Teaming Up for Term Loans February 2024 - Luxembourg and the Cayman Islands: A Comparative Analysis of Two Leading Fund Finance Jurisdictions

[co-author: Catharina von Finckenhagen]*

Luxembourg and the Cayman Islands are two of the world’s leading fund formation jurisdictions, and account for a large portion of the private equity funds domicile market. Most private equity fund structures are comprised of entities from a multitude of different jurisdictions, often including both Luxembourg and Cayman Islands funds. The efficient and commercial success of such multi-jurisdictional transactions invariably rests on the competence and experience of the legal counsel teams engaged to negotiate and advise the parties in respect of each relevant jurisdiction.

This article examines some of the principal similarities and differences between Luxembourg and the Cayman Islands when providing legal advice in connection with various types of fund financing transactions.

1.Two leading fund finance jurisdictions: Luxembourg and the Cayman Islands

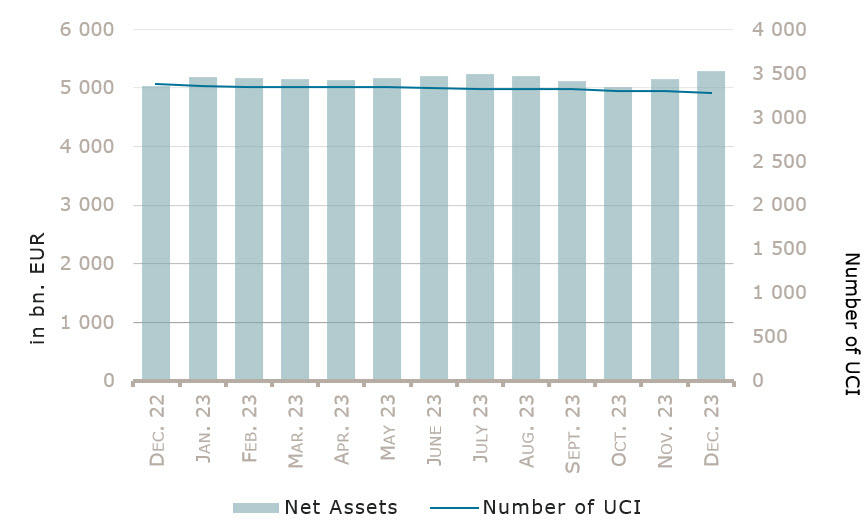

Luxembourg retains its status as the largest investment fund market globally outside the US, boasting total net assets under management of approximately €5.2 trillion[1], and holding the position as Europe's investment fund capital. Operating as the leading global distribution hub for investment funds, Luxembourg funds are marketed in 77 countries worldwide[2]. Luxembourg provides flexible management and marketing passporting rules for professional investors, innovative products pursuant to the European Union (EU) alternative investment fund managers directive (AIFMD), and a legal system continually adapting to commercial demands.

Serving as a gateway to Europe, Luxembourg offers solid regulatory control, legal certainty, and tax-efficient frameworks, making it a preferred jurisdiction for investment funds, sovereign wealth funds, and pension funds. Luxembourg is among the select nine countries still enjoying the highest AAA credit rating from S&P Global, Fitch, and Moody’s Investors Service.

The investment funds landscape in Luxembourg is evolving, marked by the recent introduction of European long-term investment fund vehicles and significant legislative updates, including revisions to the EU UCITS Directive and the AIFMD. Luxembourg also leads the EU market in the environmental, social, and governance (ESG) space, with a strong focus on directing most alternative investments toward ESG-compliant ventures.

The Cayman Islands is a well-established and flexible jurisdiction, which continues to be a jurisdiction of choice for private equity funds. The Cayman Islands’ legal framework is closely aligned with that of the UK and the US, and it serves as a tax-neutral platform for investment structures. Typically, a Cayman Islands fund is not subject to direct taxes in Cayman, thereby avoiding an additional tax layer on investments or for investors based in other jurisdictions. Notably, private equity funds in the Cayman Islands are not subject to onerous regulatory requirements[3], and the commonly featured exempted limited partnership structure closely resembles the Delaware limited partnership model, making it especially appealing to managers and investors in the US. The Cayman Islands maintain a straightforward and commercial legal system, adapting to commercial trends while upholding service quality and complying with the strictest international regulatory restrictions of recent years.

1.Civil law versus common law

The Cayman Islands and the Luxembourg legal systems are intrinsically distinct by their nature and framework.

The Cayman Islands, classified as a British Overseas Territory, operates under a legal system based on English common law, which has been modified by domestic statutes, and the highest court of appeal is the Privy Council in London. The legal concepts of the Cayman Islands and their application are generally very familiar to legal practitioners in the United States, United Kingdom, and other common law jurisdictions.

Common law is mainly unwritten and derived from customs and legal precedents, offering flexibility in its application, and constantly evolving to align with socio economic modernization.

The Luxembourg legal system, on the other hand, follows the written civil law tradition, specifically drawing from the Napoleonic Code. The first Constitution was drafted in 1841, and the current Constitution was implemented on 17 October 1868, with several revisions since then. Serving as the supreme legal authority in the state, the Constitution is supported by various sources of Luxembourg law, including international treaties, EU law, statutes, regulations, general legal principles, and case law.

The Luxembourg New Code of Civil Procedure (Nouveau Code de Procédure Civile) was introduced in July 2021 and outlines the rules governing civil procedure, encompassing not only the general domestic framework for recognizing and enforcing foreign judgments but also the provisions governed by international treaties, EU law, and specific Luxembourg regulations and legal principles. Navigating the legal and regulatory landscape in Luxembourg may appear complicated in practice, particularly when compared with the Cayman Islands, and this perception is somewhat justified. It is crucial to recognize that the complexities of Luxembourg law are rooted in legal and historical factors, primarily arising from its status as a civil law jurisdiction and an EU member state. In civil law jurisdictions, the existing written laws can sometimes be challenging to apply in practice to the issues envisaged, and therefore become subject to varying degrees of interpretation in their application.

It is worth nothing that while legal professionals and industry experts in Luxembourg generally agree on most legal questions, there are instances of conflicting interpretations of the law and particularly its application to fund finance products which can lead to additional negotiation on certain transactions. Luxembourg has successfully affirmed its position as a market leader in the fund finance industry over the past years, and as a result the legal minds in Luxembourg have for the most part aligned their interpretations of the law and agreed standard market practices.

Luxembourg's legal framework imposes more stringent obligations on fund finance parties compared to that of the Cayman Islands, requiring adherence to additional regulatory and legal requirements, especially those derived from EU laws and regulations as implemented into Luxembourg law. Additionally, there are significant differences between the two jurisdictions when it comes to the structure of the security package and the form of legal opinions.

In transactions involving multiple jurisdictions, and particularly Cayman Islands and Luxembourg laws, it is crucial to engage legal advisors with strong industry expertise and preferably a comprehensive understanding of both the common law and civil law systems so that the legal advice can be tailored to the transactional as well as the jurisdictional specifics.

1.Due diligence

The due diligence process is fundamental on any fund finance transaction, from both a Luxembourg law and Cayman Islands law perspective. Whether acting on borrower or lender side, it is important to confirm at the outset that there are no contradictions between the constituent and fund documents of the entities involved and the proposed transaction. Specifically, it is necessary to determine the legal capacity of each entity to enter into the proposed financing and to provide the security envisaged thereunder.

With the success of the fund finance industry, the trend in both the Cayman Islands and in Luxembourg is to incorporate specific finance friendly provisions into the entity’s constituent and fund documents at the outset. This is particularly helpful in the context of subscription finance facilities, where provisions addressing aspects such as capital calls, disclosures, claw backs, escrows, and specific waivers are set out in the constituent documents.

There are, however, some notable differences between the due diligence process in the two jurisdictions. The main reason for this is that there tends to be a more extensive array of due diligence documents for a Luxembourg fund than for a Cayman Islands fund because the former are subject to additional legal and regulatory requirements, as discussed above.

Fund finance transactions in Luxembourg generally involve alternative investment funds which are required to appoint an alternative investment fund manager (AIFM) pursuant to the AIFMD[4]. The AIFM assumes responsibility for the fund's risk management and portfolio management functions, often delegating the portfolio management function to an investment manager. AIFMs are typically obligated to be regulated by the Luxembourg financial supervisory authority, the Commission de Surveillance du Secteur Financier (CSSF).

In addition to the regular constituent documentation, the due diligence documents for a Luxembourg fund will typically also include an AIFM agreement, investment management and/or investment advisory agreement(s), depositary agreement, and offering documents.

Unfortunately, AIFM agreements are not always drafted with fund financing in consideration. An essential aspect to address during the due diligence process in Luxembourg involves determining what, if any functions are delegated to the AIFM in accordance with the AIFM agreement, as well as any sub-delegation by the AIFM. Identifying the delegation chain is important and so is ensuring that any legal consent required for the contemplated transaction is obtained, either through a consent letter, approval, or by including the AIFM and/or its delegate(s), as applicable, as party to the transaction to ensure their compliance with the terms of the transaction documents.

In the context of the AIFM’s role, a comprehensive review of the offering documents, form of subscription agreement, investment management agreements, and any investment advisory agreements is vital to determine how the Luxembourg fund operates within the fund structure. In addition, the significance of the offering document may vary based on the type of entity involved in the transaction. The nature of the Luxembourg fund should be carefully considered; particularly where the entity is not a conventional Luxembourg special limited partnership. It is not uncommon for the constituent documents of a corporate or semi-corporate Luxembourg entity to be relatively light, particularly where there are multiple compartments or sub-funds, and for the offering document to contain the core governance details of such compartments or sub-funds, and this must be properly reflected in the transaction documents. Correctly reflecting each intended party and ensuring that all constituent and fund documents are properly incorporated and referred to in the transaction documentation is paramount.

An additional crucial component within the framework of AIFMD is the depositary which should operate as a separate entity to the AIFM and plays an important role in safeguarding the assets of the fund. The depositary is also typically held accountable for any failures on the part of its delegates.

From a Cayman Islands law perspective, the due diligence process is generally more straightforward than in Luxembourg as it remains limited to the constituent documents of the Cayman Islands entity which are typically drafted in a credit provider friendly manner mirroring the constituent documentation of the funds from the lead jurisdiction of the transaction. As a result, negotiations are generally less onerous for Cayman Islands legal counsel than Luxembourg legal counsel. In addition, in the Cayman Islands there are no legal or regulatory restrictions relating to the appointment of an AIFM or depositary, such as in Luxembourg.

1.Security package

The nature of the security package in respect of what it aims to capture is typically similar in the Cayman Islands and in Luxembourg. On a subscription financing, security will be granted over the unfunded commitments of the investors to make capital contributions when called by the fund and over the bank account where such capital contributions are funded. On a net asset value (NAV) facility, security will generally be granted over the shares or interests of the portfolio companies, any receivables, and over bank accounts.

The governing law of the security is the main element which differs in the two jurisdictions.

It is market standard in Luxembourg to have a standalone parallel security agreement governed by the laws of the main transaction documents in addition to a Luxembourg law security agreement. Where a Luxembourg fund is involved on a subscription facility, the security over the capital call commitments of such fund’s investors should be governed by Luxembourg law in order to benefit from the application of Luxembourg law provisions, and in particular those of the Luxembourg law of 5 August 2005 on financial collateral arrangements, as amended (the Luxembourg Collateral Law)[5]. The Luxembourg Collateral Law was amended in 2022 to reflect case law and market practice, in particular in relation to enforcement of security interests and the application of enforcement proceeds.

Pursuant to the Luxembourg Collateral Law lenders will benefit from a secure and bankruptcy-remote security over both the uncalled capital commitments of the fund’s investors and any collateral account. Given that a Luxembourg fund typically has extensive connecting factors to Luxembourg through its domicile, its constituent documents, its services agreements, etc.), this dual security framework provides an additional layer of protection to the lender who benefits from contractual enforcement recourse in two jurisdictions.

Likewise, in the case of a NAV facility in Luxembourg, a Luxembourg law governed security agreement is important because the Luxembourg Collateral Law applies to any financial collateral arrangements, which include NAV type facility security such as pledges over shares, securities, intra-group loan receivables and pledges over bank accounts.

Security granted over bank accounts located in Luxembourg should be governed by Luxembourg law in accordance with the Luxembourg conflict of law rule lex loci rei sitae or lex situs, as further explained below.

Where a Cayman Islands fund is involved on a subscription finance facility, the security agreement is generally prepared by lead counsel and governed by the laws of the main transaction documents. This security agreement will typically also cover the capital call commitments of the Cayman Islands fund’s investors which are assigned by way of security, and a standalone Cayman Islands law governed security would be uncommon. It is worth noting however that where the main transaction documents are governed by the laws of England and Wales it is more common to have Cayman Islands law governed security documents.

On a NAV facility, because shares are not transferable by delivery in the Cayman Islands, security over shares will usually take the form of a legal or an equitable mortgage depending on whether the mortgagee wishes to take legal title to the shares prior to default (which is unusual). An important point to note is that perfection of security over shares in the Cayman Islands is uncertain, and credit providers will therefore generally impose various additional requirements designed to provide protection in an enforcement scenario, including blank share transfer forms, director resignation letters and registered office undertakings. A notation of the security over the shares will also typically be made on the register of members of the issuing company.

Security over interests in a Cayman Islands exempted limited partnership (ELP) or a Cayman Islands LLC (LLC) will typically take the form of an equitable mortgage or charge coupled with an assignment of amounts due to the chargor pursuant to its constituent document. Importantly, written notice of the security interest must be given to the ELP or the LLC at its registered office. Any security interest over a limited partnership interest or a limited liability company interest will take its priority from the time that the written notice of security is validly served at the registered office of the ELP or the LLC.

An express irrevocable power of attorney should be obtained in favour of the credit provider to effectively exercise any capital call rights following the occurrence of an event of default in the case of both Cayman Islands and Luxembourg funds.

Whilst Luxembourg law governed security will be required in respect of any Luxembourg located bank accounts, this will generally not be the case for a Cayman Islands fund because it is unlikely to have its bank accounts in the Cayman Islands.

1.Enforcement and conflicts of law considerations

Due to the multi-jurisdictional nature of finance transactions, conflict of law rules should be addressed as they pertain to enforcement. It important to carefully consider the choice of law and choice of jurisdiction in the transaction documents, as well as determine the recognition of the security interests over assets (rights in rem) and their enforceability against the fund, its investors and any other third party especially in a context where such parties are in different jurisdictions. The impact of an insolvency of the fund or any other security provider should also be considered in an international context.

The main reason for requiring standalone or parallel Luxembourg law governed security on a fund financing transaction is to ensure that in case of enforcement the credit provider is afforded protection under Luxembourg law and is able to enforce the security interests in the courts of Luxembourg in addition to having recourse in the jurisdiction governing the main transaction documents.

The Luxembourg courts will apply the lex loci rei sitae or lex situs principle to the creation, perfection and enforcement of a security interest over an asset, and when a conflict of law arises the applicable law will be the law of the place where the security interest is located or deemed to be located. Claims (créances) such as security over the unfunded capital commitments of a Luxembourg fund’s investors are financial collateral arrangements governed by the Luxembourg Collateral Law, and where governed by Luxembourg law or owed by a security provider or debtor located in Luxembourg these will be considered as located in Luxembourg for the purposes of the lex situs principle.

The Luxembourg Collateral Law expressly provides that a pledge of claims implies the right of the security taker to exercise the rights of the security provider in respect of the pledged claim. This confirms the principle that the power to make a capital call on investors' undrawn commitments constitutes an ancillary right to the fund's claim to the capital commitments.

Furthermore, according to the provisions of the EU Insolvency Directive[6], claims against a third party such as an investor (other than claims in relation to cash held in bank accounts) will be considered as situated in the EU member state where the security provider has its centre of main interests.

Luxembourg recently enacted the law of 7 August 2023 on business preservation and modernization of bankruptcy law (the Modernization Law), which came into force on 1 November 2023[7]. The Modernization Law introduces new measures and proceedings designed to reorganize the assets or activities of a Luxembourg debtor and applies to certain Luxembourg commercial companies. However, it is important to note that the Modernization Law has not amended the Luxembourg Collateral Law and collateral arrangements such as pledges over claims or over shares in a Luxembourg company remain enforceable through a same day enforcement process, despite the opening of any insolvency proceedings, including any reorganization proceedings under the Modernization Law.

1.Overview of priority and perfection of security

The rules of perfection[8] applicable to security over capital commitments on a fund financing are the same in the Cayman Islands and in Luxembourg. In both jurisdictions, perfection is achieved through the execution of the relevant security documents.

Both in the Cayman Islands and in Luxembourg, an investor would be able to validly discharge its obligations under a subscription agreement where it has no knowledge of the security interest created over its unfunded capital commitments. The fund must therefore deliver a notice of the security interest to its investors which also ensures the ranking in priority of the security taking effect from the date of delivery.

The investor notice is an important step in the transaction from both a Cayman Islands law and a Luxembourg law perspective, and such notice should be provided as close to the transaction closing date as possible. Current market practice both in the Cayman Islands and in Luxembourg is to require delivery of the investor notices on closing date or within a maximum of two business days thereof, with evidence of such delivery being provided to the credit provider.

Where the ultimate general partner of a Cayman Islands partnership is a Cayman Islands company, it is usual to include an entry reflecting the security interests into such company’s register of mortgages and charges.

For NAV facilities involving a Cayman Islands entity, as touched upon above, in the context of security over shares, it is usual for credit providers to require a blank share transfer form, director resignation letters and registered office undertakings. A notation of the security over the shares will also typically be made on the register of members of the company. Where the security is over interests in an ELP or an LLC, written notice of the security interest must be given to the ELP or the LLC at its registered office, and the security interest will take its priority from the time that such written notice is validly served at the registered office of the ELP or the LLC.

On a NAV facility involving a Luxembourg entity, the security over shares is recorded in the register of members of the company, and where the security is over partnership interests, it is recorded in the register of limited partners, with attention being given to any transfer restrictions envisaged in the constituent documents.

In relation to security provided over a Luxembourg located bank account, a notice is provided to the account bank and the account bank reverts with an acknowledgment of the pledge to the parties. Because the Luxembourg account bank generally has a pledge over the accounts of the Luxembourg fund by virtue of its general terms and conditions the acknowledgment is of particular importance because it must include a release by the account bank of any such pledge so that the credit provider(s) may have a perfected security over the Luxembourg bank account.

1.Legal opinions

A legal opinion will be required in respect of both Cayman Islands and Luxembourg funds on any fund financing transaction, and whilst these will include similar opinions, the form of the legal opinions will differ in the two jurisdictions.

In the Cayman Islands, funds’ legal counsel will issue a legal opinion to the credit provider(s) in respect of the Cayman Islands funds involved in the financing transaction covering their capacity and authority to enter into the transaction and transaction documents, as well as the enforcement of such transaction documents against the funds.

In Luxembourg on the other hand, market practice is to have two split legal opinions, much like in the United Kingdom: one legal opinion issued by funds’ legal counsel to cover the capacity and authority of any Luxembourg fund(s), and another legal opinion issued by lenders’ legal counsel to cover the enforcement of the transaction documents against such fund(s).

1.Market outlook

The banking turmoil that started in March 2023 is the most significant system-wide banking stress since the 2008 great financial crisis in terms of scale and scope[9]. The bank failures, while having largely distinct causes, triggered a wave of market panic that swept through the sector in Europe and the US resulting in a broader crisis of confidence in the resilience of banks, banking systems and financial markets across multiple jurisdictions.

There is less liquidity in the market, with a lot of capital having already been spent, or investors holding off on spending for the time being. Despite the slump in the market, strong demand remains for new fund formations, some successor funds, but also new strategies funds, and with many still in the capital-raising period.

The fund finance industry has witnessed many innovative lending arrangements and financing structures taking shape in the past year, which is a testament to the industry’s versatility and continued ability to adapt to market changes and appetite.

In July 2023 the US Federal Reserve, Office of the Comptroller of the Currency and the FDIC released their joint proposal, the US Basel III Endgame proposal, to update US capital rules to come into alignment with the current version of the Basel Committee’s international capital standards[10]. The proposal revises the capital framework for banks with total assets of $100 billion or more in four main areas: credit risk, market risk, operational risk, and credit valuation adjustment risk. The introduction of restrictive measures will be closely monitored going forward.

In the meantime, industry appetite for vanilla subscription financings and syndicated loans appears to have dwindled compared to previous years with other lending arrangements surging, particularly NAV and hybrid financings, which we have touched upon in this article, but also private credit and secondaries. Financing for private equity has moved away from the banks and this shift has triggered a rebalancing of the original industry player roles, particularly with investors such as asset managers, private equity funds and insurers morphing into credit providers.

Conclusion

The fund finance industry has continued to diversify its products over the past years in order to adapt to various market developments as well as legal, economic and regulatory challenges, resulting in a growth of complexity and multi-jurisdictional solutions which inevitably require increasingly technical and sophisticated legal advice for the parties involved.

Despite the differences between the two jurisdictions, both the Cayman Islands and Luxembourg have successfully modelled their legal and regulatory frameworks to offer flexible and commercial solutions to their clients, embracing constant evolution to align with the industry and market. Both jurisdictions are poised for ongoing growth in the coming years and will continue to play a pivotal role in the fund finance industry.

[1] Luxembourg Reports Legal – November 2023

[2] The Association of the Luxembourg Fund Industry (ALFI)

[3] Registration pursuant to the Private Funds Act, 2020 may be required

[4] The Luxembourg law of 12 July 2013 on alternative investment fund managers implemented the AIFMD

[5] The Luxembourg Collateral Law implemented Directive 2002/47/EC of 6 June 2002 on financial collateral arrangements

[6] Regulation (EU) of the European Parliament and the Council No. 2015/848 of 20 May 2015 on insolvency proceedings (recast), as amended

[7] The Modernization Law implemented Directive (EU) 2019/1023 of 20 June 2019 on preventive restructuring frameworks, on discharge of debt and disqualifications, and on measures to increase the efficiency of procedures concerning restructuring, insolvency and discharge of debt, and amending Directive (EU) 2017/1132

[8] i.e. an act without which the contract would not be legally enforceable and considered void

[9] Bank for International Settlement – 5 October 2023

[10] Bloomberg, January 2024

*Travers Thorp Alberga

First, please LoginComment After ~