Deutsche Bank publishes 2025 SREP requirements

Deutsche Bank AG (XETRA: DBKGn.DE / NYSE: DB) has been informed by the European Central Bank (ECB) of its decision on prudential capital requirements with effect from January 1, 2025. These requirements follow the 2024 Supervisory Review and Evaluation Process (SREP).

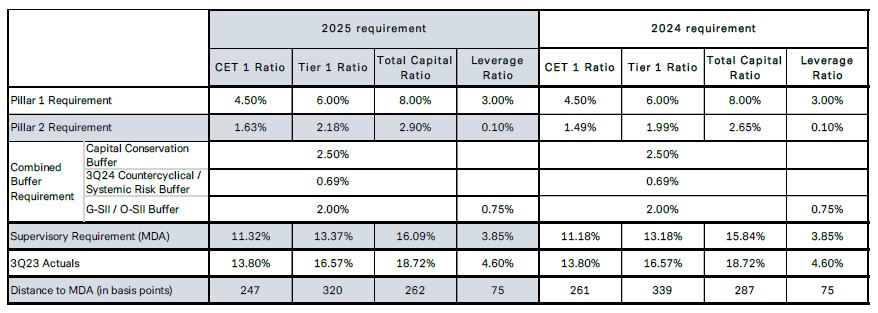

From this date, Deutsche Bank will be required to hold a Pillar 2 requirement (P2R) of 2.90% for solvency purposes, and a Pillar 2 requirement for the leverage ratio (P2R-L) of 10 basis points.

Deutsche Bank's 2025 requirements are as follows:

Deutsche Bank's last reported consolidated capital ratios, as of September 30, 2024, were significantly above the then prevailing as well as the upcoming supervisory requirements for 2025.

These requirements set the levels below which Deutsche Bank would be required to calculate a Maximum Distributable Amount (MDA). The MDA is used to determine restrictions on distributions, notably dividends on common shares, new variable remuneration and coupon payments to holders of Additional Tier 1 instruments.

First, please LoginComment After ~