels for an extended period. Moreover, once inflation has stabilised at the two per cent target in the medium term, it is projected that the policy rate will settle in the neighbourhood of two per cent, rather than returning to highly-accommodative super-low levels. This largely reflects the re-anchoring of long-term inflation expectations at our two per cent target and suggests that market participants and monetary analysts expect the longer-term equilibrium (inflation-adjusted) real rate will stand around zero per cent.

The substantial tightening in monetary policy is designed to make sure that inflation returns to our two percent target in a timely manner, both by ensuring that longer-term inflation expectations remain firmly anchored and by lowering price and costs pressures through the dampening of demand. An important channel in dampening demand is raising the financing costs facing firms.

......

First, please LoginComment After ~