Interest rate

The Banque centrale du Luxembourg (BCL) informs that, on the basis of provisional figures, the main average interest rates on credit operations and deposits applied by Luxembourg's credit institutions to households and non-financial corporations (NFCs) in the euro area evolved as follows during the month of July 2025.

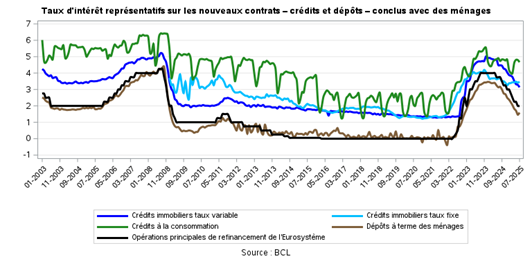

Representative interest rates on new contracts[1] – loans and deposits – concluded with households

The variable interest rate[2] on real estate loans granted to households decreased by 15 basis points to 3.13% in July 2025, compared to 3.28% in June 2025, while the volume of newly granted loans decreased by €168 million during the month of July to €238 million compared to €406 million in June. On an annual basis, the rate decreased by 135 basis points while the volume of new contracts increased by €34 million.

The fixed interest rate[3] on mortgages granted to households with an initial rate setting of more than 1 year and less than or equal to 5 years has increased by 7 basis points since June to 3.27% with a respective volume of €27 million in July 2025. The fixed interest rate with an initial rate fixing period of more than 5 years and less than or equal to 10 years decreased by 7 basis points compared to June 2025 to 3.48%. The corresponding monthly volume decreased by €19 million to €47 million.

For loans with initial fixed terms of more than 10 years, the monthly volume has decreased by €180 million since June to €225 million. The interest rates on these loans are grouped into five-year initial fixing intervals[4] and have developed as follows compared to June 2025:

- Rates with an initial fixation of more than 10 years and less than or equal to 15 years increased by 21 basis points to 3.69%.

- Rates with an initial fixation of more than 15 years and less than or equal to 20 years increased by 22 basis points to 3.38%.

- Rates with an initial fixation of more than 20 years and less than or equal to 25 years decreased by 8 basis points to 3.29%.

- Rates with an initial fixation of more than 25 years and less than or equal to 30 years increased by 5 basis points to 3.58%.

- Rates with an initial fixation above 30 years decreased by 5 basis points to 3.55%.

It is important to note that the rates indicated for the different initial fixing periods are weighted averages, calculated on the basis of a sample of banks and taking into account the volumes of loans granted.

The interest rate on consumer loans, whose initial rate setting period is greater than 1 year and less than or equal to 5 years, has decreased by 13 basis points since June to 4.67% in July 2025, while the volume of activity has increased by 8 million from 25 million in June to 33 million in July. Over the past year, the interest rate has decreased by 24 basis points while the volume of activity has increased by 1 million euros.

The interest rate on household term deposits with an original maturity of 1 year or less increased from 146 basis points in June 2025 to 159 basis points in July 2025. In one year, this rate has decreased by 154 basis points.

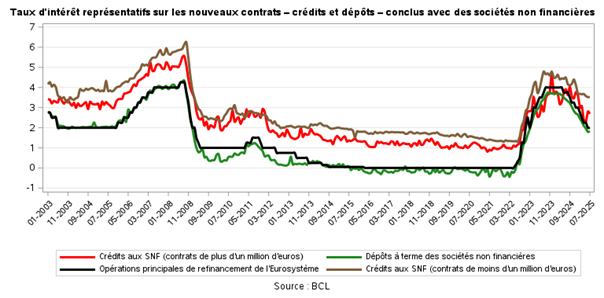

The following charts provide a detailed overview of the evolution of interest rates and new contract volumes. In addition, the development of interest rates over the past two years is presented in greater detail.

Representative interest rates on new contracts1 – loans and deposits – concluded with non-financial corporations (NFCs)

The variable interest rate on loans of less than or equal to €1 million increased by 1 basis point to 3.53% in July 2025 from 3.52% in June. The volume of these newly granted loans increased by €12 million to €136 million in July compared to €124 million in June. On an annual basis, this rate decreased by 96 basis points while the amount of new loans granted increased by €32 million.

The variable interest rate for loans of more than €1 million decreased by 11 basis points month-on-month to 2.69% in July 2025 from 2.80% in June. The volume of these newly granted loans increased by €58 million this month to €3,116 million in July 2025 compared to €3,058 million in June. In one year, this rate has decreased by 122 basis points while the amount of loans granted has increased by €1,157 million.

The interest rate on term deposits of NFCs with an original maturity of 1 year or less has increased by 4 basis points since June to reach 1.83% in July 2025. On an annual basis, this rate decreased by 158 basis points.

The tables relating to the interest rates charged by credit institutions can be consulted and/or downloaded from the BCL's website at the following address:

Weighting method

The interest rates applied to new contracts are weighted within the categories of instruments concerned by the amounts of the individual contracts. This is the result of the compilation of national aggregates carried out by the reporting credit institutions and by the BCL.

[1]A new contract is defined as any new agreement between a household or a non-financial corporation and a reporting agent. The new agreements include all financial contracts that specify for the first time the interest rate associated with the deposit or credit and all renegotiations of existing deposits and credits.

[2] Variable interest rate or interest rate with an initial fixing period of less than or equal to 1 year.

[3] Fixed interest rate weighted by the amounts of the contracts for all real estate loans granted regardless of the initial interest rate setting period (greater than 1 year). This series has only been published by the BCL since February 2009 for methodological reasons related to the identification of the declarants.

[4] Following an overhaul of the statistical collection, the BCL has been collecting since December 2022 a breakdown of initial interest rates above 10 years in five-year intervals.

First, please LoginComment After ~