China's Capital Market Shines as Shanghai Hosts 2024 Global Investors Conference

The 2024 Shanghai Stock Exchange Global Investors Conference, which opened on November 7, underscored China's pivotal role in global asset allocation. With approximately 260 representatives from leading investment institutions worldwide, including sovereign wealth funds, pension funds, commercial banks, asset management companies, and hedge funds, the event reaffirmed China's capital market as an essential destination for international investors.

////

A Market of Global Significance

ONE

Shen Bing, Director-General of the Department of Fund and Intermediary Supervision at the China Securities Regulatory Commission (CSRC), emphasized that China's capital market is becoming indispensable for global asset allocation. He highlighted three key factors driving international investor confidence:

-

Optimism in China's Economic Stability:

Amidst ongoing economic reforms and the implementation of incremental policies, China's economy continues to demonstrate resilience. Marginal improvements in fundamental data further reinforce the appeal of its capital market. -

The Growth of China's Capital Market:

Over the past 30 years, China's capital market has gained substantial global influence, boasting improved quality, depth, and liquidity. The increasing share of innovative enterprises in A-shares, H-shares, and overseas-listed companies positions China as a hub for new productivity. Moreover, valuation levels remain historically low compared to emerging markets, creating unique opportunities for long-term foreign investors. -

A Favorable Business Environment:

The CSRC's ongoing commitment to two-way market opening has fostered a stable, transparent, and predictable investment environment. This has enhanced China's attractiveness as a destination for global capital.

////

Industry Insights: Optimism Amidst Opportunities

TWO

-

Alex Zhou, Morgan Stanley Investment Management China:

Zhou noted the immense potential of China's asset management sector, describing it as vast and diverse. He pointed out that China offers a broad spectrum of investable assets, making it an attractive destination for global capital seeking diversification. -

Dilhan Pillay Sandrasegara, Temasek:

Sandrasegara praised China's commitment to policies that stabilize the economy and enhance capital market reforms. He highlighted the importance of integrating more domestic long-term capital, such as pension funds and insurance assets, to strengthen market stability and attract global investors. -

Florian Neto, Amundi:

Neto underscored the current attractiveness of Chinese assets, citing their growing earnings potential. He urged investors not to overlook the strategic opportunity presented by China's market during this period of reduced volatility. -

Emily Woodland, BlackRock:

Woodland emphasized the rise of hybrid financing opportunities in the Asia-Pacific region. She noted that innovative financing mechanisms are unlocking private capital for emerging market infrastructure projects, a trend her firm is actively pursuing.

////

The Road Ahead: Enhancing Market Dynamism

THREE

Experts at the conference agreed that strategic reforms are essential for further growth. These include streamlining IPO processes to attract high-quality listings, strengthening regulatory frameworks to improve corporate governance, and fostering greater integration between domestic and international markets.

Temasek’s Sandrasegara advocated for a stronger venture capital and private equity ecosystem, alongside enhanced connectivity between mainland China, Hong Kong, and international capital markets. Such initiatives, he argued, would solidify China’s position as a resilient and globally competitive market.

////

Outlook: Confidence in Sustained Stability

FOUR

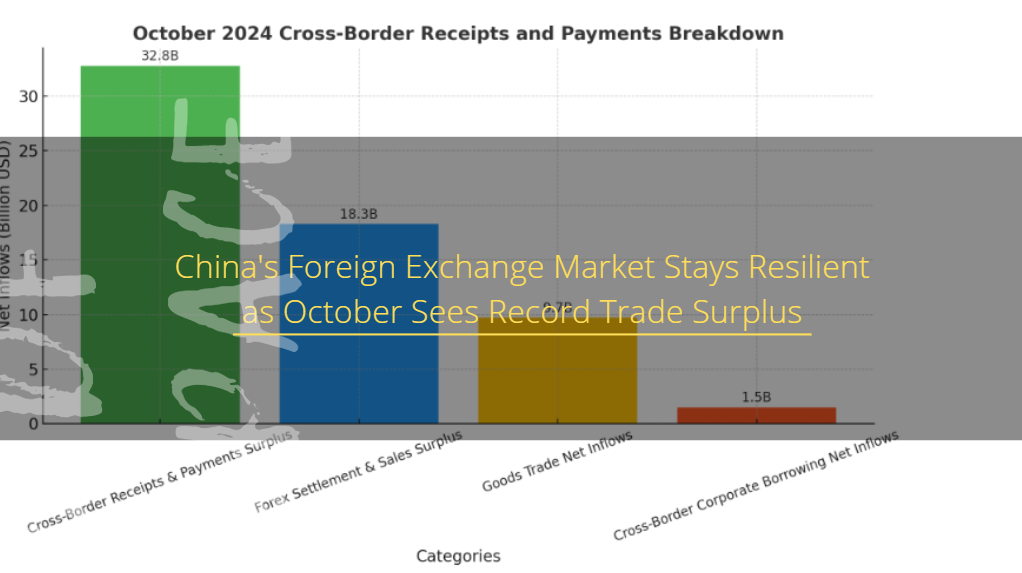

SAFE remains optimistic about the future trajectory of China's foreign exchange market, citing several key strengths:

-

Economic Resilience: Continued structural reforms and improving consumer confidence provide a solid foundation for sustained growth.

-

Broader RMB Adoption: Expanding use of the RMB in global transactions strengthens the market's capacity to weather external shocks.

-

Corporate Risk Management: Increased awareness and use of hedging instruments position enterprises to navigate global uncertainties more effectively.

With trade performance reaching new highs and domestic policies driving growth, China's foreign exchange market is well-equipped to maintain its stability. This resilience not only supports internal economic objectives but also reinforces global confidence in China's financial systems.

////

Why Now? The Case for Chinese Assets

FIVE

Speakers at the conference highlighted that current market conditions present a favorable window for investing in China. The nation's relatively low valuations, improving fundamentals, and steady economic policies provide compelling reasons for global investors to increase their allocations.

As Shen Bing concluded, the sustained stability of China's capital market—underpinned by policy support, economic reforms, and investor optimism—continues to make it an unmissable destination for international funds.

With growing global interest and strategic policy direction, China's capital market stands poised to achieve new heights, offering abundant opportunities for long-term growth and innovation.

First, please LoginComment After ~