Global situation of undertakings for collective investment at the end of September 2025

I. Overall situation

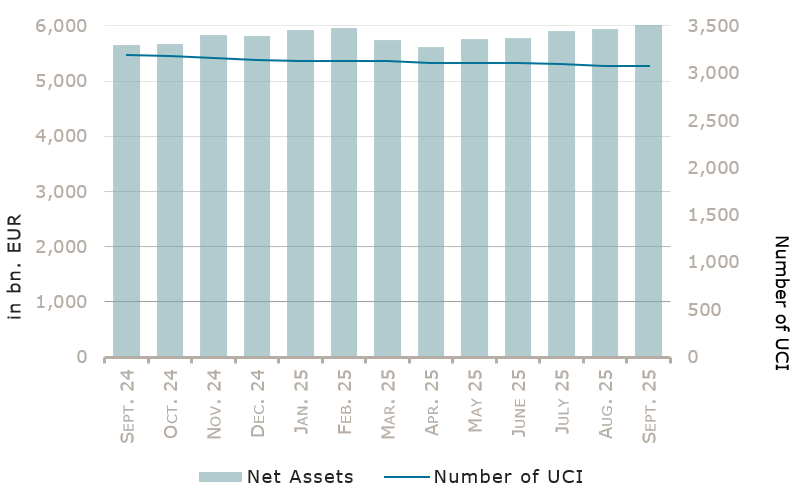

As at 30 September 2025, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 6,025.044 billion compared to EUR 5,950.291 billion as at 31 August 2025, i.e. an increase of 1.26% over one month. Over the last twelve months, the volume of net assets increased by 6.46%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 74.753 billion in September. This increase represents the sum of positive net capital investments of EUR 9.104 billion (0.15%) and of the positive development of financial markets amounting to EUR 65.649 billion (1.11%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment taken into consideration totalled 3,071, against 3,079 the previous month. A total of 2,052 entities adopted an umbrella structure representing 12,327 sub-funds. Adding the 1,019 entities with a traditional UCI structure to that figure, a total of 13,346 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of September.

Equity markets enjoyed another positive month, with several major indices reaching record highs, supported by the widely anticipated decision by the Fed to resume its monetary easing cycle, amid signs of labour market weakness and despite elevated inflation. Market performance was further supported by improved prospects for global economic growth, as well as optimism for artificial intelligence investments, notwithstanding growing concerns on elevated valuation levels and market concentration. Against this backdrop, the categories Latin American and Asian equities delivered the strongest monthly performances, as Emerging markets countries (such as Brazil or Mexico) are expected to benefit from a weak US dollar. In contrast, European equities posted lower gains amid limited improvement of the economic outlook in Germany and ongoing political instability in France.

In September, equity UCI categories registered an overall slight positive capital investment, with limited inflows in the main categories and outflows from the Eastern European and Asian equities categories.

Development of equity UCIs during the month of September 2025*

Market variation in % | Net issues in % | |

| Global market equities | 2.12% | 0.27% |

| European equities | 1.21% | 0.18% |

| US equities | 2.21% | 0.04% |

| Japanese equities | 1.62% | 0.01% |

| Eastern European equities | -0.16% | -1.79% |

| Asian equities | 4.82% | -0.59% |

| Latin American equities | 5.16% | 0.94% |

| Other equities | 3.61% | -0.06% |

* Variation in % of Net Assets in EUR as compared to the previous month

During the month, the Fed decided to cut rates by 25 bps, for the first time in 2025, and suggested that further monetary easing is likely this year. Conversely, the ECB decided to maintain its reference rates unchanged, as anticipated, with no indication of further cuts. Despite the divergences in monetary policy stances, both yield curves flattened: in the US driven by a fall in long term yields and in Europe from a rise in short terms yields. Credit spreads tightened amid a favourable investor sentiment. Against this backdrop, fixed income UCIs delivered positive monthly performances, including some negative currency effects, mostly notably the depreciation of the US dollar against euro by almost 1%.

In September, fixed income UCIs registered an overall positive net capital investment from all bonds categories whereas the EUR and Global money market categories incurred outflows.

Development of fixed income UCIs during the month of September 2025*

Market variation in % | Net issues in % | |

| EUR money market | 0.11% | -2.23% |

| USD money market | -0.60% | 0.33% |

| Global money market | -0.21% | -1.75% |

| EUR-denominated bonds | 0.30% | 0.46% |

| USD-denominated bonds | 0.06% | 0.17% |

| Global market bonds | 0.27% | 0.25% |

| Emerging market bonds | 0.67% | 1.17% |

| High Yield bonds | 0.16% | 0.42% |

| Others | 0.31% | 1.39% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of September 2025*

Market variation in % | Net issues in % | |

| Diversified UCIs | 1.14% | 0.00% |

| Funds of funds | 0.81% | 0.32% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

em

During the month under review, the following six undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- AURETAS COMPASS, 2, rue Gabriel Lippmann, L-5365 Munsbach

- FPNBCC SICAV LUX, 146, boulevard de la Pétrusse, L-2330 Luxembourg

UCI part II 2010 Law:

- FRANKLIN BSP PRIVATE MARKETS FUND (MASTER) SICAV SCSP, 19, rue de Bitbourg, L-1273 Luxembourg

- FRANKLIN BSP PRIVATE MARKETS FUND SICAV SA, 19, rue de Bitbourg, L-1273 Luxembourg

- HAMILTON LANE GLOBAL VENTURE CAPITAL AND GROWTH FUND, 3, rue Gabriel Lippmann, L-5365 Munsbach

- HANSEMERKUR DIGITAL INFRASTRUCTURE ELTIF S.C.A., SICAV, 1c, rue Gabriel Lippmann, L-5365 Munsbach

The following fourteen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- ABRDN SICAV III, 35A, avenue John F. Kennedy, L-1855 Luxembourg

- DJE CONSTANT MATURITY ITA GOV BOND FUND, 15, rue de Flaxweiler, L-6776 Grevenmacher

- LUX GLOBAL PLATFORM, 106, route d’Arlon, L-8210 Mamer

- LUXBRIDGE SICAV, 30, boulevard Royal, L-2449 Luxembourg

- SEB CONCEPT BIOTECHNOLOGY, 4, rue Peternelchen, L-2370 Howald

- SEB GLOBAL EQUAL OPPORTUNITY FUND, 4, rue Peternelchen, L-2370 Howald

UCI part II 2010 Law:

- BBGI GLOBAL INFRASTRUCTURE S.A., 6E, route de Trèves, L-2633 Senningerberg

SIFs:

- IRE-RE SA SICAV-SIF, 37A, avenue John F. Kennedy, L-1855 Luxembourg

- KIEGER FUND I, 5, Heienhaff, L-1736 Senningerberg

- NOMURA JAPAN BOND PRIMAL, 33, rue de Gasperich, L-5826 Hesperange

- SEPHIRA ASSET MANAGEMENT FUND SICAV-SIF, 94, rue du Grünewald, L-1912 Luxembourg

- UNIVEST III, 15, rue de Flaxweiler, L-6776 Grevenmacher

SICARs:

- EXPON VENTURES (S.C.A.) SICAR, 15, boulevard F.W. Raiffeisen, L-2411 Luxembourg

- HCAPITAL, SCA-SICAR, 2, rue d’Alsace, L-1122 Luxembourg

First, please LoginComment After ~