GBA – Survey shows sentiment holding up

♦Q2 GBAI headline indices stayed largely unchanged in Q2, confirming sustained momentum from Q1

♦Falling 'raw material inventory' appears less worrying when all other sub-indices are expanding

♦We also look into tech companies' underperformance, and impact of 'new quality productive forces'

Nuances behind the steady headline numbers

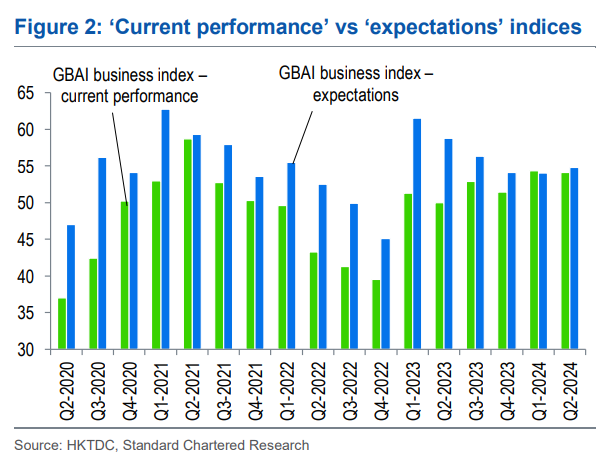

Our GBA Business Confidence Index (GBAI), based on quarterly surveys of over 1,000 companies operating in the Guangdong Hong Kong Macau Greater Bay Area (GBA) and conducted in collaboration with the Hong Kong Trade Development Council (HKTDC), shows that Q2 business sentiment was largely unchanged from Q1's solid prints, indicating steady economic momentum. ‘Current performance’ and ‘expectations’ headline indices for business activity both stayed above 54 (50 being neutral), with the latter registering its first rise in five quarters.

A further breakdown shows that the component scores of ‘production/sales’, ‘new orders’ and ‘profits’ – our best proxies for short term business performance – maintained their top three spots. ‘Raw material inventory’ stayed below 50 for a fifth straight quarter, though we note that inventory tends to fall in the early stages of a demand cycle rebound. We also see room for financing and investment expectations to play catch up, with more policy support likely to help.

Our GBAI credit indices suggest improving cash flow positions and expectations of falling bank financing costs. By industry, ‘innovation and technology’ is the lone underperformer, likely reflecting concerns over the rise in Western tariffs on imports from China. That said, despite being known for its high I&T content, Shenzhen's overall index score rose on the strong performance of its other industries. On the thematic questions, almost half our respondents said China's ‘new quality productive forces’ policy push was relevant to their business. Moreover, less than 12% of respondents saw ‘a very high risk’ of overinvestment in some of the new industries. We noted plans for more industrial upgrading and a reduction in foreign tech reliance.

Please click to read the full report.

First, please LoginComment After ~