Hong Kong's increasingly diverse stock market

Emerging technologies like artificial intelligence, battery technologies, and autonomous vehicles are capital-intensive areas that are generating growing interest among investors. Stock markets across the world are evolving to meet the fundraising demands of these fast-paced New Economy businesses.

In Hong Kong, the operator of the stock exchange has recently introduced a new chapter to its listing rules to allow the listing of qualified companies from these high growth technology sectors - enhancing Hong Kong’s competitiveness and attractiveness as a fundraising venue for the next generation of companies.

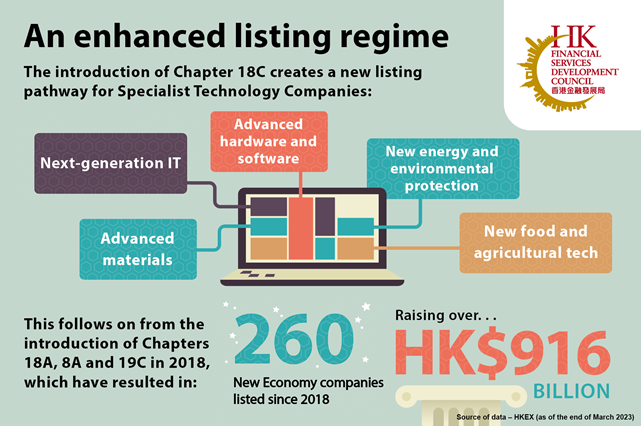

An enhanced listing regime

At the end of March, Hong Kong Exchanges and Clearing (HKEX) added Chapter 18C to its listing rules. The new regime provides a new listing pathway for “Specialist Technology Companies”, which are companies that operate in one of five Specialist Technology Industries – being (i) next-generation information technology, (ii) advanced hardware and software, (iii) advanced materials, (iv) new energy and environmental protection and (v) new food and agriculture technologies. These industries cover a wide range of cutting-edge sectors.

Technology companies typically have to spend a large amount of money on research and development to bring their products to market. As the development process advances, the costs increase, and can exceed the funds that private equity investors can provide. Access to public markets therefore helps such companies to raise the necessary capital to successfully commercialise their products.

“The new listing route now provides specialist technology companies access to the Hong Kong capital market to fund their innovative ideas and growth, especially for those based in Greater China. It provides them with the ability to raise international capital, in Asian time zone, from investors who are familiar with their products and services under Hong Kong’s reputable regulatory framework,” said Katherine Ng, Head of Listing, HKEX.

Under the new rules, companies that have yet to make revenues can list as long as they have a market capitalisation of at least HKD 10 billion. For companies with HKD 250 million or more revenue, they can list if they have a market capitalisation of at least HKD 6 billion.

For investors, Chapter 18C will deliver a wider range of investment choices in sectors that have the potential to offer high investment returns, while gaining exposure to companies at the frontier of technological progress.

At the same time, the modifications to the listing rules maintain the quality and reputation of the stock exchange by incorporating safeguards and disclosure requirements that address the risks technology companies can present.

“Our aim is to maintain a transparent and orderly market that is conducive to both new listings and investor protection,” said Ms Ng.

Building on success

The introduction of Chapter 18C is the latest in a series of market reforms that started in 2018, which by attracting New Economy companies, led to a fundamental transformation in the composition of companies listed on the stock market.

Five years ago, financial companies accounted for 29% of the total market capitalisation in Hong Kong, while 13% for information technology companies consisted of a small number of very large companies.

At the end of April 2023, the situation has become very different with the development of a robust New Economy ecosystem in the city. Information technology companies now account for 26% of the total market capitalisation, with financial companies at 19%. Property companies have also become less prominent, while healthcare companies have jumped to 9% from very little presence in Hong Kong.

These dramatic changes are the result of three listing chapters that were introduced in April 2018: 18A for pre-revenue biotech companies, 8A for weighted-voting rights issuers, and 19C for secondary listings of overseas issuers. A total of 260 New Economy companies have been listed since the reforms were implemented, raising a total of HKD 916.5 billion (USD 117.5 billion)1. Furthermore, Hong Kong has become one of the world's largest biotech fundraising hubs.

Chapter 18C is the latest step in an ongoing journey to make Hong Kong’s capital market the best fit responding to the evolving demand of issuers: “We will continually review our listing platform to ensure that we maintain Hong Kong’s attractiveness for all types of quality companies,” said Ms Ng.

[1] As of the end of March 2023

First, please LoginComment After ~