Taxing Pakistan's digital future

The country's Finance Bill 2025 draws up a new playbook for the country's fledgling digital economy, and while there is much to cheer, some red flags could derail the ambition to reach US$15 billion in IT exports by 2030.

Pakistan's tech scene is having its moment.

IT-enabled services (ITeS) exports have climbed for 17 straight months, touching a 29 per cent per cent compound annual growth rate (CAGR).

Cumulatively, the sector has already earned US$3.8 billion in the first nine months of the 2025 fiscal year and is gunning for the government's ambitious US$15 billion by 2030.

Against this backdrop, the Finance Bill 2025 has rewritten large swathes of the tax playbook for digital businesses.

Below is a quick account of what changed, why some of it makes sense, and where policymakers risk clipping the sector's wings.

The headline changes

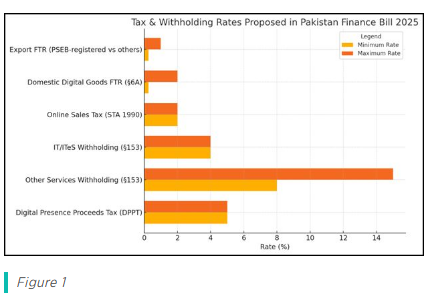

The horizontal bars in Figure 1 lay bare Pakistan's two-tier tax story: on the left, you see the near-negligible 0.25 –1 per cent export Final Tax Regime (FTR) that keeps certified software houses ultra-competitive.

Slide further right and the cliff gets steeper: IT/ITeS withholding is capped at four per cent, but the very next line, “other services,” jumps to a major eight – fifteen per cent, signalling how quickly the policy carrot turns into a stick once you leave the core tech lane.

The flat five per cent Digital Presence Proceeds Tax (DDPT) rounds things off, hinting at a pragmatic middle ground for taxing foreign platforms without scaring them away.

The chart shows why exporters cheer, freelancers worry, and everyone in between is caught in a widening compliance gap, exactly the fragmentation the Finance Bill needs to fix if it wants a truly “digital-first” tax regime.

The good news?

Predictability for exporters, by locking in the 0.25 per cent rate for another year, Islamabad signals continuity to the IT firms.

Secondly, Section 6A and the identical 2 per cent sales-tax regime attempt to end the “digital free ride” enjoyed by unregistered Instagram shops and gig sellers. When banks and courier partners deduct taxes automatically, compliance jumps without invasive audits.

Even with a shortened tax holiday, which limits the time companies enjoy their zone licences, the government is still betting big on the Special Technology Zones Authority STZA. New zone agreements, such as the Green Tech Hub was inked this January and last month's STZA Amendment Bill 2025, which streamlines one-window approvals.

The amendment seeks to strengthen regulatory frameworks, attract investment, and encourage innovation in Pakistan's special technology zones, aiming to accelerate the country's technology sector growth.

Roll back on DPPT

Intending to promote digital services, the government has announced a pause to the implementation of the DPPT from July 30, 2025, exercising its power under Section 15 of the DPPT Act to exempt certain transactions from tax.

To subscribe to the GovInsider bulletin, click here.

The notification says: “The Digital Presence Proceeds Tax shall not apply to digitally ordered goods and services supplied from outside Pakistan, by any person, which are chargeable to tax under the said Act.”

This exemption is effective retrospectively from July 1, 2025, that is, the datethe DPPT Act came into force.

It is important to emphasise that the DPPT Act remains in force as the exemption neither repeals nor abolishes the law; rather, it suspends its application.

DPPT has been envisaged to close a long-standing loophole by ensuring that global platforms that earn sizeable revenues from Pakistani users also make a modest fiscal contribution at home.

By tethering the levy to gross proceeds and collecting it through banks and payment gateways, the government hopes to safeguard its tax base without demanding a local “brick-and-mortar” presence.

However, Microsoft's recent decision to wind down its 25-year liaison office inevitably raised questions about whether the DPPT had spooked multinationals.

Yet the company itself frames the partner-led model, and had already migrated licensing functions to Ireland years earlier.

Pakistan's Ministry of IT & Telecommunication echoes that interpretation, noting it remains in active dialogue with Microsoft and expects the firm's products, training programmes, and reseller ecosystem to keep growing locally despite the structural change.

There are several other potential red flags.

For example, a micro-seller now faces an income-tax withholding of up to two per cent and an irrevocable two per cent sales-tax grab, all on gross turnover.

For a drop shipper operating on razor-thin margins, the effective bite could exceed actual profits, pushing them back into the shadows rather than the tax net.

Similarly, hardware parks, semiconductor back-end plants, and data centre projects need 12-15 years to break even. Slashing the concession period to 10 years or 2035 may spook capital that has plenty of options in, say, Vietnam or the UAE.

Some unhappiness exists

Not everybody is happy with the bill. Pakistan Software Houses Association (P@SHA) called portions of the Finance Bill “a death warrant for budding tech exporters,” arguing that rising compliance costs will “erode our global price advantage.”

While the language is incendiary, the underlying grievance, that policy flip-flops create uncertainty, is hard to dismiss.

Pakistan's IT sector is sprinting at a time when the broader economy is hobbling.

With the Pakistani rupee stabilising and global demand for outsourcing robust, this is the country's window to leapfrog into the US$15 billion export club.

Taxes, sensibly designed, can widen the base without sandbagging genuine innovators. But if compliance costs outstrip potential profits, the exodus of talent and taxable income will be far costlier than any short-term treasury gain.

The Finance Bill 2025 shows flashes of strategic thinking; it also carries landmines of unintended consequences. Parliament still has time to smooth the rough edges. If lawmakers get it right, they won't just collect more revenue, they'll underwrite Pakistan's digital future.

The clock is ticking

Tech services grew 13 per cent last fiscal year despite political headwinds.

But talent is nomadic: if developers believe their stock options are safer in Dubai's zero-tax free zone or Bangalore's Section 80JJAA cocoon, they'll vote with boarding passes.

The Finance Bill 2025 is brave in scope but brittle in execution.

Data may be the new oil, yet oil must flow, not clog, through pipelines.

Lawmakers must decide: will Pakistan be the region's next digital refinery or just another customs checkpoint?

One answer increases jobs; the other merely counts them.

First, please LoginComment After ~