Contrasting the Substantial Outflow of Securities Investment in China in 2022 with the Remarkable Rebound of Cross-Border Securities Investment in Early 2023

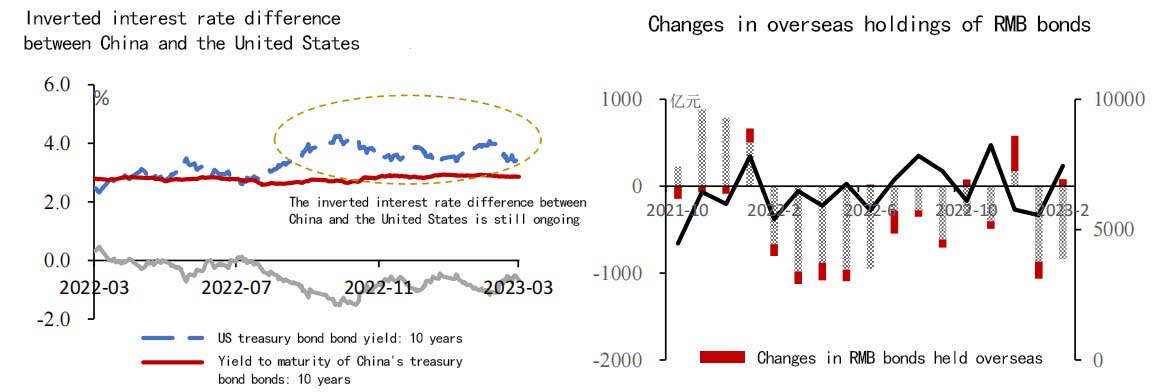

The widening deficit in securities investment projects in 2022 is mainly due to an increase in outflows of cross-border bond investment funds. In the balance of payments, securities investment projects mainly include bond and equity investments, with the net outflow of bond investments being the dominant factor, with an outflow of $267.8 billion throughout the year, while equity funds only flowed out of $13.3 billion. The main reason for this is that due to the rising inflationary pressure in developed countries such as Europe and the United States in 2022, the Federal Reserve has launched significant interest rate hikes and tight monetary policies such as a contraction of the balance sheet, resulting in a large amount of short-term cross-border funds from emerging market countries flowing to the United States. In 2022, the Federal Reserve has raised interest rates six times, totaling 375 basis points, causing an inverted interest rate gap between China and the United States. The rise in the yield of US treasury bond bonds has attracted a large number of domestic bond investment funds to withdraw.

From the perspective of investment direction, firstly, there has been a net outflow of securities investment in China. In 2022, the net outflow of overseas investment in Chinese securities was $107.9 billion. From the perspective of channels, foreign institutions mainly reduce their holdings of Chinese issued bonds and redeem bonds at maturity (with a net outflow of $145.6 billion); and the equity investment was a net inflow of $34.4 billion. Under Bond Connect, there will be obvious signs of overseas institutions reducing their holdings of RMB bonds in 2022, but the reduction will gradually narrow in the second half of the year, and it will turn into a net increase in December. Secondly, the activity of domestic and foreign securities investment has increased. In 2022, China's net outflow of foreign securities investment reached a record high of 173.2 billion US dollars. Among them, the external equity investment was 47.7 billion US dollars, a year-on-year decrease of 44%; Foreign bond investment reached $125.5 billion, a year-on-year increase of more than twice, and the scale reached a historic high.

At the beginning of 2023, cross-border securities investment significantly returned. Since the end of 2022, due to the adjustment and optimization of China's epidemic prevention and control measures, the economic and financial recovery has rebounded, coupled with a shift in market expectations for the Federal Reserve's interest rate hike, China's short-term cross-border funds have begun to significantly flow back. One is the significant return of cross-border securities investment. From the perspective of foreign payment and receipt by bank agents, the balance of securities investment items has "reversed smoothly", with net inflows of surplus in December 2022 and January 2023 being $11.8 billion and $17.8 billion, respectively. Secondly, there are obvious signs of overseas funds increasing their holdings in domestic stock and bond markets. In the stock market, there has been a significant inflow of funds from the Shanghai Stock Connect and the Shenzhen Stock Connect. From January to February 2023, the Shanghai Stock Connect and Shenzhen Stock Connect had net inflows of 79.46 billion yuan and 71.08 billion yuan, with a significant net inflow of 70.55 billion yuan and 70.73 billion yuan in January, both reaching historical highs in a single month. In the bond market, the trading volume of Bond Connect in February was 743.8 billion yuan, an increase of 34% month on month compared with January.

First, please LoginComment After ~