Peru: Hong Kong Free Trade Agreement Analysis

In May 2022, at a ministerial meeting held on the margins of the Asia‑Pacific Economic Cooperation (APEC) Ministers Responsible for Trade gathering in Bangkok, Hong Kong and Peru agreed to explore the feasibility of a bilateral Free Trade Agreement (FTA). The first round of the consequent FTA negotiations took place on 30 January 2023, when the two sides met to explore ways in which trade and investment ties between Peru and Hong Kong could be enhanced. The negotiations are still underway, but HKTDC Research has recently undertaken a consultative visit to Peru and sat down with local business representatives to gauge perspectives on the potential for increasing trade between Hong Kong and Peru.

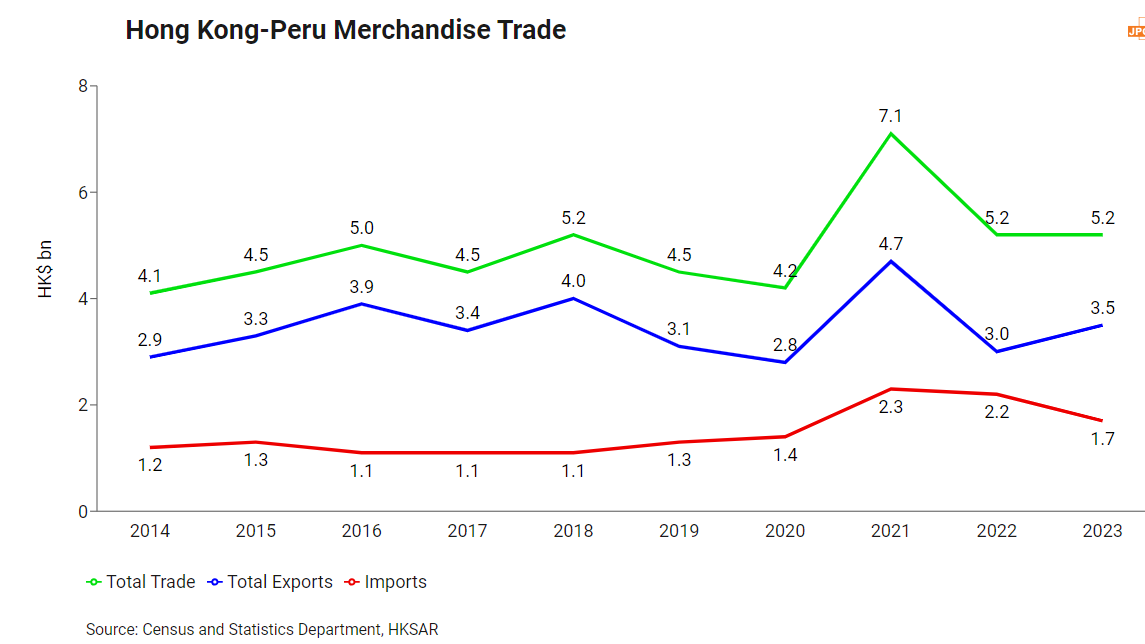

Hong Kong-Peru trade and investment: The status quo

Peru is one of Hong Kong’s principal trading partners in Latin America. In 2023, the Andean nation ranked fifth among Hong Kong’s merchandise trading partners in Latin America, with bilateral trade totalling HK$5.2 billion (USD 671 million). Hong Kong’s exports to Peru accounted for HK$3.5 billion (USD 454 million) of this, with telecommunications equipment and parts accounting for as much as 75% of the total, followed by office machines (3%) and electro‑diagnostic apparatus for medical/veterinary/radiological use (2%). Meanwhile, Hong Kong’s imports from Peru reached HK$1.7 billion (USD 217 million) in 2023, with fruit and nuts taking the lion’s share (75%), followed by dried, salted or smoked fish (6%) and watches and clocks (5%).

According to the data from the Census and Statistics Department of HKSAR, Hong Kong has minimal services trade with Peru and the bilateral investment between the two has also been far from significant.

FTA coverage

Hong Kong and Peru share a common aspiration to pursue a high‑quality and comprehensive FTA that creates more opportunities for economic growth. While the FTA negotiation is still underway, according to the Legislative Council Brief, it is expected to cover the following:

elimination or reduction of tariffs;

preferential rules of origin;

customs facilitation procedures;

reduction of non-tariff barriers, including technical barriers to trade, and sanitary and phytosanitary measures;

market access for trade in services;

market access and treatment of investment;

other subjects such as electronic commerce, government procurement, intellectual property, competition, cooperation, and small and medium sized enterprises; and

legal and institutional arrangements, including dispute settlement mechanisms for the FTA.

Business potential of the FTA

With regard to merchandise trade, enabling more unfettered market access through tariff elimination or reduction, and by removal of non‑tariff barriers, would be mutually beneficial. Products from Hong Kong could enjoy preferential tariff rates under the FTA, levelling the playing field with products from Peru’s other FTA partners. Although domestic exports account for less than 1% of Hong Kong’s total exports to Peru, the successful implementation of the FTA could serve as a catalyst to enhance bilateral trade (including re‑exports) and reinforce business certainty for both economies.

According to the interviews in Lima, Peru’s capital, local department store and shopping mall operators are actively searching for new suppliers of value‑for‑money products to meet the post‑pandemic spending spree. Currently, most imported consumer products such as apparel, footwear and homeware are sourced and imported from Asia. Hong Kong, well established as an international sourcing hub backed by a strong supply chain network and a mature financial services centre, could help Peruvian companies identify the right business partners and arrange one‑stop sourcing and trade‑related services. In fact, some Peruvian companies have already set up regional headquarters or offices in Hong Kong to handle sourcing, financing and supply chain management.

In a similar vein, Hong Kong services providers should benefit from enhanced market access, greater legal certainty and business predictability under the FTA, while better market access conditions for Hong Kong investors would also be secured.

As the Peruvian government attaches high importance to digital transformation in its economic development strategy, Hong Kong’s ICT service providers, e‑commerce players, education technology developers and fintech companies will be looking for opportunities in the fields of digital entrepreneurship and innovation.

A case in point is the new AI Law launched in July 2023, which identified several key development areas including improvement of public services, education and learning, health, justice, citizen security and digital security. According to the interviews with local Peruvian companies, chambers and organisations, the country’s AI adoption and digitalisation are still in their infancy but developing fast, so that future business prospects are likely for Hong Kong companies.

First, please LoginComment After ~