Global situation of undertakings for collective investment at the end of August 2025

This article contains AI assisted creative content

I. Overall situation

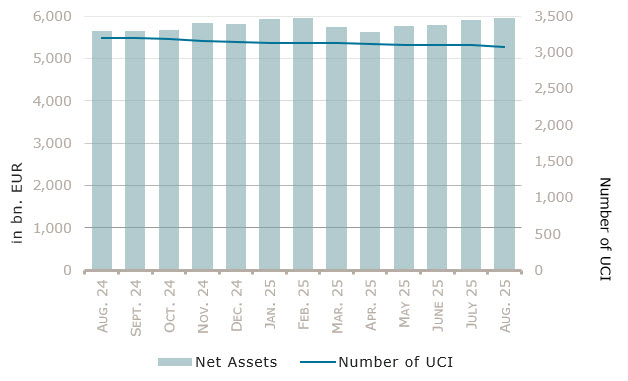

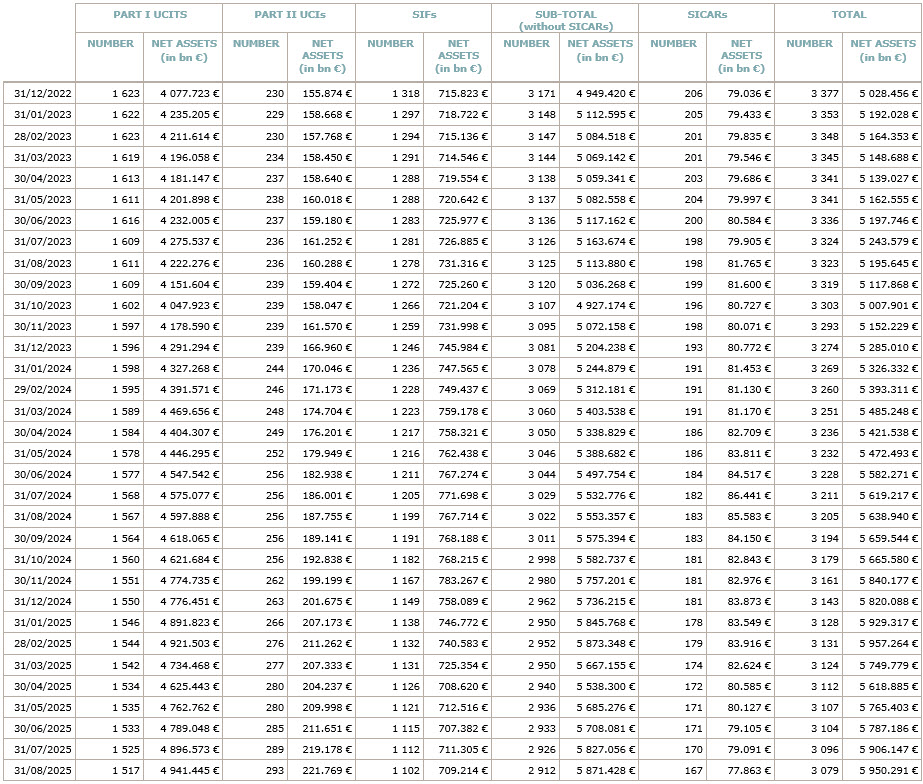

As at 31 August 2025, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,950.291 billion compared to EUR 5,906.147 billion as at 31 July 2025, i.e. an increase of 0.75% over one month. Over the last twelve months, the volume of net assets increased by 5.52%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 44.144 billion in August. This increase represents the sum of positive net capital investments of EUR 47.160 billion (0.80%) and of the negative development of financial markets amounting to EUR 3.016 billion (-0.05%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment taken into consideration totalled 3,079, against 3,096 the previous month. A total of 2,054 entities adopted an umbrella structure representing 12,330 sub-funds. Adding the 1,025 entities with a traditional UCI structure to that figure, a total of 13,355 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of August.

During the month, markets were mostly influenced by a shift in the Fed policy stance, with an increased focus on labour market rather than inflation, following the publication of economic data indicating a weakening US labour market. This resulted in increased expectations of interest rate cuts despite robust economic growth and persistently high inflation. Other notable developments raised concerns but had limited influence on markets, most notably a ruling by a US appeals court declaring illegal the reciprocal tariffs announced in April (although delaying enforcement to allow an appeal to the US Supreme Court), as well as renewed political pressures on Fed matters.

Against this backdrop, US equities experienced limited monthly losses, including a nearly 2% adverse currency effect, while European equities were unchanged, notably affected by expectations of a fall of the French government in September. Latin American equities rebounded from significant losses in July, with gains across the region including Brazil, which benefited from decelerating inflation. Finally, Japanese equities posted substantial gains supported by positive economic data.

In August, equity UCI categories registered an overall positive capital investment, with the largest monthly inflows in the categories Other, Eastern European and Japanese equities, whereas Latin American equities incurred significant outflows.

Development of equity UCIs during the month of August 2025*

Market variation in % | Net issues in % | |

| Global market equities | 0.09% | 0.04% |

| European equities | -0.05% | 0.24% |

| US equities | -0.41% | -0.06% |

| Japanese equities | 3.27% | 0.82% |

| Eastern European equities | -0.99% | 0.89% |

| Asian equities | 1.40% | -0.36% |

| Latin American equities | 5.70% | -1.27% |

Other equities | 0.39% | 0.90% |

* Variation in % of Net Assets in EUR as compared to the previous month

During the month, bond markets benefitted from a decline in US yields (given the negative relationship between yields and prices), particularly at the short end of the curve, driven by increased expectations of interest rate cuts. In Europe, yields were broadly stable, except in France where they increased due to political uncertainty. Against this backdrop, most fixed income UCI categories posted modest negative monthly losses, largely explained by unfavourable currency effects.

In August, fixed income UCIs registered an overall positive net capital investment from all categories except for the USD-denominated bonds category which incurred marginal outflows.

Development of fixed income UCIs during the month of August 2025*

Market variation in % | Net issues in % | |

EUR money market | 0,12% | 0,07% |

| USD money market | -1,71% | 6,11% |

| Global money market | -0,16% | 1,77% |

| EUR-denominated bonds | -0,06% | 0,82% |

| USD-denominated bonds | -0,11% | -0,06% |

| Global market bonds | -0,09% | 1,07% |

| Emerging market bonds | 0,36% | 0,97% |

High Yield bonds | -0,12% | 1,34% |

| Others | -0,14% | 1,96% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of August 2025*

| Market variation in % | Net issues in % | |

| Diversified UCIs | 0,17% | 0,45% |

| Funds of funds | -0,44% | 0,30% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following twelve undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- DEKA-INFRASTRUKTUR AKTIEN, 6, rue Lou Hemmer, L-1748 Senningerberg

- HQAM SICAV, 2, rue Gabriel Lippmann, L-5365 Munsbach

- MUNICH RE INVESTMENT PARTNERS FUNDS SICAV, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- PREMIUM SELECTION UCITS SICAV, 9, rue de Bitbourg, L-1273 Luxembourg

- PTAM SICAV, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- UNIEURORENTA UNTERNEHMENSANLEIHEN 2029 III, 3, Heienhaff, L-1736 Senningerberg

- UNIEURORENTA UNTERNEHMENSANLEIHEN 2031 II, 3, Heienhaff, L-1736 Senningerberg

UCI part II 2010 Law :

- BLACKSTONE PRIVATE MARKETS SOLUTIONS SCA-SICAV, 5, allée Scheffer, L-2520 Luxembourg

- DAWSON (LUX) S.A. SICAV–UCI PART II, 4, rue Peternelchen, L-2370 Howald

- DEUTSCHE BANK PRIVATE MARKETS SICAV, 10, rue du Château d’Eau, L-3364 Leudelange

- EURAZEO PRIME, 60, Avenue J.F. Kennedy, L-1855 Luxembourg

SIFs:

- CONTINO FONDS – FIS, 4, rue Thomas Edison, L-1445 Strassen

The following twenty-nine undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- ASIAN BOND OPPORTUNITIES UI, 15, rue de Flaxweiler, L-6776 Grevenmacher

- BLACKSTAR MULTIPLE OPPORTUNITIES, 4, rue Thomas Edison, L-1445 Strassen

- FRANKLIN TEMPLETON ALTERNATIVE FUNDS, 8A, rue Albert Borschette, L-1246 Luxembourg

- PROMONT, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- UNIABSOLUTERERTRAG, 3, Heienhaff, L-1736 Senningerberg

- UNIANLAGEMIX: KONSERVATIV, 3, Heienhaff, L-1736 Senningerberg

- UNIEM FERNOST, 3, Heienhaff, L-1736 Senningerberg

- UNIEURORENTA REAL ZINS, 3, Heienhaff, L-1736 Senningerberg

- UNIFAVORIT: AKTIEN EUROPA, 3, Heienhaff, L-1736 Senningerberg

- UNIRENTA CORPORATES, 3, Heienhaff, L-1736 Senningerberg

- UNIRESERVE, 3, Heienhaff, L-1736 Senningerberg

- UNIRESERVE: EURO-CORPORATES, 3, Heienhaff, L-1736 Senningerberg

- UNIVALUEFONDS: EUROPA, 3, Heienhaff, L-1736 Senningerberg

- VAM FUNDS (LUX), 46A, avenue John F. Kennedy, L-1855 Luxembourg

- VAM MANAGED FUNDS (LUX), 46A, avenue John F. Kennedy, L-1855 Luxembourg

SIFs:

- ANTIN INFRASTRUCTURE PARTNERS II SICAV-SIF, 15, boulevard F.W. Raiffeisen, L-2411 Luxembourg

- AXA IM MEZZOALTO, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- EUROPEAN FINANCE OPPORTUNITIES S.C.A. SICAV-SIF, 75, Parc d’Activités, L-8308 Capellen

- EVERGREEN SICAV-FIS, 6, avenue Marie-Thérèse, L-2132 Luxembourg

- FORESIGHT GROUP S.C.A. SICAV-SIF, 17, boulevard F.W. Raiffeisen, L-2411 Luxembourg

- IMPACT FINANCE FUND, 5, allée Scheffer, L-2520 Luxembourg

- LE MANS FONDS SCS, SICAV-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- NUVEEN ALTERNATIVE INVESTMENT FUNDS SICAV-SIF, 49, avenue John F. Kennedy, L-1855 Luxembourg

- SHERE LUX – SICAF-SIF, 5, rue Jean Monnet, L-2180 Luxembourg

- TECTUM S.A., SICAV-FIS, 5, rue Jean Monnet, L-2180 Luxembourg

- UBP DEDICATED SICAV-SIF, 287-289, route d’Arlon, L-1150 Luxembourg

SICARs:

- BWPE – FTL S.C.A., SICAR, 18, boulevard de la Foire, L-1528 Luxembourg

- CAPMAN LYNX SCA, SICAR, 15, boulevard F.W. Raiffeisen, L-2411 Luxembourg

- CATALYST ROMANIA S.C.A. SICAR, 8, rue Lou Hemmer, L-1748 Senningerberg

First, please LoginComment After ~