China's Financial Sector Records Strong Growth During 14th Five-Year Plan

This article contains AI assisted creative content

China's financial sector has shown robust growth over the 14th Five-Year Plan period (2021–2025). By the end of June 2025, banking assets approached CNY 470 trillion (USD 66.2 trillion), maintaining China's position as the world's largest banking system.

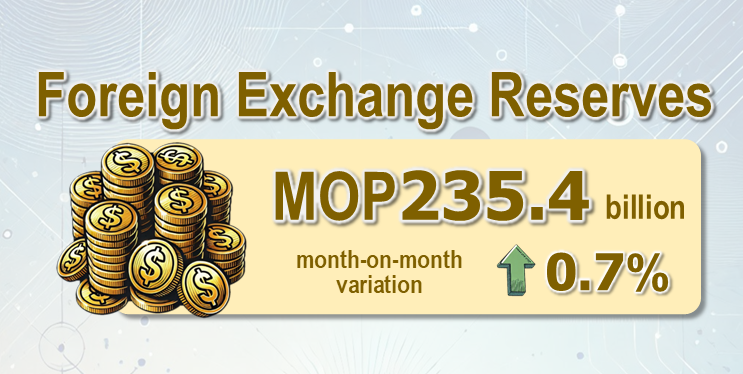

China has retained the largest foreign exchange reserves globally and ranks second in both stock and bond markets. Digital finance, green finance, and inclusive finance have advanced steadily, while cross-border RMB payment and settlement networks are now largely established. Mobile payments continue to lead internationally.

Financial services supporting the real economy have improved in quality and efficiency. Loans to small and medium-sized technology enterprises grew at an average annual rate above 20%, while lending to small and micro businesses, as well as green development initiatives, also exceeded 20% annual growth during the period.

The total assets of China's banking and insurance sectors now exceed CNY 500 trillion, expanding at an average annual rate of 9% over the past five years, making China the world's largest credit market and second-largest insurance market. Trust, wealth management, and insurance asset management institutions oversee nearly CNY 100 trillion, doubling the scale recorded at the end of the previous Five-Year Plan. Among the world's top 1,000 banks, 143 are Chinese, with six occupying the top ten positions.

Key regulatory indicators remain healthy. Non-performing loan ratios, capital adequacy, and solvency have steadily improved. Non-performing asset disposals increased by over 40% compared with the previous Five-Year Plan. Combined capital and risk provisions exceed CNY 50 trillion, reinforcing resilience against market shocks.

Over the past five years, the banking and insurance sectors provided CNY 170 trillion in new funds to the real economy through loans, bonds, and equity financing.

In the stock market, technology companies now constitute more than 25% of A-share market capitalization, exceeding the combined value of banking, non-bank financial, and real estate sectors. More than 90% of newly listed companies in recent years are tech-focused or technology-intensive. Medium- and long-term funds held CNY 21.4 trillion in circulating A-shares by the end of August 2025, representing a 32% increase from 2020.

China's foreign exchange reserves have remained above USD 3 trillion throughout the period. International payments remain stable, with the current-account surplus as a percentage of GDP within a reasonable range. Cross-border investment and financing are active, with overseas institutions and individuals holding more than CNY 10 trillion in domestic stocks, bonds, deposits, and loans. Total cross-border receipts and payments reached USD 14 trillion in 2024, a 64% increase from 2020.

These developments underscore China's expanding financial scale, improving services for the real economy, and increasing participation in global markets, providing insight into the evolving dynamics of China's financial system.

First, please LoginComment After ~