Sound system will protect banks from risks

China's top regulator delivered a key report that has stressed the importance of strengthening and refining modern financial regulation, reinforcing the systems that safeguard financial stability and ensuring no systemic risks arise.

Such requirements have assumed even greater strategic significance following recent risk events in the United States and Europe, which has made it important to monitor the situation of global financial risks.

The collapse of Silicon Valley Bank has shown that macroeconomic policy adjustments play a decisive role in maintaining financial stability. Interest rate policy is a crucial factor influencing liquidity risk.

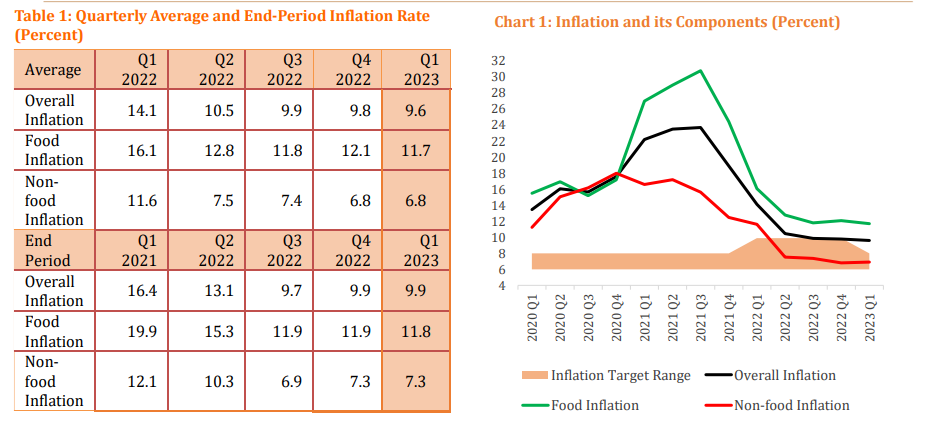

The US Federal Reserve had maintained a low interest rate environment — even zero interest rates for some time — for a decade since 2012.From March 2022, however, the Fed raised interest rates 10 times as of May this year to fight inflation, increasing the target range for the federal funds rate to between 5 percent and 5.25 percent, versus zero percent and 0.25 percent in early 2022.

Such a rollercoaster ride in interest rates has threatened the stability of the financial system. For SVB, the drastic increase in interest rates led to substantial losses in its long-term financial assets, triggering its collapse.

Some may point out that the maturity mismatch of SVB's assets and liabilities was the main reason for its failure. But the collapse of other banks, including Signature Bank and First Republic Bank, shortly after SVB's collapse, indicates that the main source of risk lies in the external environment — the aggressive change in interest rates has exposed multiple banks to similar risks.

The Fed's radical rate hikes have not yielded the desired results in terms of curbing inflation. They have instead led to a rapid deterioration in bank liquidity and triggered a crisis, indicating that US macroeconomic policy adjustments lack thorough analysis and appropriate policy tools.

Based on the experience of the Fed's rate hikes, it is clear that central banks should strike an appropriate balance between taming inflation by tightening liquidity conditions and controlling the risks financial institutions face.

Ensuring a proper pace of macroeconomic policy adjustments is crucial for financial stability.

The bank failures also reveal a deficiency in banking industry regulation. In 2018, the US raised the banks' stress test threshold to $250 billion in assets. SVB's asset size before its collapse was $220 billion.

SVB did not have to meet regulatory requirements on the liquidity coverage ratio and net stable funding ratio. While the LCR aims to ensure that banks have enough cash or high-quality bonds to survive stresses in markets for a month, the NSFR seeks to reduce funding risks over a longer-term horizon.

As a result, SVB failed to maintain an adequate level of liquidity to address the risk of deposit outflows. In 2022, the bank's deposits decreased by as much as 9 percent.

In the digital age, determining whether systemic risks will arise is no longer possible solely based on the size of an individual bank and its connections with its peers. Although SVB was not a large-sized bank nor systemically important, the US ultimately handled its collapse under the principle of "systemic risk exception".

The risk transmission of bank runs in the digital age may have undergone significant changes. The speed of bank runs is faster — SVB collapsed almost instantly, and the effect is wider, thus more likely to threaten financial stability.

Therefore, regulatory authorities need to enhance their understanding of the banking industry in response to evolving technologies and emerging risks.

Going forward, attention should be paid to the evolution of financial risks in the United States. The surge in interest rates could raise the funding cost of vulnerable small and medium-sized banks and expose some of them to liquidity risks. If the Fed raises interest rates further, it is difficult to say whether the US' financial situation will undergo unexpected changes.

Partly due to SVB's failure, more than $200 billion in deposits were withdrawn from US small banks in March, while US money market funds saw a net inflow of about $304 billion in the three weeks through March 29. This shift of funds can create imbalances in the financial market.

The US commercial real estate industry is also experiencing a cyclical adjustment and smaller banks have significant exposure to related risks. Around $2.6 trillion in commercial mortgages — 80 percent of which are from small banks — will mature between 2023 and 2027.

Luckily, the effect of the overseas banking crisis on China has been relatively mild as activity in the US and Europe only accounts for a limited share of Chinese banks' operations. The sound asset quality of China's banking industry and the independence of the country's monetary policy from overseas adjustments will also help isolate Chinese banks from the upheaval.

Nevertheless, as the US and Europe are important trade partners of China, any economic recession in these regions can affect China's exports.

Chinese policymakers have stepped up efforts to expand domestic demand and prioritize the recovery and expansion of consumption, which will help counter the external uncertainties and ensure high-quality development.

The US banking crisis also serves as a reminder for China that it is important to consider the comprehensive impact on the economy while adjusting macroeconomic policies.

Looking ahead, the global economy is expected to face a challenging environment characterized by high interest rates, high inflation, high debt and low growth, leading to inevitable market volatility.

Within this context, policymakers should take into account the wide-ranging effect that macroeconomic policy adjustments may have. Financial stability in particular needs to be fully considered in policymaking as the goal of macro-prudential regulation is to avoid systemic financial risks.

It is also essential to ensure that there are sufficient tools and resources to address any potential bank collapse. In the past, the cost of such risk events has primarily been borne by the central bank or local governments in China.

Going forward, it may be sensible to let the market assume a greater share of responsibility. In addition to the existing deposit insurance system, a mechanism can be established whereby funds contributed by large commercial banks provide temporary liquidity relief to small and medium-sized banks.

First, please LoginComment After ~