Could a wealth tax ever be a workable climate fix?

When West Germany needed to rebuild after World War II, it knew where to find a ready supply of financing.

The 50% wealth tax, or “burden sharing act” that it implemented in 1952 recirculated a big chunk of assets held by the country's richest 1%, and arguably laid the groundwork for its post-war economic miracle.

Now, calls for a wealth tax are increasingly popping up on the global agenda – this time for a different kind of rebuild.

With about three-quarters of the countries on Earth setting goals to slash greenhouse gas emissions to zero, and a “carbon budget” that's dwindling, a more adequate financial response to what's been recognized as an existential crisis is in order.

Wealth taxes are often proposed during tough times, like in the aftermath of a war or a pandemic. They've also been widely viewed as more successful conversation starters than policy tools. But some economists say if a desperate search for climate funding is needed, then the extremely affluent – who not coincidentally have the most egregious carbon footprint – might be a good place to start.

In France, a report delivered last month to the prime minister estimated that the country will need €66 billion annually for its transition to net-zero emissions, and suggested a wealth tax on the richest 10% of the population to provide those funds. US President Joe Biden has proposed a 25% tax on wealth worth over $100 million to support an agenda that includes tackling the climate crisis. In New Zealand, the Green Party has made a 2.5% tax on individual wealth equivalent to about $1.2 million, in the form of things like real estate or stocks, a prominent part of its platform.

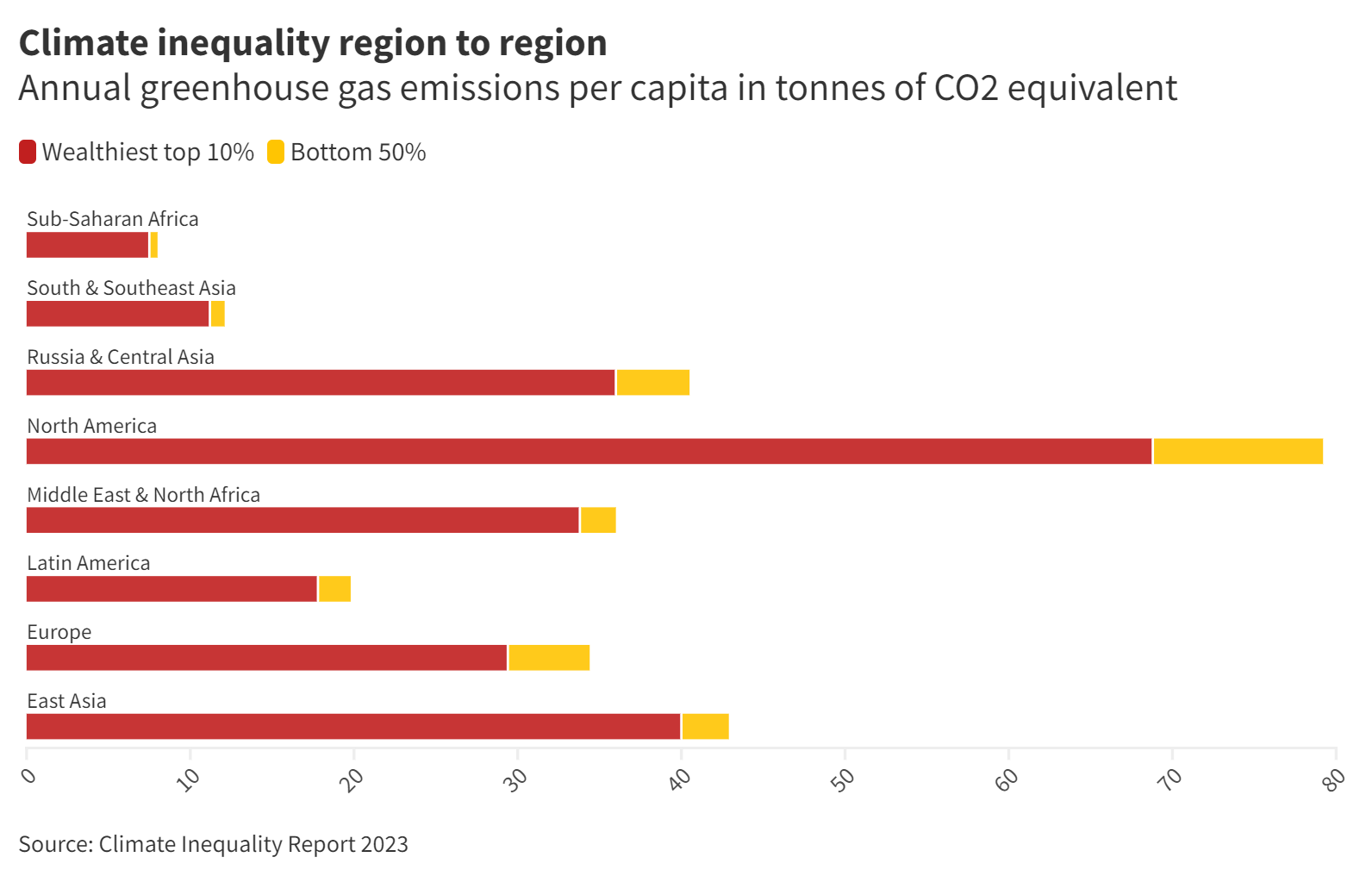

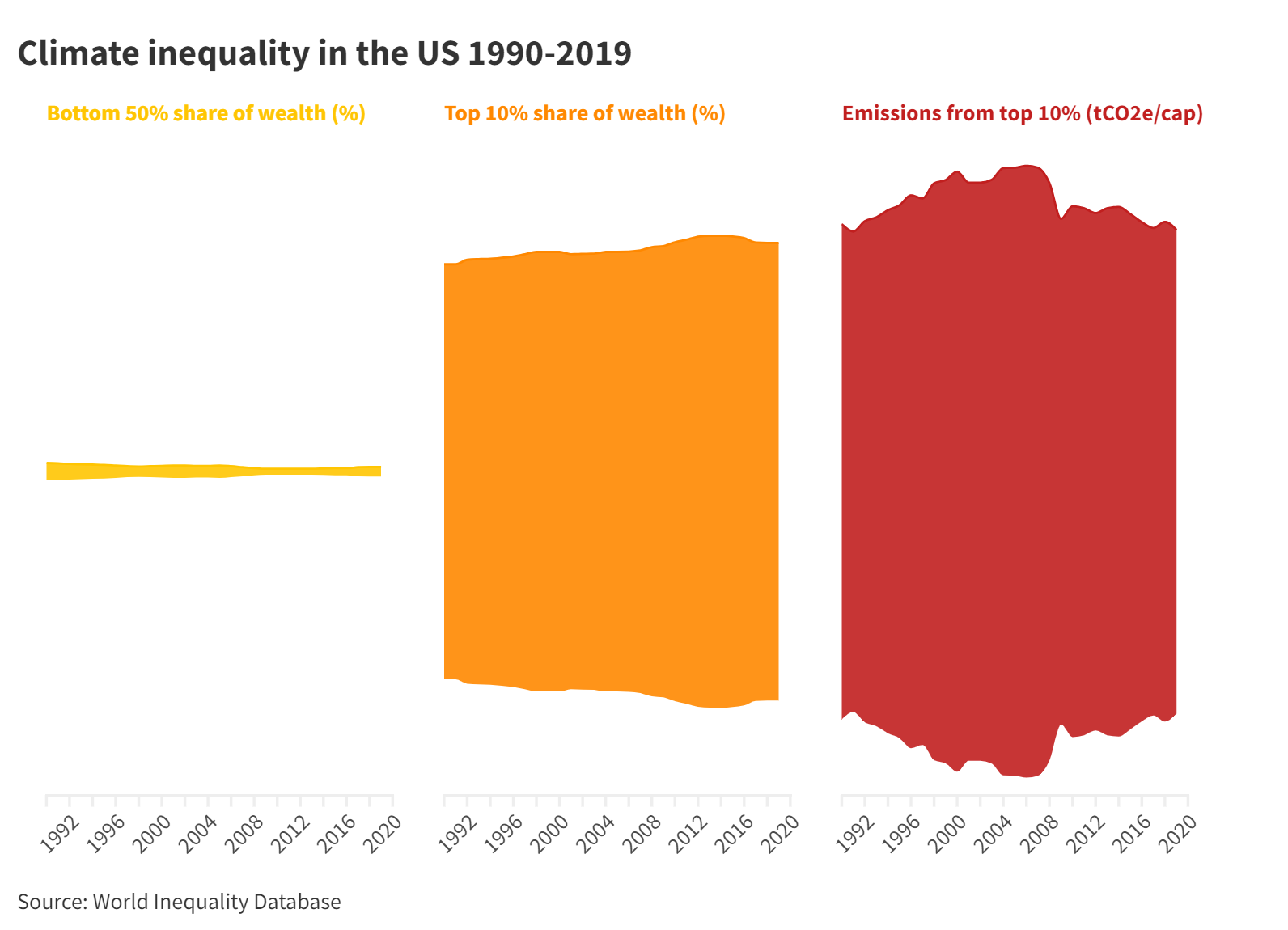

France, the US, and New Zealand share more than enviable levels of prosperity. In France, the wealthiest 10% of the population generates about three times the harmful emissions per capita than the average; in the US it's significantly more than three times, and in New Zealand it's nearly six times. As developed countries, they're far from unique in that sense.

They're also just a few of many places where the very rich have gotten richer.

According to a UN-backed report published in January, a global tax starting at 1.5% on individual wealth worth more than $100 million could raise nearly $300 billion per year. That would theoretically address a big portion of the $340 billion developing countries will soon need annually for adequate climate adaptation.

The report estimated that the one in 10 people who control three-quarters of world's wealth generate roughly half of all emissions; the bottom half of the population, with 2% of the wealth, are responsible for just 12% of emissions.

But a new wealth tax in France seems unlikely. And odds are stacked against the US proposal. Between 1990 and 2017, the number of highly-developed countries in the world levying individual net wealth taxes actually dwindled by 67%. Politically, the measures can be a tough sell. Wealth is an essential backbone for an economy, critics say, and by the way these things may be far easier to announce than to collect.

Norway, which not long ago increased its wealth tax, has seen a record number of super-rich residents simply depart for more accommodating locales.

Wealth, warming and taxes

The destabilizing effects of wealth taxes may not always be as obvious as an exodus to Switzerland.

One study published earlier this year found that corporate executives in Europe tend to react to wealth taxes by raising dividend levels for the stock they own in their companies, to help them pay up. Higher dividends usually make shareholders happy. But in these particular cases share prices don’t rise as much as they would otherwise, according to the study, hindering companies’ willingness to invest, provide jobs, and carry on the circle of market-based life.

There’s also a school of thought that the richest among us could just enjoy less of an advantage when it comes to acquiring things necessary for a green transition, in ways that make it easier for everyone else. The subsidies for buying electric cars could be pulled for people in higher income brackets, for example, and that money could be redirected to helping the less-wealthy make the same purchases.

While wealth taxes may be a blunter instrument, their track record isn't all bad.

West Germany isn’t the only country that used one to aid its post-World War II recovery. A 1946 wealth tax in Japan designed for that same purpose is deemed to have been relatively successful; other nations that deployed them for a post-war rebuild included Finland, Italy, and Austria.

More recently, Ireland leaned on a wealth tax in the aftermath of the 2008 global financial crisis and its own banking collapse.

As we approach alarming levels of warming, and a troubling series of climate tipping points, there may well be a more intense push for the money necessary to decisively address the problem. Basic issues of fairness will likely never not be a part of that discussion.

And it may not just be the affluent, heavily-emitting countries that will be expected to help less-affluent, lower-emitting countries adapt to a new climate reality. Nearly two-thirds of the inequality of emissions now stems from income differences within countries, the historian Adam Tooze noted recently. It's a problem of inequality that’s now more equally shared.

A global wealth tax to address the climate crisis “is obviously an extremely attractive and equitable idea,” Tooze wrote, which “presumably has no chance of realization.”

Climate impacts are also now more equally shared. For weeks, beginning early last month, Canadian forests were hit by climate change-fueled blazes of an immensity unimaginable to foreign firefighters sent in as reinforcements. But it seemed to require heavy smoke wafting down to New York earlier this month, blanketing the wealthiest city in the world, to raise global awareness.

More reading on taxes and climate change

For more context, here are links to further reading from the World Economic Forum's Strategic Intelligence platform:

“Another failed idea that never dies.” This piece argues that wealth taxes are punitive intrusions on the rich that encourage avoidance, evasion, and capital flight. (Institute of Economic Affairs)

Wealthy countries should “assume their historical responsibility” and pay for programs like solar power installation in developing nations, according to the head of the International Energy Agency. (Eco-Business)

About those wealthy countries – according to this report, official figures on their climate-related financial flows to developing markets obscure how much money is actually going towards climate projects. (Yale Environment 360)

Wealth taxes as a powerful tool to fight inflation, too? This piece makes the case. (Social Europe)

A different kind of tax that could (should) be helpful – according to this piece, a quarter of all carbon released into the atmosphere has been covered by a price, often levied in the form of the tax. (GreenBiz)

In Canada, an area the size of the Netherlands has been scorched by wildfires so far this year, according to this piece – which explores why disasters like this will probably become far more common in the future. (The Conversation)

Tap wealth to combat climate change, or risk seeing climate change destroy wealth? This study found that smoke particulates from more frequent wildfires could cost the US economy as much as $82 billion per year. (Cornell University)

On the Strategic Intelligence platform, you can find feeds of expert analysis related to Taxes, Climate Change, and hundreds of additional topics. You'll need to register to view.

First, please LoginComment After ~