The Dual Circulation Strategy: Boosting Domestic Demand and Increasing Imports

In the face of new challenges and opportunities at home and abroad, China is committed to pursuing high‑level opening‑up to the outside world, accelerating the creation of a new development mode with domestic circulation playing a leading role supported by mutual reinforcement between the domestic and international circulations, and integrating export and domestic demand to advance high‑quality economic development. Under the policy of bolstering domestic demand it can be expected that local consumption will continue to upgrade and expand, and as income levels rise, demand for consumer goods will diversify. Moreover, as action is being taken by China to encourage and increase imports, suppliers of quality niche products stand to benefit from the huge market opportunities this creates.

It is worth noting that the Yangtze River Delta (YRD) region has China's most vibrant economic development and is a key engine for economic growth. Shanghai, the YRD's leading city, is home to the country's first pilot free trade zone and the China International Import Expo (CIIE), and an important window for the outside world to enter the mainland market amid its drive to expand imports. The central government has been actively promoting integrated regional development of the YRD and efforts have been made to build a number of global consumption centres [1].

In view of this, provinces within the region, drawing from the experience of Shanghai in establishing itself as a global consumption centre, are gathering together in the YRD high‑quality enterprises, merchandise and services from around the world to jointly create a multi‑level regional consumer market that connects global consumers. Against this backdrop, the YRD has become an important gateway for businesses wishing to tap China's domestic market. Hong Kong companies can make use of the trade platforms in Shanghai and its neighbouring cities to make their way into the YRD and the huge domestic mainland market.

In this connection, HKTDC Research and the Shanghai Municipal Commission of Commerce jointly conducted a study whereby a field survey in the YRD was carried out in the second quarter of 2023. Local import platforms and related enterprises were interviewed and market intelligence collected with a view to helping Hong Kong and foreign businesses gain an understanding of developments in the post‑pandemic mainland market. Emphasis was placed on how these businesses can expand into the vast mainland domestic market via the YRD region in a bid to grasp the opportunities arising from China's “dual circulation” strategy. This report mainly analyses the major import sales channels and consumer goods import platforms in the YRD with the aim of helping Hong Kong suppliers and traders choose the right import channels and co‑operation partners in their move to expand into the mainland market more effectively.

YRD: a key gateway to expanding domestic sales

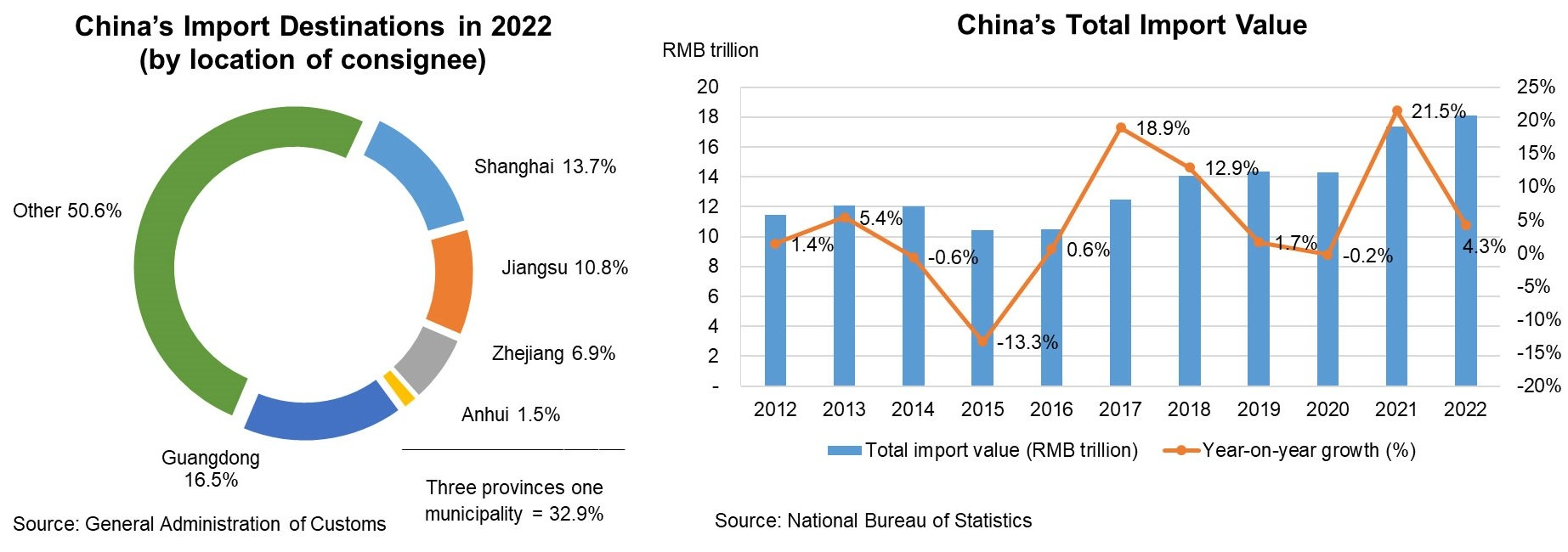

Since the Covid pandemic began to ease off in early 2023, China's economy and consumer market have gradually rebounded. Despite the lacklustre performance of the global economy due to central bank interest rate hikes around the world, widespread inflation and geopolitical tensions, China continues to encourage import expansion in order to meet the constant demand of its population for imported consumer goods.

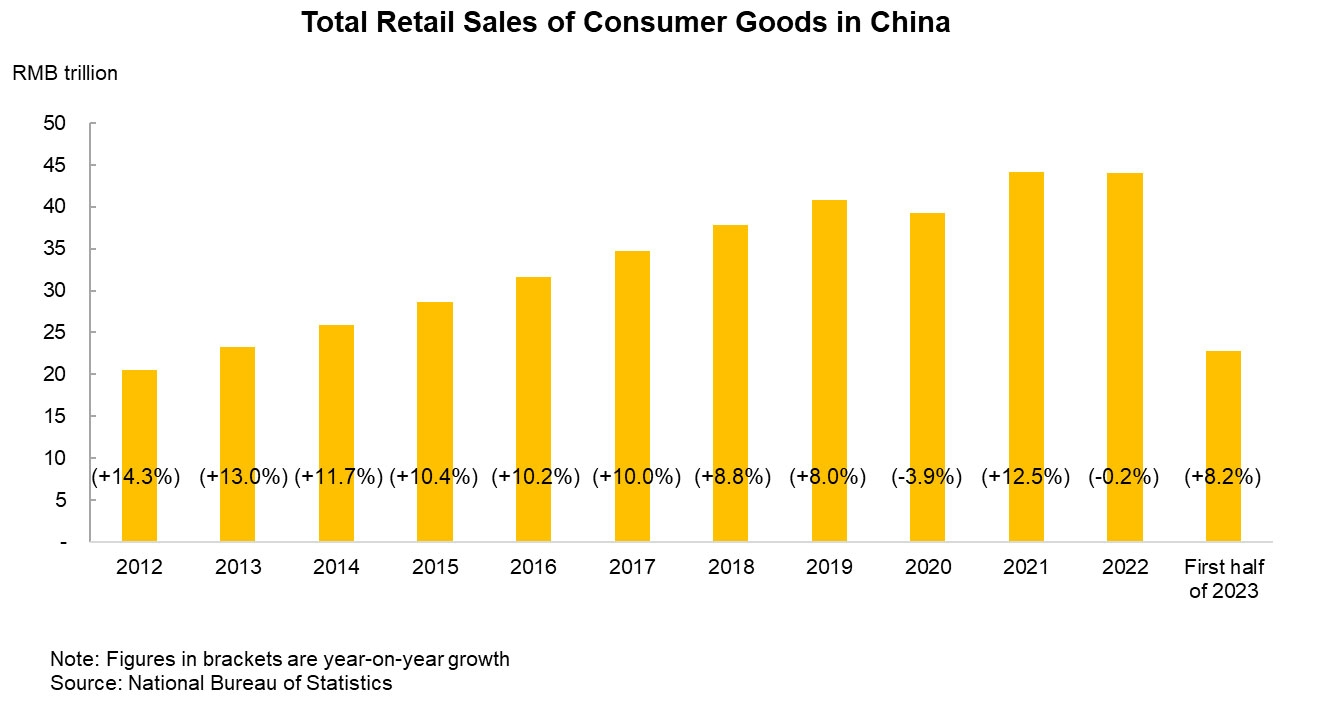

As a matter of fact, the consumer market in China has been growing rapidly in recent years. Although under the prevention and control measures implemented during the pandemic total retail sales of consumer goods dropped 0.2% to RMB44 trillion (about US$6.05 trillion) in 2022 after climbing 12.5% in 2021, the mainland consumer market has rebounded swiftly since early 2023 following the easing of pandemic prevention and control measures across the board. According to figures released by the National Bureau of Statistics, in the first half of 2023 total retail sales of consumer goods reached RMB22.8 trillion, up 8.2% over the same period a year earlier. Of this, online retail sales of physical goods registered RMB6.1 trillion, an increase of 10.8% year‑on‑year and accounting for 26.6% of total retail sales of consumer goods.

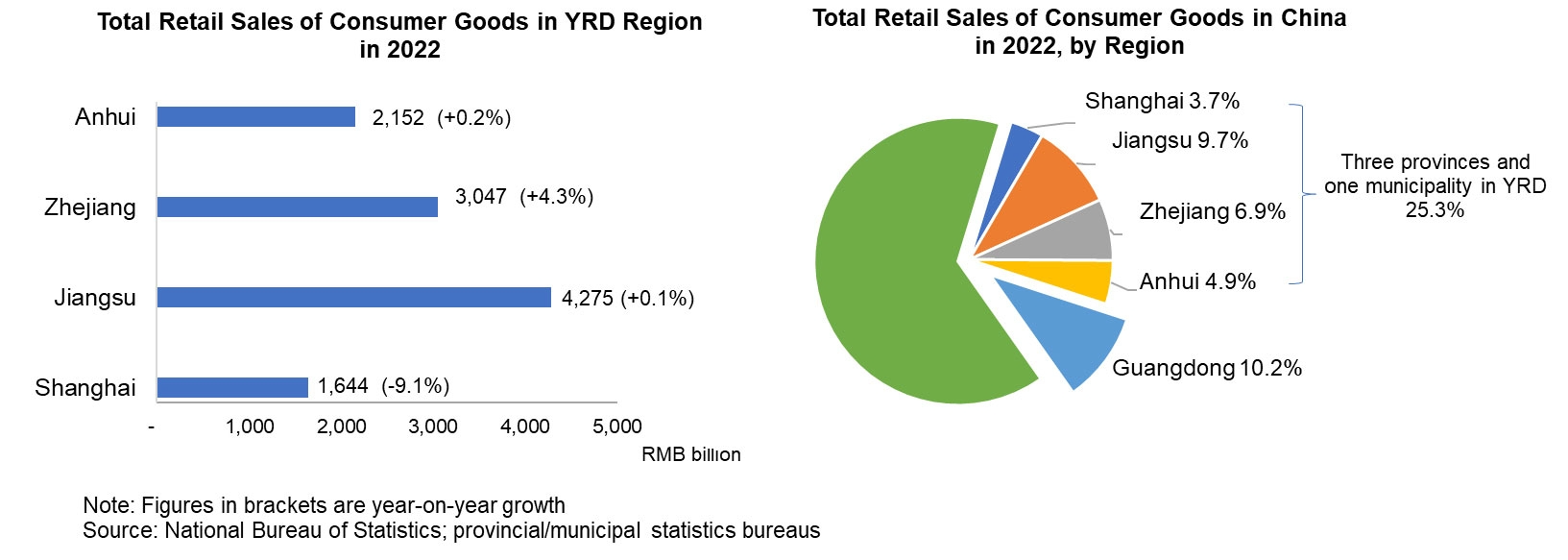

As income levels in the YRD are relatively high, the consumption power of local residents ranks top in the country. For instance, per capita disposable income for Shanghai municipality, Zhejiang and Jiangsu provinces in 2022 was RMB79,610, RMB60,302 and RMB49,862, respectively, higher than the national average of RMB36,883. This shows that consumers in the YRD have stronger purchasing power, making the region one of the country’s largest consumer markets. In Guangdong province, which is home to nine of the Guangdong‑Hong Kong‑Macao Greater Bay Area (GBA) cities, total retail sales of consumer goods in 2022 rose 1.6% to RMB4.5 trillion, accounting for more than 10% of the national total, and its potential consumption should not be underestimated. However, in the YRD, adding Anhui province to Shanghai municipality, Zhejiang and Jiangsu means that the aggregate retail sales of consumer goods of these “three provinces and one municipality” account for one‑quarter of the national total. In light of this, in addition to Guangdong province/GBA, with which Hong Kong companies are familiar, the YRD is a regional market not to be overlooked by businesses selling mainland and foreign products to the domestic market.

Leveraging changing import channels

With the central government's vigorous encouragement, China's total imports have been rising in the past 10 years. Last year, in spite of the negative impact brought about by the pandemic and global economic downturn, imports still recorded an increase of 4.3% in RMB terms. The YRD has continued to serve as one of China’s key import gateways. In 2022, the aggregate imports of Shanghai municipality, and Zhejiang, Jiangsu and Anhui provinces reached RMB5.97 trillion, accounting for 33% of the national total. Besides, apart from Shanghai where the annual CIIE is held, provinces in the YRD have also established a multitude of comprehensive bonded zones, which greatly facilitate the import of cargoes into the mainland. Coupled with the various kinds of service platforms for imports of goods built by public service units under the government and private enterprises in the YRD, this can help Hong Kong suppliers and traders expand the domestic market.

Leveraging government policies aimed at building Shanghai and the whole YRD region into a centre of consumer goods from around the world, enterprises in the region are actively co‑operating with foreign suppliers in importing quality products and services, combining these with well‑known mainland branded products to expand into the YRD and other regional markets, which have recovered and are growing in the post‑pandemic era. Highlights of the policies include:

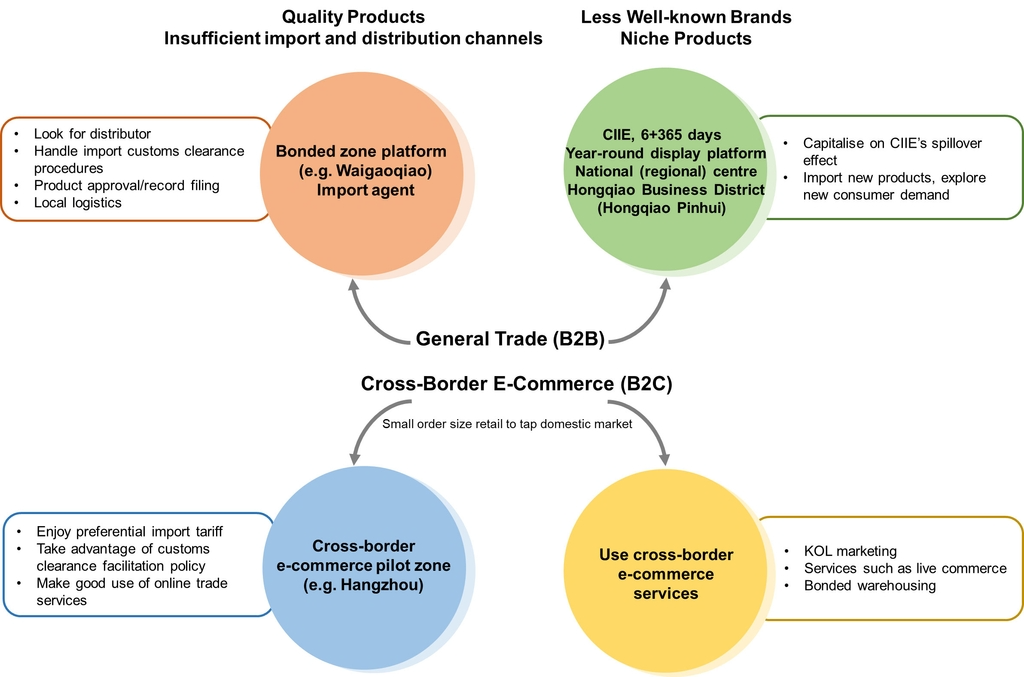

- With regard to general trade, a large number of trade platforms dedicated to imports have been set up at the Shanghai Waigaoqiao Free Trade Zone providing foreign suppliers with B2B services such as bonded products display, product promotion, import agency, and logistics. These platforms can not only help Hong Kong companies find mainland distributors, but also assist the city's small- and medium-sized enterprises (SMEs) in handling mainland import formalities such as customs clearance, product approval/record filing, inspection and quarantine. [For more details, see Waigaoqiao's Service Trading Platforms Key Import Facilitators]

- As part of the integrated development of the YRD, the Hongqiao Business District in Shanghai is the centre of an outward-looking international hub. Businesses in the district can effectively network with distributors in Shanghai and capitalise on the convenient transport and logistics services to connect with clients in the entire YRD region, such as Kunshan, Taicang and Suzhou in Jiangsu province as well as Jiaxing and Haining in Zhejiang province. The local trade platforms engaged in import are also eager to strengthen co-operation with Hong Kong companies in jointly tapping the YRD domestic market. [For more details, see Hongqiao CBD an Effective YRD Access Point]

- Cross-border e-commerce, as a new format of trade, is not only booming in the YRD but also changing the trading landscape in the whole region. Hangzhou in Zhejiang province is the first cross-border e-commerce pilot zone in China. Thriving on the country’s cross-border e-commerce policy support, the city is the base of e-commerce giant Alibaba. With a great number of e-commerce operators developing in leaps and bounds in Hangzhou and its surrounding areas, the city is hailed as China’s cross-border e-commerce capital.

- China grants preferential import tariff policy and customs clearance facilitation to cross-border e-commerce operators. This gives such operators in the YRD the incentive to collaborate with local import platforms and logistics enterprises to connect with foreign suppliers to further expand the domestic consumer market. In addition to providing various kinds of online trade services required in developing retail business, such as KOL marketing and live commerce, other services available include cross-border e-commerce retail import and bonded warehousing. All these can help foreign enterprises capture cross-border retail import opportunities on the mainland via e-commerce retail channels by using the B2C “small order size” sales model.

The above‑mentioned development is gradually giving a facelift to the distribution channels of imported products in the YRD. Hong Kong companies should pay close attention to the characteristics of different channels so they can make the best use of traditional general trade and the new cross‑border e‑commerce business model to expand the domestic market of the YRD and other regions.

[Note: For more details on import channels in YRD, see other articles in “Dual Circulation Import Opportunities: Accessing the Mainland Market Via the YRD”]

Accessing the domestic market

Foreign enterprises can expand domestic sales under general trade via various trade platforms. They can also consider making use of cross‑border e‑commerce retail channels to enter the YRD as well as grasp business opportunities in the entire mainland market. In view of the fact that the YRD is one of the most economically developed regions in China, local consumers have considerable purchasing power, and demand for quality import goods is strong, [For more details, see Growing Preference of YRD Consumers for Premium Products] the region can serve as the gateway for Hong Kong companies to expand into the domestic market in eastern China, northern China and other regions.

Nevertheless, Hong Kong companies using the services of import platforms in the YRD should make sure their products meet the demand of the local consumer market. They should also note that mainland consumers attach great importance to the performance‑price ratio of the products, that is, whether they are good value for money. In terms of import sales, Hong Kong companies should compare the fees charged by different import platforms or agents as well as the benefits of the services they provide before choosing the right co‑operation partner. Besides, under China’s dual carbon goals (carbon peaking and carbon neutrality), mainland enterprises and consumers are paying more attention to products' green attributes and carbon footprints. In light of this, in formulating their domestic sales strategies, Hong Kong companies must take into consideration all factors concerned so as to guarantee the sustainability of their domestic sales businesses.

[1] On 19 July 2021, with the blessing of the State Council, the Ministry of Commerce announced the list of pioneering global consumption centre cities, which included Shanghai, Beijing, Guangzhou, Tianjin and Chongqing. On 25 August 2021, the General Office of the Shanghai Municipal People's Government released an implementation plan for building Shanghai into a global consumption centre in a move to advance the work of constructing global consumption centres.

First, please LoginComment After ~