SZSE Earnestly Implements the Consensus Reached between CSRC & SFC by Continuously Enriching and Optimizing the Connectivity Mechanism

On August 11, 2023,China Securities Regulatory Commission(hereinafter referred to as“CSRC”) and Securitiesand Futures Commission of Hong Kong(hereinafter referred to as“SFC”) issued a joint announcement, unveiling their agreement on promoting block trades (and non-automatchingtrades) to be included in the connectivity mechanism. According to the joint announcement, overseas investors will be able to participate in block trades on SZSE through the Shenzhen-Hongkong Stock Connect (Northbound Trading), while domestic investors can be involved innon-automatching trades on the Hong Kong Stock Exchange through the Shenzhen-Hongkong Stock Connect (Southbound Trading). In addition, block trades through the Shenzhen-Hongkong Stock Connect (Northbound Trading) and non-automatching trades through the Shenzhen-Hongkong Stock Connect (Southbound Trading) will be opened simultaneously. This is the latest practical measure to optimize the connectivity mechanism and promote mutual benefit between the financial markets of Chinese mainland and Hong Kong. It is conducive to improving trading convenience and market activity, enriching the ways for investors from both sides to participate in each other's markets and better meeting the diversified trading needs of investors.

Block trades generally refer to transactions with significantly larger trading volumes than the market average. To avoid the impact of block trades on the market, major domestic and foreign securities markets have established specialized trading mechanisms, adopting differentiated arrangements in trading methods, pricing mechanisms and information disclosure. Since the launch of the block trading mechanism by SSE and SZSE, the market has been running smoothly and orderly. The non-automatching system in the Hong Kong market is also an important way commonly used by Hong Kong investors. The inclusion of block trades in the connectivity mechanism will further enrich the latter's ways of trading.

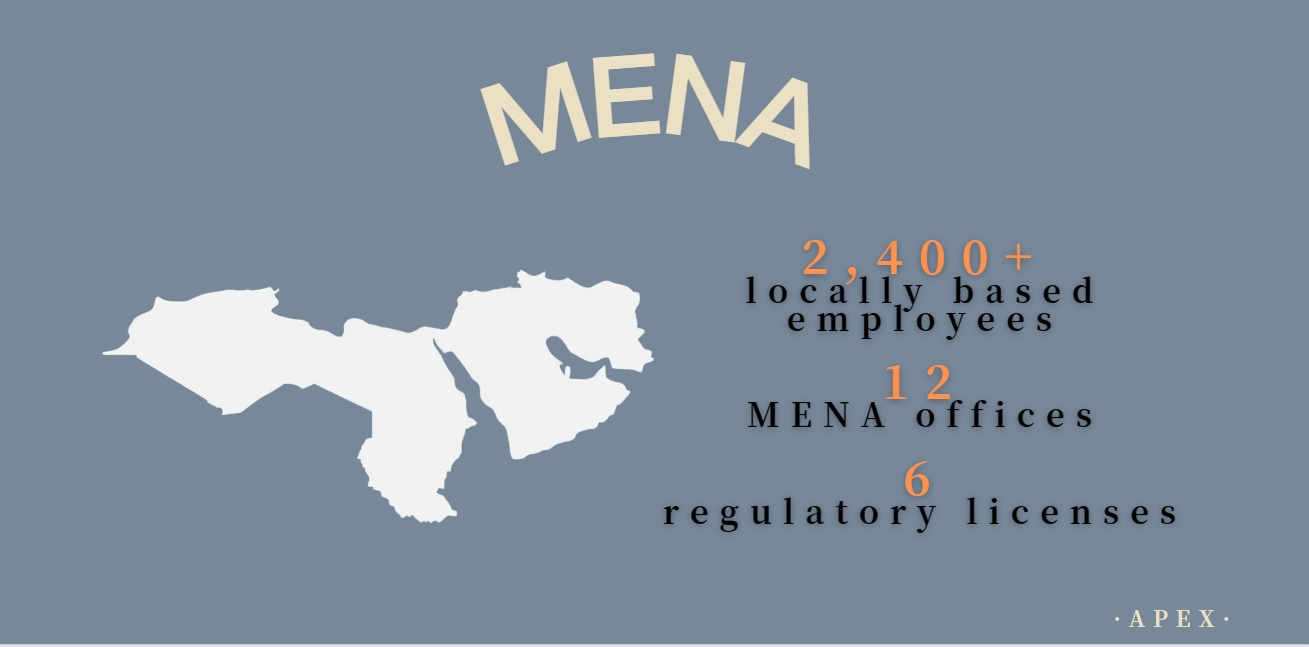

Since the opening of the Shenzhen-Hongkong Stock Connect in 2016, SZSE has firmly carried out the deployments of the Party Central Committee and the State Council, and the requirements of CSRC Party Committee for promoting the opening up of the capital market to the outside world, continuously optimized and improvedthe connectivity mechanism, expanded the scope of eligible securities and enriched the variety of eligible securities.Therefore,Shenzhen-Hongkong Stock Connect has been widely recognized and appreciated by domestic and foreign investors, and has become an important channel for investors from Chinese mainland and Hong Kong to participate ineach other's markets. As of the end of July 2023, the Shenzhen-Hongkong Stock Connect has been operated smoothly with active trading. The cumulative turnover of the Shenzhen-Hongkong Stock Connect (Northbound Trading) has reached CNY 55.2 trillion,with the net inflow of cross-border funds of more than CNY 930 billion. The cumulative turnover of the Shenzhen-Hongkong Stock Connect (Southbound Trading) has reached CNY 13.47 trillion,with a net inflow of cross-border funds of CNY 1.13 trillion. The Shenzhen-Hongkong Stock Connect makes a positive contribution to the sustained and healthy development of the capital marketsin both regions.

SZSE is jointly studying with relevant parties, according to CSRC's unified deployment, the implementation ways of block trades (andnon-automatching trades) under the connectivity mechanism. Based on fully soliciting the opinions of the market players, it will study and formulate business plans and improve supporting arrangements such as business, technology, and supervision, to ensure the smooth operation of block trades (andnon-automatching trades) under the Shenzhen-Hongkong Stock Connect.

Next, SZSE will continue to leverage its geographical advantage and platform functions, actively get involved in the development of the Guangdong-Hong Kong-Macao Greater Bay Area and the pilot demonstration area and continuously optimize and expand the connectivity mechanism to help promote high-quality two-way opening up of the capital markets.

First, please LoginComment After ~