China's Foreign Exchange Market Stays Resilient as October Sees Record Trade Surplus

China's foreign exchange market maintained stability in October 2024, supported by robust trade inflows and moderated seasonal outflows, according to the latest data from the State Administration of Foreign Exchange (SAFE). The month's performance, marked by double surpluses in cross-border receipts and payments and in bank forex settlements and sales, reflects sustained investor confidence amidst a steady economic recovery.

////

Key Data: Sustained Net Inflows and Trade Surplus

ONE

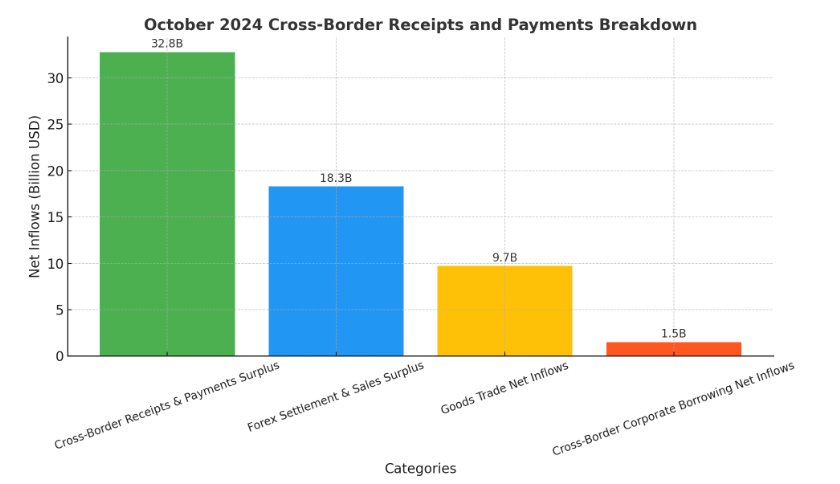

In October, the cross-border receipts and payments surplus reached $32.8 billion, while banks reported a forex settlement and sales surplus of $18.3 billion. These figures point to strong enterprise settlement rates, among the highest this year, and reduced demand for forex purchases.

Goods trade continued to be the primary driver of net inflows, with cross-border receipts climbing to historical highs for the third consecutive month. Net inflows in this category rose by 9.7% from September, buoyed by resilient export performance and streamlined trade operations.

Seasonal outflows, such as those related to outbound tourism, education expenses, and dividend payouts by foreign-invested enterprises, further retreated from summer peaks. Additionally, cross-border corporate borrowing registered a modest net inflow, reinforcing the overall surplus trend.

////

Structural Strength: Policies

and Market Resilience

TWO

SAFE underscored the role of economic stability and policy measures in enhancing the market's adaptability to external pressures. Aided by incremental stimulus policies and sustained GDP growth, the foreign exchange market has shown resilience in mitigating external uncertainties.

Three key factors contributed to this stability:

-

•Growing RMB Usage in Cross-Border Transactions: The increased adoption of the RMB reflects heightened confidence in the local currency, reducing reliance on dollar-based settlements and enhancing liquidity management.

-

•Improved Corporate Hedging Practices: Enterprises demonstrated growing proficiency in managing currency risks, shifting away from spot market reliance toward structured hedging strategies.

-

•Enhanced Market Oversight: Continued regulatory efforts ensured orderly trading and minimized speculative risks, bolstering overall market stability.

////

By the Numbers: A Strong Year-to-Date Performance

THREE

From January to October 2024, banks settled $1.89 trillion and sold $1.99 trillion in foreign exchange, resulting in a cumulative deficit of $100 billion. This was offset by robust inflows from trade and investment activities. Over the same period, non-banking sectors recorded $5.87 trillion in cross-border receipts and $5.83 trillion in payments, underscoring the vitality of cross-border capital flows.

////

Outlook: Confidence in Sustained Stability

FOUR

SAFE remains optimistic about the future trajectory of China's foreign exchange market, citing several key strengths:

-

•Economic Resilience: Continued structural reforms and improving consumer confidence provide a solid foundation for sustained growth.

-

•Broader RMB Adoption: Expanding use of the RMB in global transactions strengthens the market's capacity to weather external shocks.

-

•Corporate Risk Management: Increased awareness and use of hedging instruments position enterprises to navigate global uncertainties more effectively.

With trade performance reaching new highs and domestic policies driving growth, China's foreign exchange market is well-equipped to maintain its stability. This resilience not only supports internal economic objectives but also reinforces global confidence in China's financial systems.

First, please LoginComment After ~