HKD-RMB Dual Counter Model, HKEX Explained

The HKD-RMB Dual Counter Model was launched on June 19, 2023 and this article explains how the Dual Counter Model works, promotes RMB internationalisation and strengthens Hong Kong's role as an international financial centre.

Key Takeaways

1.The HKD-RMB Dual Counter Model is the latest addition to HKEX's ecosystem of offshore RMB products and offers investors the choice of trading the security of a Hong Kong-listed company in either HKD or RMB.

2.At launch on June 19, the Dual Counter Model includes 24 Dual Counter Securities. Those securities' HKD counters account for approximately 40% of average daily turnover on Hong Kong's cash equities market.

3.Under the Dual Counter Market Making Programme, market makers will offer buy and sell quotes on RMB-denominated securities, providing consistent liquidity in the RMB counter, and minimising price discrepancies between the HKD and RMB counters.

4.As the RMB product ecosystem expands, the direction of travel is clear – more choice for investors, bigger capital pools for issuers, increased cross-border capital circulation, closer connectivity with China, and faster RMB internationalisation.

The HKD-RMB Dual Counter Model is the latest addition to HKEX's offshore RMB product ecosystem

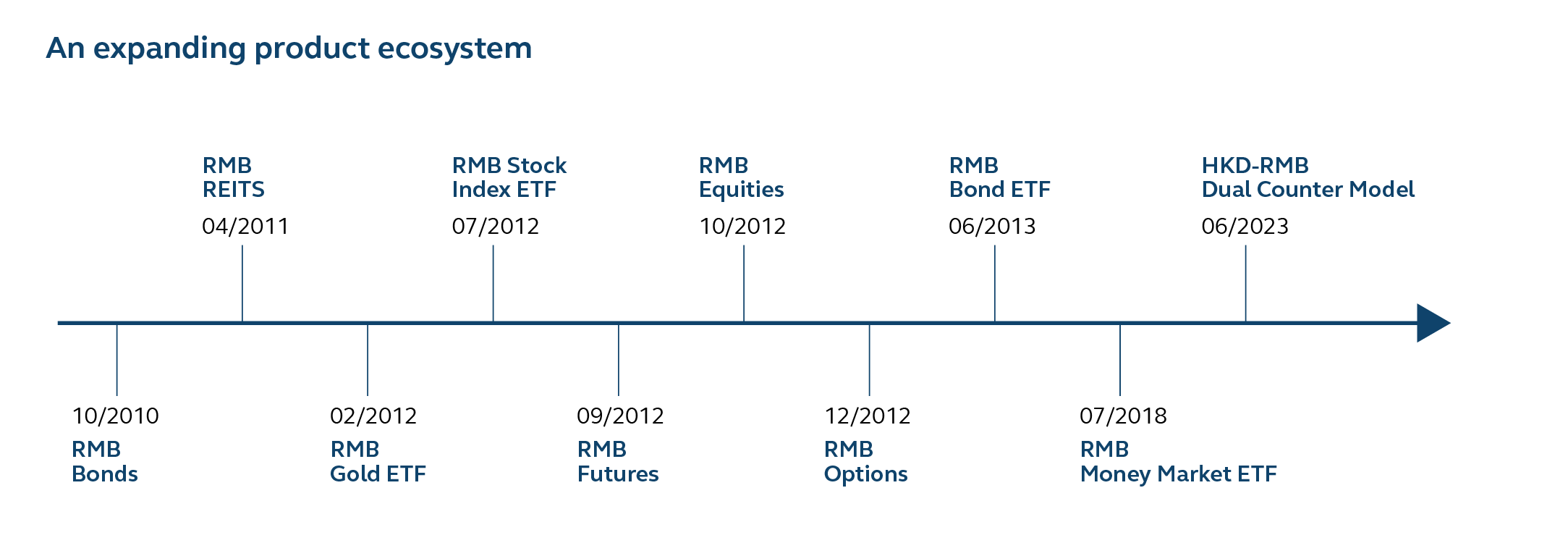

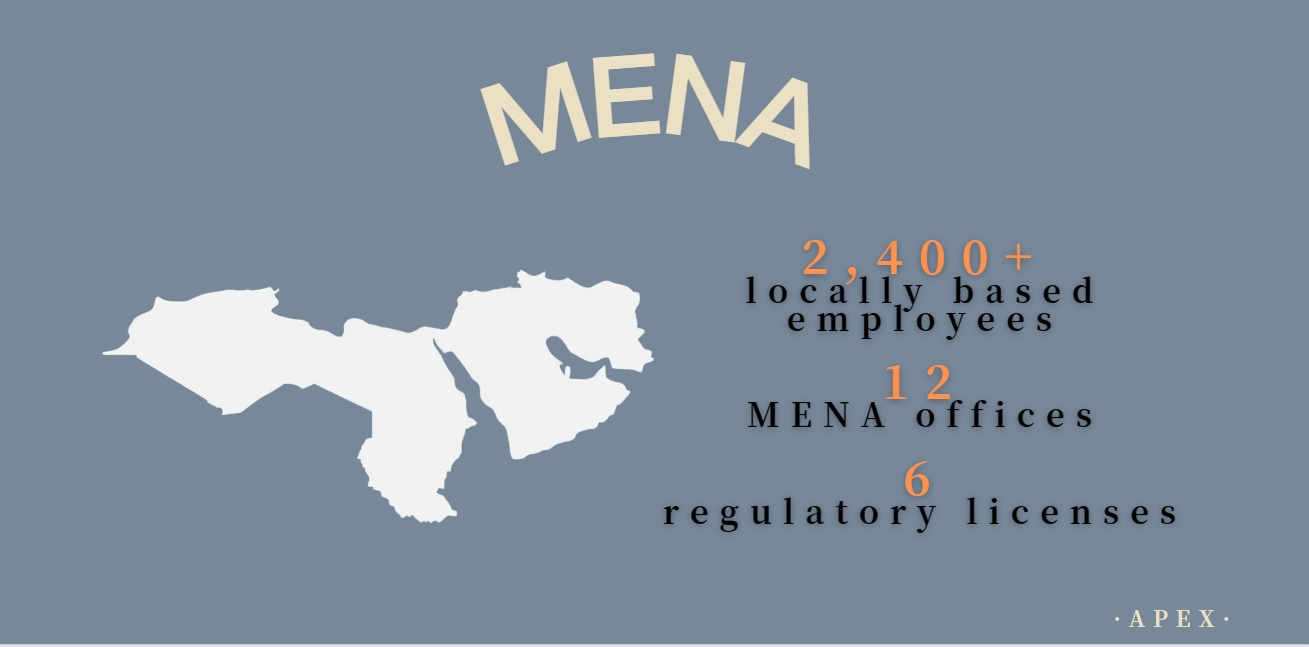

Hong Kong was the first market in the world to offer offshore RMB investment products and, since 2010, HKEX's offshore RMB product ecosystem has grown to include a wide range of RMB-denominated bonds, real estate investment trusts (REITs), equities and ETFs.

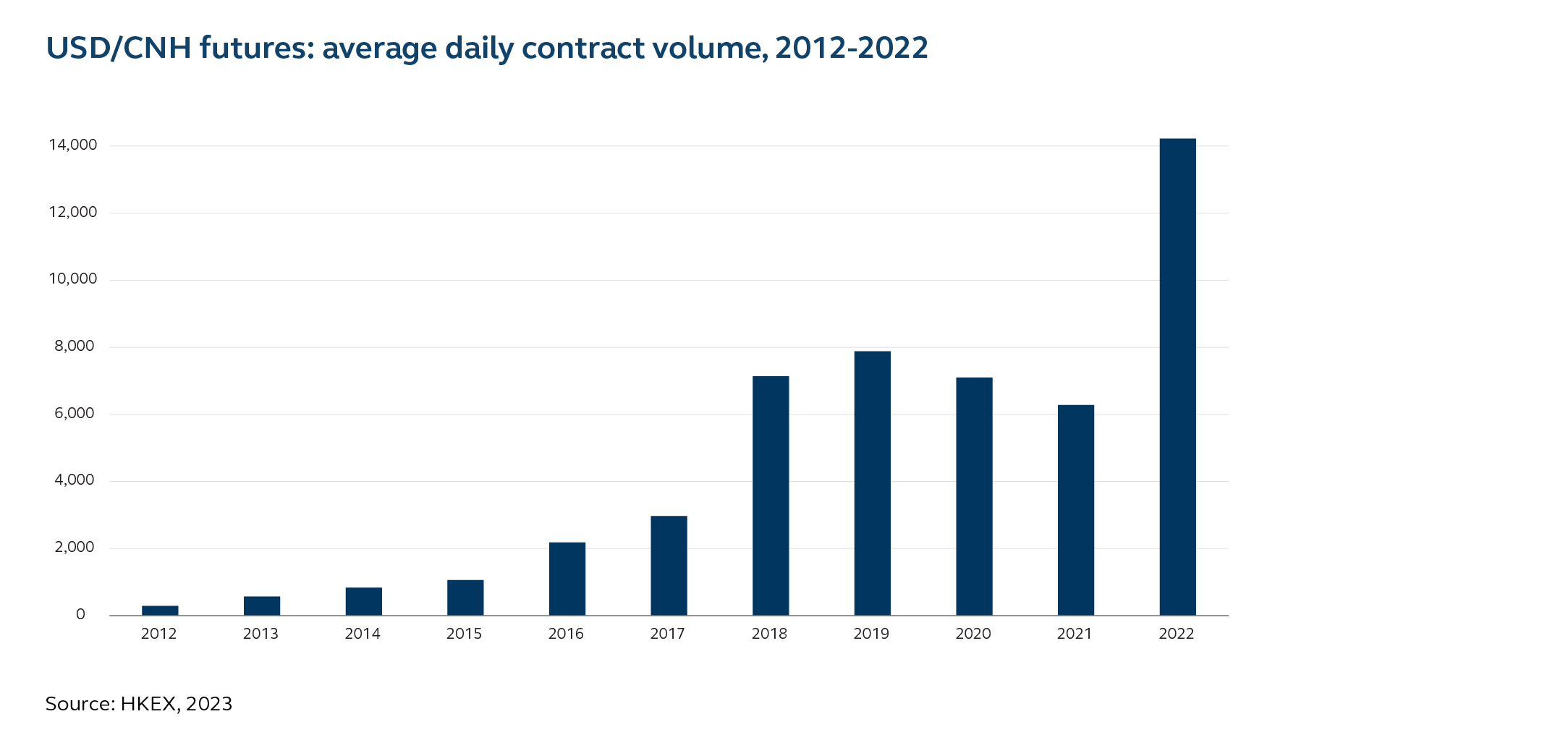

To further support the development of RMB securities, HKEX has also introduced risk management tools, such as USD/CNH futures.

That product, the world’s first deliverable RMB currency futures product to be quoted, margined, and settled in RMB, was introduced in September 2012 and average daily contract volume reached more than 14,000 contracts in 2022, according to HKEX data.

Apart from products, HKEX has worked with partners and stakeholders to create mutual market access programmes, such as Stock Connect and Bond Connect, that provide global investors with access to RMB-denominated products via a user-friendly interface and system.

The HKD-RMB Dual Counter Model is the latest initiative that connects offshore investors with RMB-denominated investment opportunities and paves the way for onshore Mainland investors to trade RMB-denominated securities through Southbound Stock Connect at a later stage.

The HKD-RMB Dual Counter Model

In short, this model is simply: “one share, two currencies.”

The HKD-RMB Dual Counter Model offers investors a choice of trading the shares of a Hong Kong-listed company in either HKD or RMB.

From the launch of the Dual Counter Model on June 19, investors may trade 24 Dual Counter Securities: a selection that includes some of the largest, most widely traded companies on the Hong Kong cash equities market and their HKD counters account for approximately 40% of average daily turnover of cash equities, according to HKEX data.

In the HKD-RMB Dual Counter Model, securities under the two counters are of the same class and are fully interchangeable and investors in either counter have identical rights, such as dividend and voting rights.

The Dual Counter Market Making Programme is a key part of the Dual Counter Model.

Through it, market makers will offer buy and sell quotes on RMB-denominated securities, providing consistent liquidity in the RMB counter, linking up liquidity between HKD and the RMB counters and carrying out arbitrage trading, cross-counter, to minimise price discrepancies between the two counters.

More choices, bigger capital pools

Through the Dual Counter Model, investors will have a wider choice of trading currencies and investing opportunities and will be able to seamlessly and flexibly interchange securities listed in both HKD and RMB counters.

For issuers, the Dual Counter Model connects them to the RMB liquidity pool, in particular investors with offshore RMB. As the model develops, it is expected that investors in Mainland China will eventually have the opportunity to trade RMB-denominated, Hong Kong-listed stocks via Southbound Stock Connect.

The time is right

Why launch the HKD-RMB Dual Counter Model now?

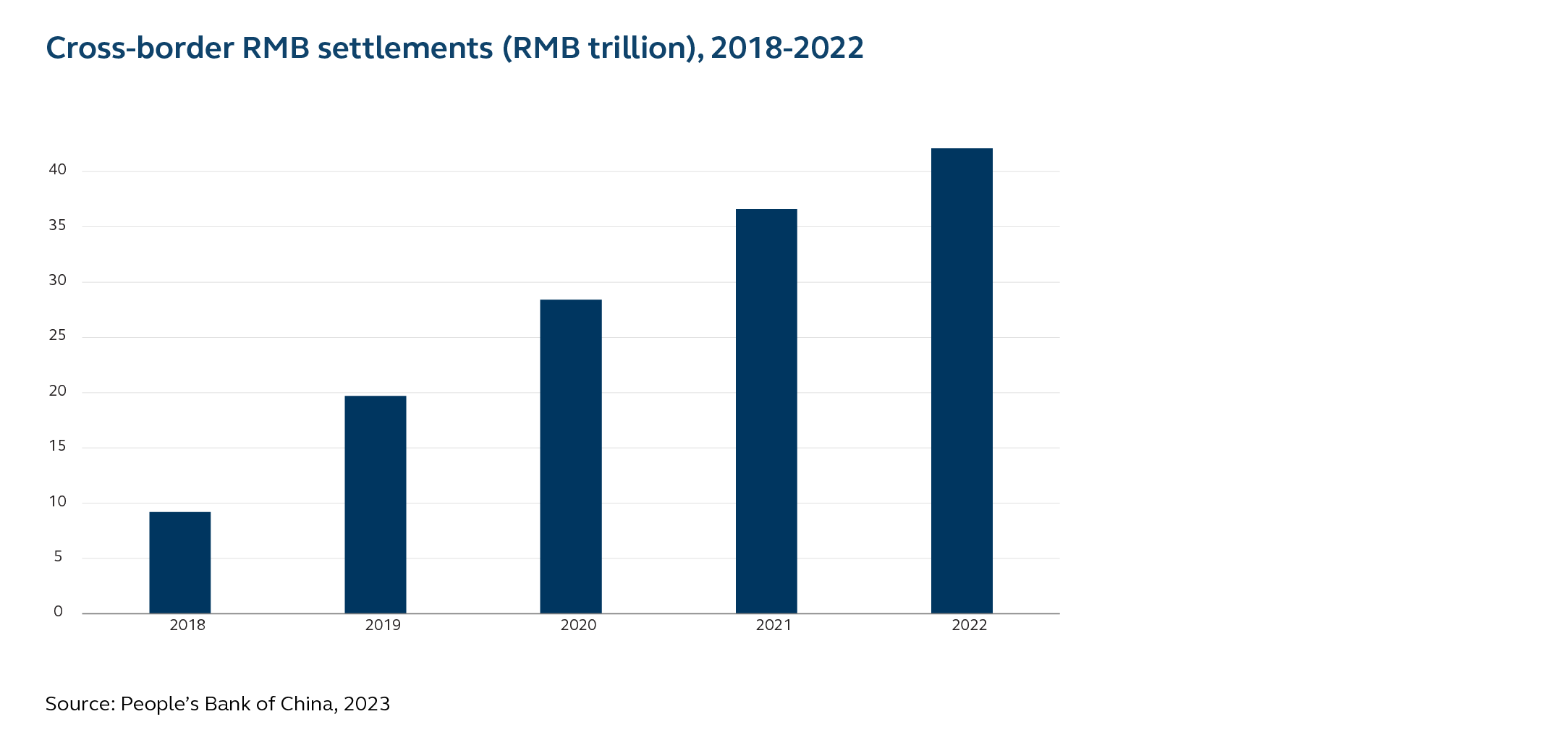

The RMB internationalisation process means the RMB is increasingly being used as a trading and investment currency and offshore RMB liquidity pools are growing.

For example, RMB 42.1 trillion (USD 6.1 trillion) of China’s cross-border payments and receipts were settled in RMB during 2022, up 15% compared with RMB 36.6 trillion in 2021, and up 48.2% compared with RMB 28.4 trillion in 2020, according to data from the People’s Bank of China.

The RMB is now one of the five most actively traded currencies in the world. It rose to fifth place in over-the-counter (OTC) foreign exchange markets in April 2022, up from eighth in the same month in 2019, according to an October 2022 survey of central banks by the Bank for International Settlements (BIS).

By enriching the RMB product ecosystem with the addition of RMB-denominated securities in the Dual Counter Model, HKEX is channeling the growing vitality in the RMB space into financial markets and promoting RMB internationalisation.

Hong Kong is the world's leading offshore RMB centre – total RMB deposits in Hong Kong have increased from RMB 597 billion in April 2018 to RMB 832 billion in April 2023, and Hong Kong was the world's largest offshore RMB settlement center in 2020, handling approximately 75% of all global RMB payment transactions, according to the Society for Worldwide Interbank Financial Telecommunication (SWIFT).

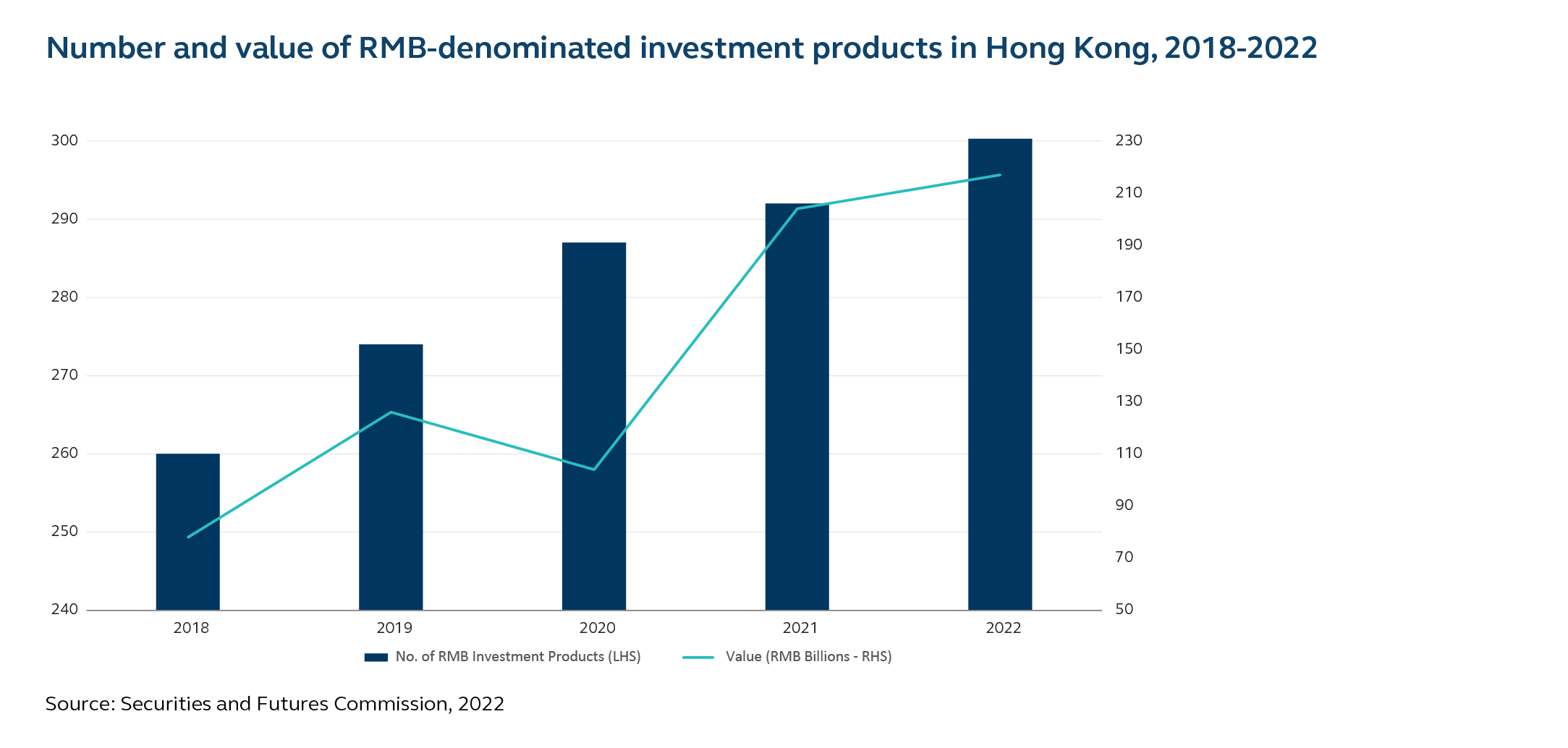

Also, the number and value of RMB-denominated investment products in Hong Kong is expanding – rising from 260 in 2018 to 342 at the end of 2022, and with the total value growing from RMB 78 billion to RMB 217 billion over the same time horizon, according to the Securities and Futures Commission.

The start of something bigger

Over the years, HKEX has made continuous enhancements to Stock Connect and Bond Connect, and it will be the same for the Dual Counter Model.

The number of Dual Counter Securities will increase, albeit in stages, and it is expected that Mainland investors will eventually be able to trade RMB-denominated securities through Southbound Stock Connect.

Under the current Southbound Stock Connect mechanism, Mainland investors trade HKEX securities in HKD and settle the trades in RMB, hence are exposed to foreign exchange risks, if exchange rates fluctuate.

Quoting and trading Hong Kong-listed stocks in RMB can reduce exchange rate risks for Mainland China investors and increase the attractiveness of Hong Kong-listed securities to them.

The inclusion of RMB-denominated securities in Southbound Stock Connect will, however, take some time as it requires upgrading some infrastructure and close cooperation among various stakeholders in both Hong Kong and Mainland China.

Strengthening Hong Kong's role as an IFC

While it will take time to build liquidity, the Dual Counter Model is an important step in growing Hong Kong's RMB ecosystem, one that already includes access to A-shares via Stock Connect, RMB bonds through Bond Connect, as well as HKEX's diverse selection of RMB-related products.

This latest step also follows the recent inclusion of international companies with a primary Hong Kong listing in Southbound Stock Connect, providing them with accessibility to the sizeable mainland market.

With the Dual Counter Model, mainland investors could eventually buy the stocks of these companies directly in RMB, raising the appeal and convenience of these transactions.

As the RMB product ecosystem expands, the direction of travel is clear – more choice for investors, bigger capital pools for issuers, increased cross-border capital circulation, closer connectivity with China, and faster RMB internationalisation – and all this is happening in Hong Kong, strengthening the city's role as East-West superconnector, offshore RMB hub and international finance centre.

First, please LoginComment After ~