Bank of England:Money and Credit - December 2023

Key points:

♦Individuals repaid, on net, £0.8 billion of mortgage debt in December compared to net zero in November.

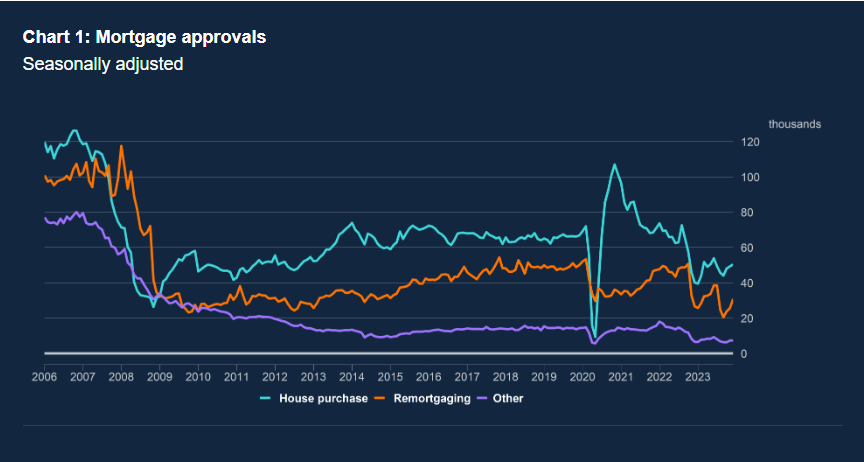

♦Net mortgage approvals for house purchases rose from 49,300 in November to 50,500 in December. Net approvals for remortgaging increased from 25,700 in November to 30,800 in December.

♦The ‘effective’ interest rate – the actual interest paid – on newly drawn mortgages fell by 6 basis points to 5.28% in December. The first drop since November 2021.

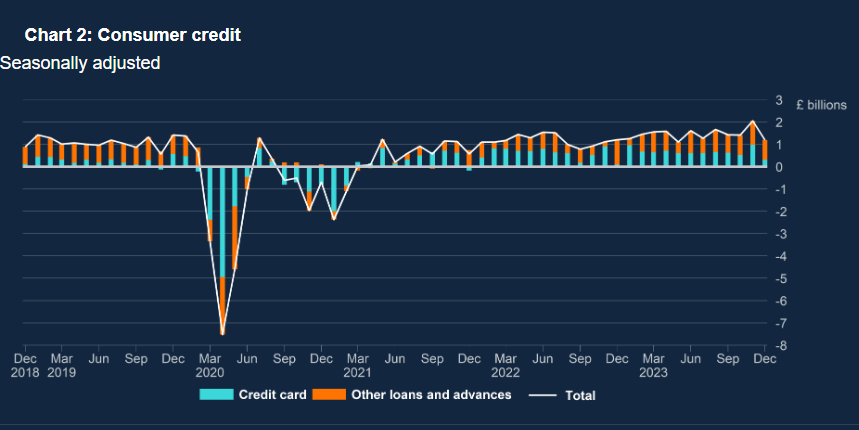

♦Net borrowing of consumer credit by individuals fell to £1.2 billion in December, from £2.1 billion in November.

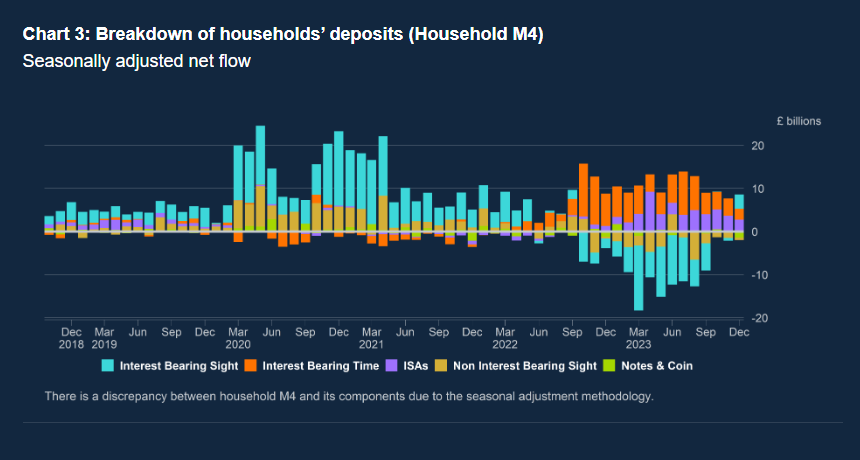

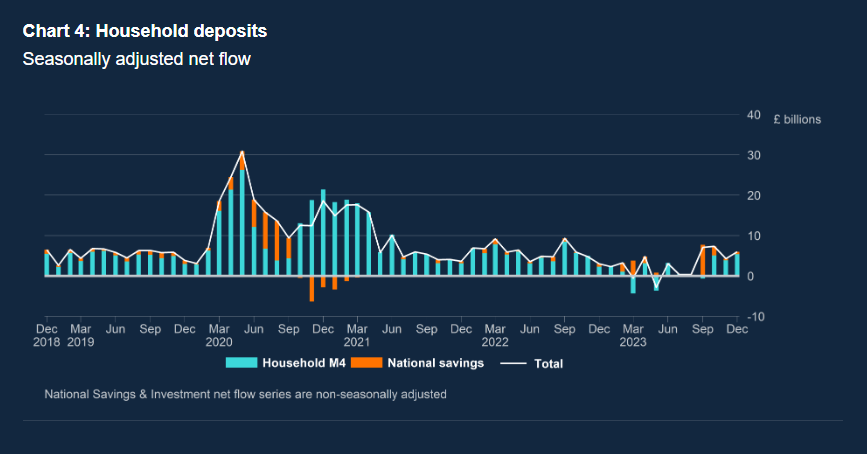

♦Households deposited, on net, £5.4 billion with banks and building societies in December. Households, on aggregate, did not follow the recent trend of withdrawing from sight deposit accounts, and for the first time since May 2022, flows into sight deposits were higher than time deposits.

♦UK non-financial businesses (PNFCs and public corporations) borrowed, on net, £0.7 billion, following £1.4 billion of repayments in November.

♦The net flow of sterling money (known as M4ex) continued to be volatile month-on-month. M4ex increased by £19.9 billion in December, compared to a decrease of £2.9 billion in November. As seen in recent months, flows have largely been driven by movements in non-intermediate other financial corporations’ (NIOFCs’) holdings of money. These holdings increased by £15.6 billion in December, compared to a decrease of £6.9 billion in November. Households also contributed to the growth in M4ex, albeit to a lesser extent.

♦The flow of sterling net lending to private sector companies and households (M4Lex) amounted to £6.4 billion in December, down from £12.7 billion in November. This was mainly driven by a decrease in the flow of lending to NIOFCs.

References in the text point to the summary tables below. For further statistics, please see our visual summaries, Effective Rates (ER) statistical release, Capital Issuance statistical release, and Bankstats tables.

Lending to individuals

Mortgage lending (M&C Tables D and E):

Individuals repaid, on net, £0.8 billion of mortgage debt in December compared to net zero in November. The annual growth rate for net mortgage lending was flat for the first time since the series began in March 1994, a new series low. Gross lending continued to increase, from £16.4 billion in November to £17.2 billion in December. Gross repayments also increased, from £15.6 billion to £19.1 billion over the same period.

Net approvals (that is, approvals net of cancellations) for house purchases, which is an indicator of future borrowing, rose from 49,300 in November to 50,500 in December (Chart 1). Net approvals for remortgaging (which only capture remortgaging with a different lender) increased from 25,700 in November to 30,800 in December.

The ‘effective’ interest rate – the actual interest paid – on newly drawn mortgages fell by 6 basis points, to 5.28% in December. The first drop since November 2021. The rate on the outstanding stock of mortgages increased by 9 basis points, from 3.27% in November to 3.36% in December.

Consumer credit (M&C Tables B and C):

Net consumer credit borrowing fell to £1.2 billion in December, from £2.1 billion in November (Chart 2). This was mainly driven by lower borrowing through credit cards, which fell from £1.0 billion in November to £0.3 billion in December. Similarly, net borrowing through other forms of consumer credit (such as car dealership finance and personal loans) also decreased, from £1.1 billion in November to £0.9 billion in December.

The annual growth rate for all consumer credit decreased slightly, and is now at 8.5% in December. This reflects a fall in the annual growth rate for other forms of consumer credit, from 6.9% in November to 6.7% in December. This fall was partially offset by credit card borrowing growing slightly, from 12.4% to 12.7%, the highest rate since February 2023.

The effective interest rate on interest-charging overdrafts decreased by 54 basis points, to 21.91% in December. The effective rate on interest-bearing credit cards decreased by 8 basis points, to 20.86%. By contrast, the effective rate on new personal loans to individuals saw a 12 basis point increase, and now sits at 9.17%.

Households' deposits (M&C Table J):

Households deposited, on net, £5.4 billion with banks and building societies in December. Households, on aggregate, did not follow the recent trend of withdrawing from sight deposit accounts, and for the first time since May 2022, flows into sight deposits of £3.3 billion were higher than time deposits of £2.5 billion into time deposits. The flows into interest-bearing sight deposits were partly offset by net outflows from non-interest bearing accounts of £0.6 billion (Chart 3).

Households' net deposit flows into National Savings and Investment (NS&I) increased slightly to £0.6 billion in December, from £0.4 billion in November. Deposits into NS&I accounts are not captured within households’ deposits with banks and building societies, but can act as a substitute for them. Overall households’ deposits with banks and building societies, as well as NS&I accounts, grew by £6.0 billion in December. This is more than the average monthly rate of £4.2 billion over the past 6 months, but less than the £7.4 billion observed in October (Chart 4).

The effective interest rate paid on individuals' new time deposits with banks and building societies fell by 27 basis points, to 4.80%. The effective rate on the outstanding stock of time deposits increased by 9 basis points to 3.71% in December, while the effective rate on stock sight deposits remained stable at 2.03%.

Lending to and deposits from businesses

Businesses’ borrowing from banks (M&C Tables F-I):

During December, UK non-financial businesses (PNFCs and public corporations) borrowed, on net, £0.7 billion from banks and building societies (including overdrafts), following £1.4 billion of repayments in November. Within this measure, large non-financial businesses borrowing increased from a net repayment of £0.8 billion in November, to a net borrowing of £1.8 billion in December.

Net borrowing by small and medium-sized non-financial businesses (SMEs) decreased from net repayments of £0.6 billion in November, to net repayments of £1.0 billion in December.

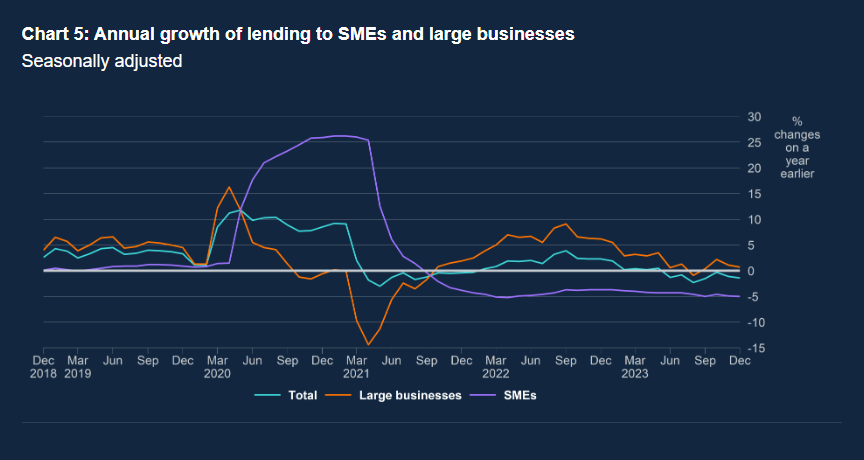

The annual growth rate of borrowing by large businesses was 0.7% in December, down from 1.1% in November. Lending to SMEs continued to contract by around the same annual rate as has been observed since around January 2022, the annual growth rate decreased from -4.9% in November to -5.0% in December.

The average cost of new borrowing from banks by UK PNFCs fell from 7.00% in November to 6.78% in December. Similarly, the effective interest rate on new loans to SMEs decreased by 19 basis points to 7.46% in December.

Market Finance (M&C Table F):

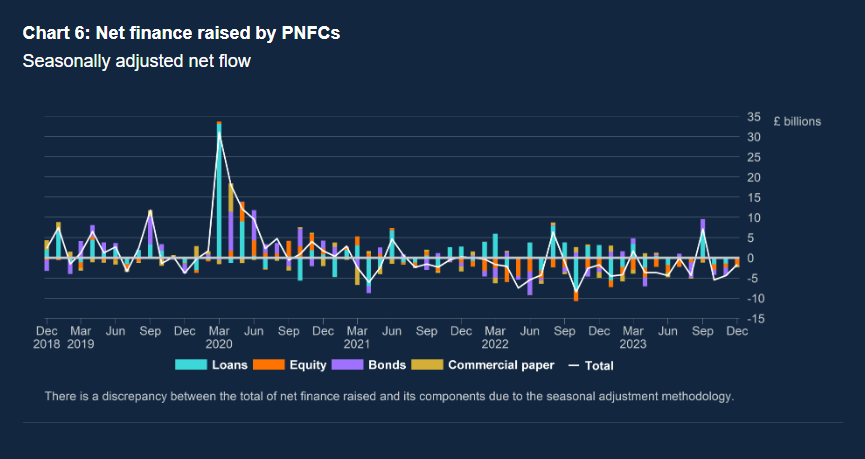

In December, private non-financial companies (PNFC) repaid, on net, £2.3 billion of market finance, a decrease from net repayments of £2.9 billion in November. The net repayments were driven by £1.5 billion of net equity buybacks, £0.2 billion of net bond redemptions, and £0.7 billion of net commercial paper redemptions (Chart 6).

Businesses’ deposits:

During December, UK non-financial businesses withdrew £5.5 billion from banks and building societies in all currencies, following deposits of £6.1 billion in November. The effective rate on new time deposits saw a 3 basis point increase to 4.72% in December. Similarly, the effective rate on stock sight deposits increased by 5 basis points, and now sits at 2.62%.

Aggregate money (M4ex) and lending (M4Lex) (M&C Table J)

The net flow of sterling money (known as M4ex) continued to be volatile month-on-month. M4ex increased by £19.9 billion in December, compared to a decrease of £2.9 billion in November. As seen in recent months, flows have largely been driven by movements in non-intermediate other financial corporations’ (NIOFCs’) holdings of money. These holdings increased by £15.6 billion in December, compared to a decrease of £6.9 billion in November. Households also contributed to this, with an increase in holdings of £5.4 billion in December compared to £3.9 billion in November. This increase was partly offset by PNFCs’ holdings of money, which decreased by £1.2 billion in December from net zero in November.

The flow of sterling net lending to private sector companies and households (M4Lex) was £6.4 billion in December, down from £12.7 billion in November. This was mainly driven by a decrease in the flow of lending to NIOFCs, from £11.4 billion in November, to £7.2 billion in December. The flow of lending to PNFCs also contributed to a broader decrease in M4Lex, from £0.8 billion of net lending, to £0.7 billion in net repayments. Flows of lending to households fell from £0.5 billion in November, to £0.1 billion of repayments in December.

First, please LoginComment After ~