Insights on E-Commerce Opportunities in Indonesia: Positioning of Hong Kong Products

In March 2025, HKTDC Research published a consumer survey in six ASEAN markets, entitled ASEAN E-Commerce Opportunities: Insights on Consumer Behaviours and Positioning of Hong Kong Products. It evaluated the consumption behaviour of e‑shoppers in these markets, and their perception of Hong Kong brands and products. Using the results of the survey, this article analyses the e‑commerce landscape in Indonesia and aims to help Hong Kong companies position their retail e‑commerce business in this market.

Key highlights

-

Indonesia's retail e-commerce market is expected to grow by an average annual rate of 15% between 2025 and 2029.

-

Consumers in Indonesia are frequent online shoppers, making an average of 8.2 purchases per month.

-

During the survey period, consumer electronics (89%), cosmetics and personal care products (69%), and fashion items (66%) emerged as the three most popular product categories among online shoppers in Indonesia.

-

Product quality and brand image are among the most important considerations across most product categories for Indonesia's online shoppers. Other key factors influencing purchasing decisions are price promotion campaigns, product ingredients and customer services quality.

-

When considering purchasing new products or brands, online shoppers in Indonesia care most about brand image (64%), followed by attractive price or promotion (44%) and then value for money (43%).

-

Indonesia’s online shoppers are interested in foreign products, particularly in categories such as consumer electronics and luxury goods.

-

96% of survey respondents reported spending more during major festivals, with their expenditure rising by an average of 28%.

-

Shopee (on which 90% of respondents reported shopping) and Tokopedia (81%) are the two leading e-commerce platforms in Indonesia.

-

The main reasons online shoppers in Indonesia give for buying from e-commerce platforms are fast delivery (14%), promotion campaigns (14%) and informative description page (13%).

-

Reviews and ratings on e-commerce platforms were considered the most important source of product information for online shoppers in Indonesia (63%), followed by social media platforms (45%) and recommendations by family, relatives or friends (39%).

-

About one-third of respondents expect products to be reached on the same day, while another 47% anticipate next-day delivery service.

E-shoppers in Indonesia hold Hong Kong brands and products in high regard

-

Hong Kong brands are popular among e-consumers in Indonesia, with 73% of online shoppers having purchased a Hong Kong-sourced product in the past 12 months. Consumers aged 18-29 and 30-49 had a similarly strong tendency to buy Hong Kong products, higher than that of their older counterparts.

-

Online shoppers in Indonesia see Hong Kong products as less costly (43%), higher quality (35%) and more creative (34%).

-

The Hong Kong brands and products that e-consumers in Indonesia reported purchasing most often were consumer electronics (76%), fashion (35%) and cosmetics and personal care products (29%).

-

E-consumers in Indonesia tend to spend 65%, 48% and 22% more on consumer electronics, household groceries, and fresh and packaged food products, respectively.

Hong Kong companies are selling online in Indonesia

-

As a supplement to the above survey, HKTDC Research conducted a series of interviews with Hong Kong businesses that are currently selling their products to ASEAN consumers through online channels.1

-

More Hong Kong e-commerce sellers have been eyeing the Indonesian market in recent years amid a growing middle class and rising smartphone penetration. Interviewees noted that Hong Kong businesses should consider product differentiation, for instance through customisation, as a business strategy for the local market. Competing purely on the basis of price was viewed as impractical, given the intense competition in the market.

-

One particularly relevant case is a Hong Kong SME producing and selling jewellery and accessories by making extensive use of sustainable and upcycled materials. Apart from selling ready-made products on the brand’s official site, the company offers bespoke designs and production services to give customers deeper engagement with the brand’s designs and ethos, helping to create a long-term relationship between the customer and the brand.2

Survey findings highlight unique consumer preferences among online shoppers in Indonesia, offering valuable insights that businesses can harness for strategic advantage. These trends indicate that Hong Kong‑based companies and brands are well placed to tap into the expanding e‑commerce landscape across Indonesia and the wider ASEAN region.

I. Indonesia’s Retail E-commerce Market Overview

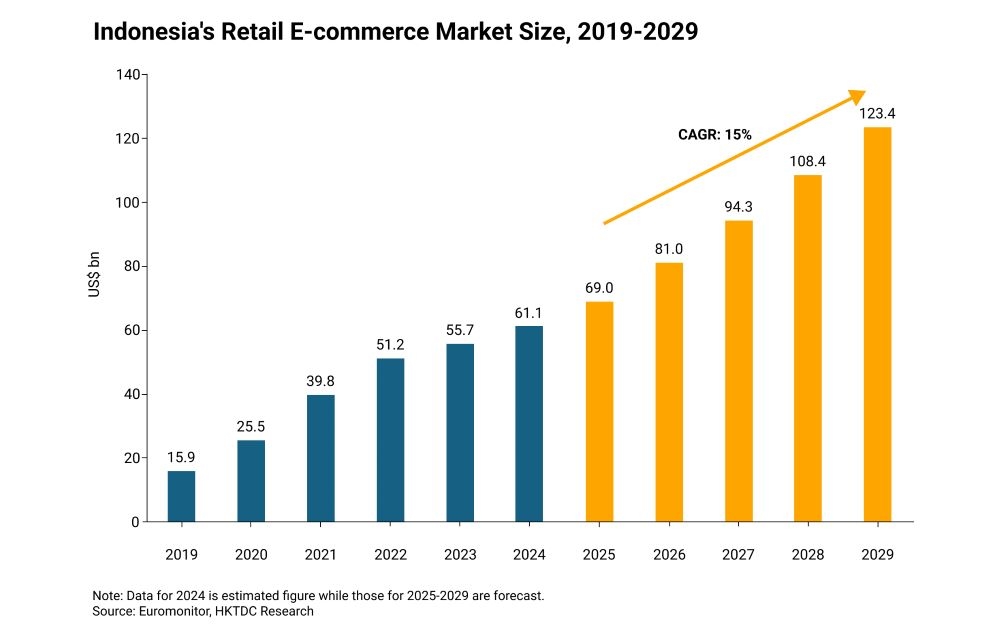

Significant growth of 15% in Indonesia retail e-commerce market is anticipated

The value of Indonesia’s retail e‑commerce market in 2024 was estimated to be US$61.1 billion. It is expected to grow to US$123.4 billion in 2029 from US$69.0 billion in 2025 – an average annual growth rate of 15% – according to projections by Euromonitor.

The de minimis value for goods imported into Indonesia is USD 3 (lowest among ASEAN-6)

Since January 2020, the de minimis value for importing goods into Indonesia has been fixed at USD 3. For products typically purchased by online shoppers, the import duties range from 0% to 40%. In addition, a Value‑Added Tax (VAT) of 12% is imposed on most imported goods.3 As for products such as alcoholic beverages, tobacco, and sugary drinks, excise tax will also be imposed.4

|

Indonesia |

Malaysia |

The |

Singapore |

Thailand |

Vietnam | |

|

De minimis value |

US$3 |

US$110 |

US$180 |

US$310 |

US$40 |

US$40 |

|

Sales taxes |

12% |

10% |

12% |

9% |

7% |

8% |

|

Import Duties5 |

0%-40% |

0%-30% |

0%-40% |

0% |

0%-30% |

0%-40% |

|

Note: Figures as of July 2025. | ||||||

II. Consumer preference and online shopping patterns in Indonesia

Middle-aged consumers are more likely to engage in online shopping

Consumers in Indonesia shopped online an average of 8.2 times per month. The 30‑49 age group made online purchases more frequently (9.5 times per month) than other age groups. The 18‑29 year‑olds also shopped online regularly (8.0 times per month). The group aged 50 and above made fewer online purchases (5.9 times a month).

|

Age Groups |

Average purchases per month |

|

18-29 |

8.0 |

|

30-49 |

9.5 |

|

50+ |

5.9 |

|

Overall |

8.2 |

|

N= 310. | |

Consumer electronics consistently ranked as the most purchased category

Consumer electronics6 (bought by 89% of those surveyed), cosmetics and personal care products (69%), and fashion (66%) are the most popular categories of product among online shoppers in Indonesia.

|

Online purchases by product category in the past 12 months |

(%) |

|

Consumer electronics |

89 |

|

Cosmetics and personal care products (such as shampoo, body wash, lotions, etc) |

69 |

|

Fashion (such as clothing, handbags, trendy brands, accessories and shoes, etc) |

66 |

|

Fresh and packaged food products |

60 |

|

Household groceries |

57 |

|

Sports related products (such as sports equipment, clothing & shoes, etc) |

47 |

|

Lifestyle products and houseware products |

44 |

|

Non-prescription medicine and healthcare supplements |

39 |

|

Toys and hobby items |

39 |

|

Pet products |

31 |

|

Baby and children’s products |

29 |

|

Luxury goods (such as jewellery, timepieces, etc) |

20 |

|

N =310. Top three ranked choices by respondents are highlighted, with darker highlights indicating a higher-ranking choice. | |

Product quality and brand image are the top priority when making online purchase decisions

In six out of 10 product categories, “product quality or efficacy” emerged as the top priority, including for lifestyle & houseware products (cited by 86% of respondents), sporting products (82%), consumer electronics (72%), luxury goods (68%), pet products (68%) and fashion (56%). This factor was also the second‑most important consideration for non‑prescription medicine and healthcare supplements (38%) and the third‑most important factor for toys and hobby items (48%).

“Brand image, word of mouth, or reputation” was identified as the most important factor for cosmetics and personal care products (66%), non‑prescription medicine and healthcare supplements (58%), and toys and hobby items (50%). It also ranked as the second‑most important factor across six out of 10 product categories, including sporting goods (66%), consumer electronics (56%), pet products (54%), lifestyle and houseware items (52%), luxury goods (52%), and baby and children’s products (38%). Additionally, it was considered the third‑most influential factor for fashion products (44%).

“Price promotion campaigns” was also an important consideration for online shoppers in Indonesia when making purchasing decisions. This is particularly the case for toys and hobby items, with 50% of the survey respondents considering it as the most important factor. It was seen as the third‑most important factor when purchasing consumer electronics (44%), lifestyle and houseware products (40%), sporting goods (40%) and luxury items (38%). Meanwhile, “product ingredients” was ranked as the most important factor in purchasing baby and children's products (44%). It also emerged as the third‑most crucial factor for cosmetics and personal care items (46%), as well as for non‑prescription medicines and healthcare supplements (30%).

Customer service quality was identified as the third‑most important factor when purchasing luxury goods (38%), baby and children’s products (36%), pet products (32%) and non‑prescription medicine and healthcare supplements (30%) online.

Product design, safety or suitability, and functionality or features are also influential factors in the purchase of selected products. Specifically, “product design” was ranked as the second‑most important consideration for fashion (50%), while “product safety” held the same rank for cosmetics and personal care items (50%). Lastly, “product functionality” was considered as the third‑most influential factor in the purchase of lifestyle and houseware products (40%).

Major factors considered when purchasing online

|

(%) |

Consumer electronics |

Fashion |

Cosmetics & personal care products |

Lifestyle & houseware products |

Sports goods |

Non-prescription medicine & healthcare Supplements |

Toys & hobby items |

Pet goods |

Baby & children’s goods |

Luxury goods |

|

Product quality or efficacy |

72 |

56 |

28 |

86 |

82 |

38 |

48 |

68 |

10 |

68 |

|

Brand image, word of mouth or reputation |

56 |

44 |

66 |

52 |

66 |

58 |

50 |

54 |

38 |

52 |

|

Price Promotion Campaigns |

44 |

36 |

32 |

40 |

40 |

16 |

50 |

26 |

34 |

38 |

|

Product Ingredients |

n.a. |

n.a. |

46 |

n.a. |

n.a. |

30 |

n.a. |

n.a. |

44 |

n.a. |

|

Customer services quality |

14 |

30 |

18 |

26 |

26 |

30 |

12 |

32 |

36 |

38 |

|

Product design or appearance |

6 |

50 |

4 |

8 |

12 |

10 |

32 |

10 |

28 |

6 |

|

Product Safety or suitability |

n.a. |

n.a. |

50 |

n.a. |

n.a. |

20 |

n.a. |

24 |

30 |

n.a. |

|

Product functionality or features |

26 |

42 |

6 |

40 |

20 |

2 |

6 |

10 |

16 |

2 |

|

After-sales services |

18 |

8 |

18 |

16 |

20 |

22 |

12 |

10 |

8 |

14 |

|

Return and Refund policies |

18 |

12 |

8 |

26 |

22 |

10 |

12 |

12 |

6 |

14 |

|

Base: Online shoppers in Indonesia (50 respondents per product category). The top three choices ranked by respondents are highlighted, with darker shading indicating a higher-ranking preference. | ||||||||||

Brand image plays a crucial role in influencing online purchases of new brands

When looking to purchase a new product or brand, e‑consumers in Indonesia care most about brand image, word of mouth or reputation (mentioned by 64% of respondents), attractive price / promotions (44%) and value for money (43%).

|

Key factors driving online purchases of a new brand/product |

(%) |

|

Brand - Brand image/ word of mouth/ reputation |

64 |

|

Price - Attractive price / promotions |

44 |

|

Product - Value for money |

43 |

|

Product - Unique product features or functions |

42 |

|

Promotion - Positive product reviews or ratings by platforms |

27 |

|

Product - Appealing product or packaging design |

17 |

|

Promotion - Recommended by friends or family |

15 |

|

Promotion - Recommended by experts |

12 |

|

Promotion - Large-scale advertising campaigns (such as bus wraps and billboards) |

8 |

|

Promotion - Free sample trial |

6 |

|

Promotion - Live broadcasting or live streaming |

6 |

|

Promotion - Celebrities or KOLs endorsement |

5 |

|

Product - Highly sought-after in overseas markets |

3 |

|

N=310. Top three ranked choices by respondents are highlighted, with darker highlights indicating a higher-ranking choice. | |

International brands are preferred in select product categories

Survey participants expressed a preference for foreign brands over local ones in two of the 12 product categories, namely consumer electronics and luxury goods.

|

Online Purchases by Product Category in the Past 12 Months (%) |

Local Brands (L) |

Foreign Brands (F) |

(F-L) |

|

Consumer electronics |

64 |

72 |

+8 |

|

Luxury goods |

76 |

78 |

+2 |

|

Sports related products |

76 |

76 |

0 |

|

Toys and hobby items |

86 |

68 |

-18 |

|

Fashion |

82 |

62 |

-20 |

|

Cosmetics and personal care products |

88 |

64 |

-24 |

|

Lifestyle and houseware products |

90 |

66 |

-24 |

|

Baby and children’s products |

94 |

68 |

-26 |

|

Non-prescription medicine & healthcare supplements |

88 |

48 |

-40 |

|

Pet products |

84 |

44 |

-40 |

|

Household groceries |

100 |

44 |

-56 |

|

Fresh and packaged food products |

96 |

38 |

-58 |

|

N =310. Top three ranked categories where foreign brands preferred over local brands by respondents are highlighted, with darker highlights indicating a higher-ranking choice. | |||

The festival season sparks a 28% surge in consumer spending

96% of respondents said they spend more during major festivals, with an average increase in spending of 28%.

|

Extra spending during major festivals |

(%) |

|

Yes |

96 |

|

Over 40% increase |

22 |

|

21%-40% increase |

42 |

|

11%-20% increase |

31 |

|

1%-10% increase |

3 |

|

Same as usual |

4 |

|

% increase (mean) |

28 |

|

N=310. Source: HKTDC Survey | |

Shopee and Tokopedia rank among the most widely used platforms for online shopping

Shopee and Tokopedia are the two leading e‑commerce platforms in the country. In addition to the large variety of products available on both platforms, their extensive logistics networks facilitate efficient product delivery, enhancing shoppers’ experience. While Shopee has been a leading e‑commerce marketplace across the region, Tokopedia’s collaboration with TikTok allows it to broaden its consumer base by combing social media and retail e‑commerce.

TikTok was the fourth‑most used e‑commerce platform in the survey, trailing Shopee, Tokopedia and Lazada. Despite the Indonesian government banning commercial transactions on social media platforms such as TikTok in September 2023, TikTok bought a controlling stake in Tokopedia, allowing purchases on TikTok to be handled by Tokopedia’s payment infrastructure.

Top 10 Platforms Used for Online Purchases in the Past 12 Months

|

Rank |

Platform |

(%) |

|

1 |

Shopee ID |

90 |

|

2 |

Tokopedia |

81 |

|

3 |

Lazada ID |

57 |

|

4 |

TikTok |

53 |

|

5 |

Blibli |

29 |

|

6 |

Bukalapak |

23 |

|

7 |

Zalora ID |

19 |

|

8 |

Matahari Mall |

13 |

|

9 |

Amazon |

10 |

|

10 |

Official brand website |

9 |

|

N = 310. | ||

Fast delivery and promotional campaigns are considered the most influential factors driving consumer purchases on e-commerce platforms

All survey respondents reported that they had used e‑commerce platforms to make purchases. The primary reasons respondents cited for making purchases through e‑commerce platforms were fast delivery (14%), promotional campaigns such as discount vouchers (14%) and informative product description pages (13%).

|

Reasons for Shopping Through E-Commerce Platforms |

(%) |

|

Faster delivery |

14 |

|

Launching promotion campaigns such as offering discount vouchers |

14 |

|

Product description page is informative |

13 |

|

Large variety of products including niche brands or unique items |

12 |

|

Presence of leading brands and reputable merchants |

10 |

|

Platform offering value-added services such as free delivery |

10 |

|

The return and refund process is simple and fast |

5 |

|

Real-time logistic tracking service |

5 |

|

The live broadcast content on the platform is rich and convincing |

4 |

|

Price guarantee such as 90-day price match guarantee |

4 |

|

Customer reward programs such as extra discount and priority purchase |

3 |

|

Fidelity policy |

3 |

|

User friendly interface |

3 |

|

Flexibility in choosing a courier company |

3 |

|

N= 310. Top three ranked choices by respondents are highlighted, with darker highlights indicating a higher-ranking choice | |

Authenticity is the main reason to buy from a brand’s official website

According to the survey, 81% of the respondents who shopped on official websites mentioned that it was because of the guarantee of getting authentic products. In addition, brand loyalty and getting customized products and services were other reasons.

|

Reasons for Shopping on a Brand’s Official Website |

(%) |

|

Authentic product |

81 |

|

Brand loyalty |

7 |

|

Offering customized products and services |

7 |

|

Customer loyalty programmes such as additional discount, priority purchase and cash rebates |

4 |

|

Selling at a lower price |

0 |

|

Brand website offering discount |

0 |

|

Price match guarantee |

0 |

|

N=27. Top three ranked choices by respondents are highlighted, with darker highlights indicating a higher-ranking choice. | |

Reviews and ratings on e-commerce platforms as the most influential source of product information for consumers

For e‑consumers in Indonesia, the most important way to collect product information is via reviews and ratings on e‑commerce platforms (cited by 63% of respondents), followed by social media platforms (45%) and recommendation by family, relatives or friends (39%).

|

Channels to collect product information |

(%) |

|

Reviews and ratings on e-commerce platform (such as Amazon, Shopee, Lazada) |

63 |

|

Social media platforms (e.g. Facebook and TikTok) |

45 |

|

Recommendation by family, relatives or friends |

39 |

|

Brand official websites or their official social media accounts |

35 |

|

Relevant articles on search engines such as Google |

25 |

|

Online/ Mobile ads |

23 |

|

Recommendations by experts/ KOL |

18 |

|

Staff at retail stores |

10 |

|

Email promotions |

4 |

|

N= 310. Top three ranked choices by respondents are highlighted, with darker highlights indicating a higher-ranking choice. | |

Almost one-third of respondents expect same-day delivery

32% of online shoppers expect same‑day delivery when purchasing through e‑commerce platforms, while another 47% want their products the day after placing orders.

|

Expected delivery times |

(%) |

|

To be delivered on the same day |

32 |

|

To be delivered on the next day |

47 |

|

To be delivered on the third day |

17 |

|

To be delivered within a week |

3 |

|

To be delivered in two weeks’ time |

0 |

|

Can accept it to be delivered longer than two weeks |

0 |

|

N=310. | |

III. Hong Kong brands in Indonesia

73% of survey respondents reported purchasing Hong Kong brands or products in the past 12 months. Among them, individuals aged 18‑29 and 30‑49 demonstrated a stronger preference for Hong Kong products compared with those aged 50 or above.

Purchasing Hong Kong Brands or Products in the Last 12 Months

|

Age Groups |

(%) |

|

18-29 |

74 |

|

30-49 |

74 |

|

50+ |

69 |

|

Overall |

73 |

|

N=310. | |

Consumer electronics are the most purchased Hong Kong product category in online shopping

The Hong Kong brands and products that respondents reported purchasing most often were consumer electronics (cited by 76%), fashion (35%), and cosmetics and personal care products (29%).

|

Hong Kong brands/products purchased over the past 12 months |

(%) |

|

Consumer electronics |

76 |

|

Fashion |

35 |

|

Cosmetics and personal care products |

29 |

|

Sports related products |

21 |

|

Toys and hobby items |

21 |

|

Lifestyle products and houseware products |

19 |

|

Fresh and packaged food products |

17 |

|

Non-prescription medicine and healthcare supplements |

15 |

|

Baby and children’s products |

14 |

|

Household groceries |

13 |

|

Luxury goods |

13 |

|

Pet products |

7 |

|

N=226. Top three ranked choices by respondents are highlighted, with darker highlights indicating a higher-ranking choice. | |

E-shoppers see Hong Kong brands and products as less costly, higher quality and more creative

When asked about their views on Hong Kong brands or products, 43% of respondents said they are less costly, 35% considered them of higher quality, and 34% found them to be more creative.

|

Consumer perceptions of Hong Kong brands/products |

(%) |

|

Hong Kong products are less costly |

43 |

|

Hong Kong products/brands are of higher quality |

35 |

|

Hong Kong products/brands are more creative |

34 |

|

Hong Kong brands are more trendy |

28 |

|

Hong Kong products use better material / more durable |

27 |

|

Hong Kong is the window for purchasing limited editions (such as co-branded models, trendy shoes) |

25 |

|

Hong Kong products/brands/companies are guaranteed to be authentic |

24 |

|

Have stronger confidence in Hong Kong products/brands/enterprises |

23 |

|

Hong Kong brands can blend Chinese and Western elements well (such as concepts and technique) |

21 |

|

Hong Kong is a great place to source rare products (e.g. second-hand cameras) |

20 |

|

Hong Kong products/brands have better safety standards |

19 |

|

N=310. Top three ranked choices by respondents are highlighted, with darker highlights indicating a higher-ranking choice. | |

E-consumers in Indonesia spend more on Hong Kong-sourced products across three key categories

The difference in the amount that e‑consumers in Indonesia spend on Hong Kong brands rather than on those from elsewhere is particularly marked in consumer electronics, household groceries, and fresh and packaged food products. According to the survey, they spent 65%, 48%, and 22% more on these categories, respectively.

|

Median expenditure per purchase (US$) |

All |

HK |

|

Consumer electronics |

37 |

61 |

|

Household groceries |

25 |

37 |

|

Fresh and packaged food products |

18 |

22 |

|

Luxury goods |

246 |

246 |

|

Sports related products |

92 |

31 |

|

Lifestyle and houseware products |

62 |

31 |

|

Cosmetics and personal care products |

37 |

25 |

|

Fashion |

31 |

31 |

|

Baby and children’s products |

31 |

22 |

|

Toys and hobby items |

31 |

20 |

|

Non-prescription medicine and healthcare supplements |

28 |

18 |

|

Pet products |

12 |

25 |

|

All = spending on products from all areas; HK = spending on Hong Kong brands and products. | ||

1 See HKTDC Research (2025) ‑ The ASEAN E-Commerce Marketing Strategies and Tactics: The Experts’ Opinion

2 See HKTDC Research (2025) ‑ niin Jewellery: A Sustainable Brand and Innovative Design to Anchor its Online Presence in Indonesia

3 As of June 2025, the statutory VAT rate in Indonesia is 12%. Meanwhile, the Indonesian government has introduced a tax base adjustment system, for most non‑luxury goods, the effective VAT rate is 11%.

4 For example, cigarettes are subject to an excise tax of up to 275% of the factory price (in addition to import duties) or 57% of the retail price. See DHL (2025) – Excise Tax in Indonesia and their implications for businesses

5 Depending on the types of imported goods, import duties can be as high as 150% for products such as spirits and alcohol in some of these countries. Import duties rates listed in the table above typically refer to consumer goods sold via retail e‑commerce.

6 This includes audio & video products, home appliances, computer & related accessories, smartphones, tablets & related accessories, e‑sports products and equipment (such as consoles, accessories and games) and other consumer electronic products and accessories (such as wearable electronic devices, power banks, electronic healthcare devices, etc).

First, please LoginComment After ~