Sarah Breeden: Investing in financial stability

Introduction

I suspect I won't need to convince this audience of the importance of corporate debt and financing conditions. What I'd like to do instead is explain why the Financial Policy Committee (FPC) cares about them.

The FPC has two objectives: a primary one to maintain financial stability, and a secondary one to support economic growth. The supply of finance to the corporate sector touches on both.

For our primary objective we look to ensure that risks to financial stability aren't generated by excessive levels of corporate debt – where indebtedness might build in an upswing and lead to a damaging credit crunch in a downturn.

And for our secondary objective we want to make sure the financial system is supplying enough long-term, stable funding to allow businesses to make productive investments, and finance major economic transitions such as the journey to net zero.

So, in both cases, stability is our watchword. We are aiming at a supply of business finance which is stable through the economic cycle – avoiding damaging swings from credit boom to bust. And we want to ensure the financial system provides the sort of funding – long-term and stable – which supports business investment.

Corporate debt and financial stability

The FPC’s primary objective is to ensure the resilience of the UK financial system by detecting, monitoring, and – where possible – countering systemic risk. These risks are often not contained within the financial system. As we saw at the onset of the pandemic, tight linkages between the financial system and the real economy mean that shocks emanating from one can transmit to the other.

One potential source of risk we monitor closely is corporate debt

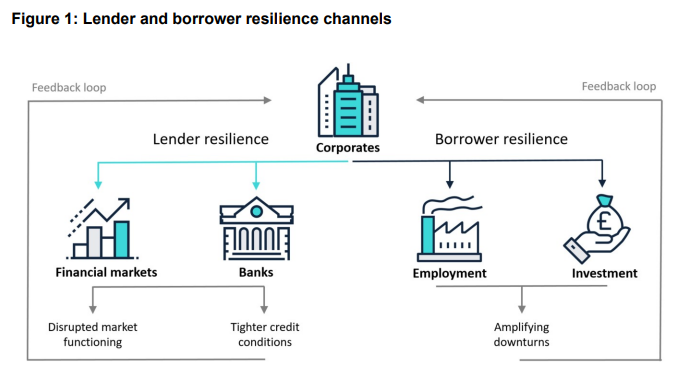

Of course corporate debt is an integral part of the functioning of the real economy. It allows companies to smooth cash flows, and – as I’ll talk about later – fund investment. But corporate debt can come with spillovers – where actions after a shock can amplify its effect on others (externalities and market failures as an economist would say), with potential consequences for the stability of the financial system. The FPC has identified two main channels through which this could happen.

The first operates through lender resilience and brings the risk of a ‘credit crunch’. Over-indebted

companies might face challenges servicing their debt. And if they default, lender losses can test

lender resilience and hence provision of credit to the economy more broadly.

The first operates through lender resilience and brings the risk of a ‘credit crunch’. Over-indebted

companies might face challenges servicing their debt. And if they default, lender losses can test

lender resilience and hence provision of credit to the economy more broadly.

The second operates through borrower resilience and brings the risk of ‘debt overhang ’. In a downturn, more highly indebted corporates can reduce investment and employment by more than those with less debt, as we saw during the global financial crisis (GFC). This behaviour can amplify macroeconomic downturns, further affecting corporate resilience, and potentially also increasing losses for lenders on other forms of lending. UK corporate debt fell after the GFC, but has risen since as firms took advantage of low borrowing costs and favourable economic conditions. With UK corporates now navigating an increasingly challenging macro environment, risks to financial stability can materialise through either channel.

First, please LoginComment After ~