PBOC Releases 2023 China Financial Market Development Report

2023 China Financial Market Development Reports.pdf

In 2023, China's financial markets exhibited robust growth and innovation, underpinned by the country's dedication to high-quality economic development. This report highlights key developments that are particularly relevant to international investors and businesses.

Bond Market: A Pillar of Stability and Innovation

China's bond market saw significant expansion in 2023, with total bond issuance reaching RMB 71 trillion, a 14.8% increase year-on-year. The market's growth was driven by strong demand for government bonds, corporate debentures, and financial bonds. Notably, green bond issuance surged, with 475 green bonds issued, totaling RMB 836 billion. This trend underscores China's commitment to sustainable finance.

Institutional reforms also marked the bond market's progress. The introduction of the "bond basket" trading mechanism and the optimization of bond issuance regulations enhanced market efficiency and attracted a broader investor base. The bond market's opening-up continued, with overseas institutions increasing their holdings to RMB 3.72 trillion, accounting for 2.4% of the total.

Stock Market: Navigating Volatility with Structural Strength

The stock market faced volatility in 2023, with major indices experiencing fluctuations. However, the comprehensive implementation of the registration-based IPO system marked a significant milestone, enhancing market functionality and efficiency. Institutional investors' participation increased, contributing to a more stable and mature market ecosystem.

Sector-wise, technology, media, and telecommunications (TMT) sectors outperformed, driven by advancements in artificial intelligence and digital infrastructure. Meanwhile, traditional sectors like real estate and consumer goods faced challenges, reflecting broader economic trends. The SSE and SZSE's focus on developing thematic indices aligned with national strategies, such as sci-tech innovation and green development, further enriched the market's investment landscape.

Foreign Exchange Market: Balancing Stability and Innovation

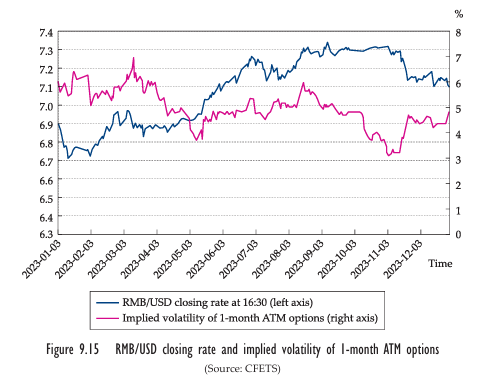

The RMB exchange rate remained relatively stable against a basket of currencies, despite depreciation against the USD. The interbank foreign exchange market saw increased trading volumes, with turnover reaching USD 41.64 trillion. The launch of central counterparty (CCP) clearing for G10 currency pair transactions and the extension of trading hours enhanced market efficiency and international connectivity.

Innovative measures, such as the introduction of e-CNY for cross-border settlements and the expansion of the bank-enterprise foreign exchange trading platform, improved the quality of services for the real economy. These initiatives are expected to bolster China's financial infrastructure and support the RMB's internationalization.

Gold Market: A Bright Spot Amid Uncertainty

The gold market witnessed a surge in prices, with both domestic and international gold prices hitting record highs. The Shanghai Gold Exchange (SGE) recorded a trading volume of 41,500 tons, up 7.09% year-on-year. The introduction of RMB non-resident accounts (NRA) and the pilot program for e-CNY in cross-border settlements marked significant steps towards market internationalization.

Global central banks increased their gold reserves, reflecting the heightened demand for safe-haven assets. China's gold market innovations, such as the launch of the Containerized Freight Index (Europe Service) futures contract, further enhanced the market's role in supporting the real economy and international trade.

Derivatives Market: Expanding Horizons

China's derivatives market experienced robust growth, with trading volumes and turnover increasing significantly. The commodity futures and options market saw a cumulative trading volume of 8.333 billion lots and a turnover of RMB 435.34 trillion. The launch of new products, such as the Containerized Freight Index (Europe Service) futures, and the expansion of the financial futures and options market, including the introduction of 30-year treasury bond futures, underscored the market's innovation drive.

The RMB interest rate derivatives market also saw substantial growth, with trading volumes reaching RMB 31.98 trillion. The launch of Swap Connect and the introduction of standardized interest rate swap contracts linked to NCDs enhanced market accessibility and risk management capabilities.

Outlook: A Path to High-Quality Development

Looking ahead, China's financial markets are poised for continued growth and innovation. The focus will remain on enhancing market functionality, supporting the real economy, and promoting high-quality development. Key areas of emphasis include:

- Enhancing Market Mechanisms: Further optimization of trading mechanisms and regulatory frameworks to improve market efficiency and stability.

- Supporting Real Economy: Continued efforts to direct financial resources towards key sectors, such as technology, green development, and inclusive finance.

- Internationalization:Steady progress in opening up financial markets to attract more international investors and promote the RMB's global use.

- Risk Management: Strengthening risk prevention and resolution mechanisms to ensure market stability and protect investors' interests.

For international investors and businesses, China's financial markets offer a blend of stability and innovation, backed by robust economic fundamentals and forward-looking policies. The ongoing reforms and opening-up initiatives present opportunities for global participation and collaboration, fostering a mutually beneficial environment for economic growth and financial development.

First, please LoginComment After ~