Insights on E-Commerce Opportunities in the Philippines: Positioning of Hong Kong Products

In March 2025, HKTDC Research published a consumer survey in six ASEAN markets, entitled ASEAN E-Commerce Opportunities: Insights on Consumer Behaviours and Positioning of Hong Kong Products. It evaluated the consumption behaviour of e‑shoppers in these markets, and their perception of Hong Kong brands and products. Using the results of the survey, this article analyses the e‑commerce landscape in the Philippines and aims to help Hong Kong companies position their retail e‑commerce business in this market.

Key highlights

-

The Philippines' retail e-commerce market is expected to grow by an average annual rate of 15% between 2025 and 2029.

-

Consumers in the Philippines are frequent online shoppers, making an average of 8.4 purchases per month.

-

Consumer electronics (90%), fashion (74%), and cosmetics and personal care products (71%) were the top-selling categories in the Philippines in the past 12 months.

-

Product quality or efficacy is the most important consideration for shoppers making online purchase decisions in the Philippines. Brand image, product safety and price promotion campaigns are also important factors.

-

Buying new products or brands, e-consumers in the Philippines care most about value for money (68%), brand image, word of mouth or reputation (51%), followed by the presence of unique product features or functions (34%).

-

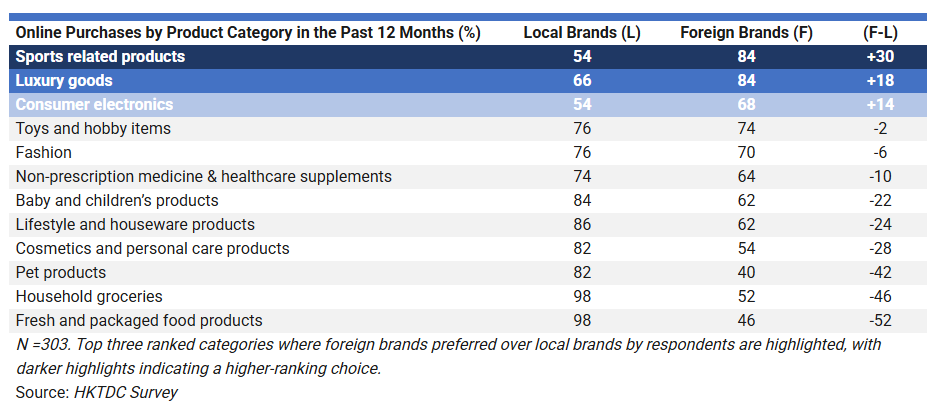

Respondents in the Philippines preferred foreign brands in three of the 12 product categories in the survey, namely, sports products, luxury goods and consumer electronics.

-

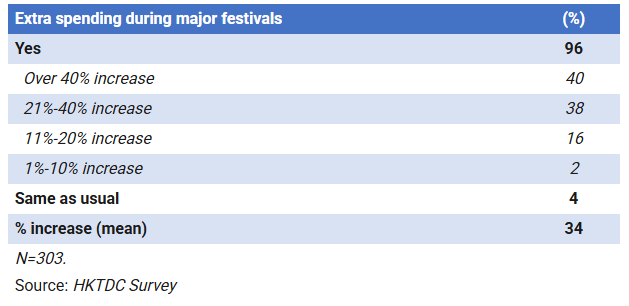

During major festivals, 96% of respondents reported that they spent more, with an average rise of 34%.

-

Shopee (with which 91% respondents shopped) and Lazada (88%) are the two leading e-commerce platforms in the Philippines.

-

The main reasons that consumers in the Philippines favour e-commerce platforms include a large variety of products (16%), promotion campaigns (15%) and informative product descriptions (15%).

-

Reviews and ratings on e-commerce platforms were deemed the most important information source for online shoppers in the Philippines looking for product information (64%), followed by social media platforms (52%) and recommendations by family, relatives or friends (46%)

-

More than 70% of online shoppers in the Philippines expect delivery within three days after placing orders, while 6% of them anticipate same-day service.

Shoppers in the Philippines hold strong recognition and trust on Hong Kong brands

-

Hong Kong brands are popular among e-consumers in the Philippines, with 69% of online shoppers having purchased a Hong Kong-sourced product in the past 12 months. Consumers aged 18-29 had a higher tendency to buy Hong Kong products than those in other age cohorts.

-

E-consumers in the Philippines see Hong Kong products as more trendy (41%), less costly (40%) and higher quality (34%).

-

Hong Kong brands and products that e-consumers in the Philippines reported purchasing most often were consumer electronics (71%) followed by fashion (52%) and cosmetics and personal care products (37%).

-

E-consumers in the Philippines show a strong preference for Hong Kong-branded consumer electronics, as they are willing to spend extra (about 43%) compared with similar products from elsewhere.

Hong Kong companies are eyeing the Philippines e-commerce market

-

As a supplement to the above survey, HKTDC Research conducted a series of interviews with Hong Kong businesses that are currently selling their products to ASEAN consumers through online channels.1

-

Some of these business owners are targeting the Philippines’ consumer market because of the country’s rapid economic growth, and hence stronger purchasing power.2

-

Meanwhile, given the archipelagic landscape of the country, product delivery can be challenging especially for SMEs. Businesses are advised to work with e-commerce platforms and/or logistics service providers, with more extensive transportation networks.

Survey findings highlight clear preferences among online shoppers in the Philippines, offering valuable insights that businesses can harness to inform strategic decisions. These results indicate that Hong Kong‑based companies and brands are well placed to capitalise on the expanding e‑commerce landscape in both the Philippines and the wider ASEAN region.

I. The Philippines retail e-commerce market overview

The Philippines’s retail e-commerce market is expected to expand by 15% annually

The value of the Philippines’ retail e‑commerce market in 2024 was estimated to be US$11.6 billion. It is expected to grow to US$23.7 billion in 2029 from US$13.7 billion in 2025 – an average annual growth rate of 15% – according to projections by Euromonitor.

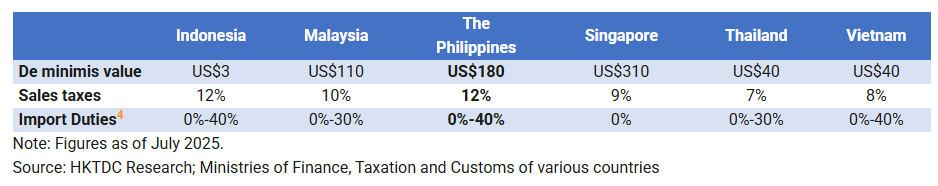

Goods imported to the Philippine are subjected to import duties and VAT

The Philippine government generally imposes ad valorem import duties on goods entering the country. For most products commonly purchased by online shoppers, import duty rates range from 0% to 40%. The country’s de minimis threshold is PHP10,000 (US$180), meaning goods valued below this amount are typically exempt from import duties. In addition, imports are subject to a 12% Value‑Added Tax (VAT), regardless of their value. The government also imposes excise taxes on specific goods such as tobacco products.3

De minimis values, sales taxes and import duties in the ASEAN-6

|

II. Consumer preference and online shopping patterns in the Philippines

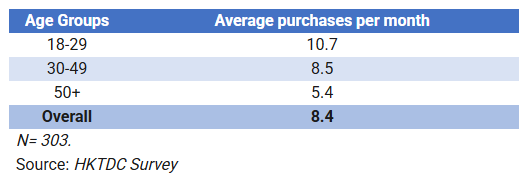

Younger demographics show a greater tendency to shop online

Consumers in the Philippines shopped online an average of 8.4 times per month. Younger cohorts were more frequent online shoppers than older ones. The 18‑29 age group made purchases most often, averaging 10.7 times per month. Those aged 30‑49 also shopped frequently, with an average of 8.5 times per month. In contrast, consumers aged 50 and above made significantly fewer online purchases, averaging just 5.4 times per month.

|

Consumer electronics are the leading product type in e-commerce transactions

Consumer electronics5 (bought by 90% of those surveyed), fashion (74%), and cosmetics and personal care products (71%) are the most popular categories of product among online shoppers in the Philippines.

|

Product quality as the top consideration when making online buying decisions

In eight out of 10 product categories, “product quality or efficacy” emerged as the most important factor when making purchasing decisions, including fashion (cited by 88% of respondents), sporting products (also 88%), lifestyle & houseware products (80%), toys & hobby items (74%), consumer electronics (70%), luxury goods (64%), pet products (62%) and cosmetic and personal care products (56%). It is also the second‑most influential factor driving the purchases of non‑prescription medicine and healthcare supplements (50%).

“Brand image, word of mouth, and reputation” stood out as another leading factor influencing purchase decisions, particularly for non‑prescription medicines and healthcare supplements, cited by 54% of respondents. It also ranked as the second‑most important consideration when buying luxury goods (58%), consumer electronics (54%), sporting goods (50%), toys and hobby items (44%), fashion (42%), and baby and children’s items (42%). It was also the third‑most influential factor for cosmetics and personal care products (40%) and pet products (36%).

“Product safety and suitability” emerged as another key consideration, especially when buying baby and children’s products, with 58% of respondents identifying it as the most important factor. It also ranked as the second‑most influential driver of purchase decisions among e‑consumers in the Philippines for cosmetics and personal care items (50%), non‑prescription medicines and healthcare supplements (50%) and pet products (50%).

“Price promotion campaigns” is seen as the second‑most crucial factor in the purchase of lifestyle and houseware products (40%). It also ranks as the third‑ most influential factor for online shopping in sporting goods (38%) and consumer electronics (30%). “Product design” was considered an impactful factor when purchasing toys and hobby products (40%), fashion items (34%), as well as baby and children’s goods (30%). Online shoppers also emphasised product functionality or features when buying lifestyle and houseware products (34%) and the quality of customer service when purchasing luxury goods (40%).

Major factors considered when purchasing online

|

(%) |

Consumer electronics |

Fashion |

Cosmetics & personal care products |

Lifestyle & houseware products |

Sports goods |

Non-prescription medicine & healthcare Supplements |

Toys & hobby items |

Pet goods |

Baby & children’s goods |

Luxury goods |

|

Product quality or efficacy |

70 |

88 |

56 |

80 |

88 |

50 |

74 |

62 |

26 |

64 |

|

Brand image, word of mouth or reputation |

54 |

42 |

40 |

30 |

50 |

54 |

44 |

36 |

42 |

58 |

|

Product safety or suitability |

n.a. |

n.a. |

50 |

n.a. |

n.a. |

50 |

n.a. |

50 |

58 |

n.a. |

|

Price promotion campaigns |

30

|

16 |

26 |

40 |

38 |

28 |

28 |

32 |

16 |

22 |

|

Product design or appearance |

16 |

34 |

8 |

26 |

32 |

2 |

40 |

10 |

30 |

30 |

|

Product functionality or features |

24 |

30 |

4 |

34 |

18 |

4 |

4 |

4 |

6 |

6 |

|

Customer services quality |

22 |

28 |

20 |

26 |

18 |

10 |

20 |

26 |

26 |

40 |

|

Return and refund policies |

20 |

20 |

12 |

28 |

22 |

14 |

30 |

12 |

14 |

26 |

|

After-sales services |

10 |

8 |

12 |

20 |

22 |

8 |

6 |

20 |

14 |

12 |

|

Product ingredients |

n.a. |

n.a. |

30 |

n.a. |

n.a. |

28 |

n.a. |

n.a. |

26 |

n.a. |

|

N = 50 respondents per product category. Note: n.a. means no data is available for the entry. The top three choices ranked by respondents are highlighted, with darker shading indicating a higher-ranking preference. | ||||||||||

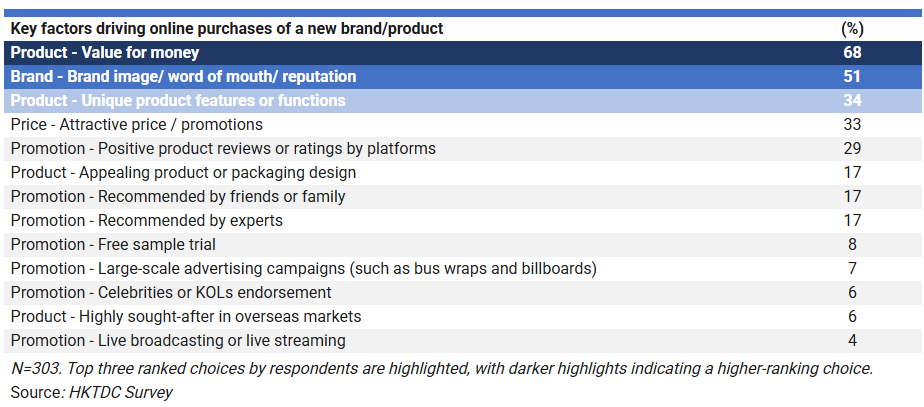

When buying from a new brand online, shoppers prioritise value for money

When looking to purchase a new product or brand, e‑consumers in the Philippines care most about value for money (mentioned by 68% of respondents), brand image, word of mouth or reputation (51%) and the presence of unique product features or functions (34%).

|

Online shoppers in the Philippines favour foreign brands in some product categories

Respondents expressed a preference for foreign brands in categories such as sports‑related products, luxury goods, and consumer electronics.

| |||

Average spending rises by 34% during major festivals

96% of respondents said they spend more during major festivals, with an average increase in spending of 34%.

|

Shopee, Lazada and TikTok are the most popular platforms for online shopping

Shopee and Lazada are the two leading e‑commerce platforms in the Philippines, both offering a wide range of products including electronics, fashion, cosmetics and lifestyle goods. Shopee stands out for its mobile‑first strategy, leveraging the Philippines’ rising smartphone penetration, while Lazada distinguishes itself with LazMall, a dedicated space where only official brand owners and authorized distributors can sell, ensuring product authenticity. Both platforms have also recently implemented Buy Now, Pay Later (BNPL) options, allowing customers to pay for their purchases in instalments.6

TikTok, a video‑based social media platform owned by a Chinese tech company, ranks third in terms of popularity. It has successfully merged entertainment with e‑commerce by enabling manufacturers and individual sellers to connect with potential buyers through livestreaming that encourages impulse purchases. This feature also fosters a secure and engaging shopping experience by offering a curated selection of verified online retailers and ensuring access to genuine, high‑quality products.

Top 10 Platforms Used for Online Purchases in the Past 12 Months

Large variety of products is the key reason for shopping via e-commerce platforms

All survey respondents reported that they had used e‑commerce platforms to make purchases. They cited a large variety of products (16%), promotional campaigns (15%), and informative product descriptions (15%) as the top reasons for shopping on e‑commerce platforms.

|

Reasons for Shopping Through E-Commerce Platforms |

(%) |

|

Large variety of products including niche brands or unique items |

16 |

|

Launching promotion campaigns such as offering discount vouchers |

15 |

|

Product description page is informative |

15 |

|

Faster delivery |

11 |

|

Presence of leading brands and reputable merchants |

7 |

|

Platform offering value-added services such as free delivery |

7 |

|

User friendly interface |

6 |

|

Customer reward programs such as extra discount and priority purchase |

6 |

|

The return and refund process is simple and fast |

5 |

|

Price guarantee such as 90-day price match guarantee |

4 |

|

Real-time logistic tracking service |

3 |

|

The live broadcast content on the platform is rich and convincing |

3 |

|

Flexibility in choosing a courier company |

2 |

|

Fidelity policy |

1 |

|

N= 303. Top three ranked choices by respondents are highlighted, with darker highlights indicating a higher-ranking choice. | |

Shoppers turn to official brand websites mainly to ensure authenticity

17% of the respondents in the survey bought items on brands’ official websites during the survey period. These were likely to be luxury goods or products with higher value, which may explain why respondents considered the guarantee of getting an authentic product the primary reason to shop on official websites (cited by 54%).

|

Reasons for Shopping on a Brand’s Official Website |

(%) |

|

Authentic product |

54 |

|

Selling at a lower price |

16 |

|

Price match guarantee |

12 |

|

Customer loyalty programmes such as additional discount, priority purchase and cash rebates |

8 |

|

Brand loyalty |

4 |

|

Offering customized products and services |

4 |

|

Brand website offering discount |

2 |

|

N=50. Top three ranked choices by respondents are highlighted, with darker highlights indicating a higher-ranking choice. | |

E-commerce reviews and ratings serve as the primary source of product insights for consumers

For e‑consumers in the Philippines, the most important way to collect product information is via reviews and ratings on e‑commerce platforms (cited by 64% of respondents), followed by social media platforms (52%) and recommendation by family, relatives or friends (46%).

|

Channels to collect product information |

(%) |

|

Reviews and ratings on e-commerce platform (such as Amazon, Shopee, Lazada) |

64 |

|

Social media platforms (e.g. Facebook and TikTok) |

52 |

|

Recommendation by family, relatives or friends |

46 |

|

Brand official websites or their official social media accounts |

32 |

|

Relevant articles on search engines such as Google |

20 |

|

Recommendations by experts/ KOL |

17 |

|

Online/ Mobile ads |

15 |

|

Staff at retail stores |

10 |

|

Email promotions |

4 |

|

N= 303. Top three ranked choices by respondents are highlighted, with darker highlights indicating a higher-ranking choice. | |

More than two-thirds of online shoppers expect their orders to be delivered within three days

About one‑third of respondents expect products to be delivered no longer than one day after they placed orders, while some of them even prefer same‑day delivery. Another 35% expect delivery on the third day. In other words, more than two‑third of respondents from the Philippines expect to receive their orders within three days of placing orders.

|

Expected delivery times |

(%) |

|

To be delivered on the same day |

6 |

|

To be delivered on the next day |

28 |

|

To be delivered on the third day |

35 |

|

To be delivered within a week |

29 |

|

To be delivered in two weeks’ time |

1 |

|

Can accept it to be delivered longer than two weeks |

0 |

|

N=303. | |

III. Hong Kong brands in the Philippines

69% respondents reported purchasing Hong Kong brands or products over the past 12 months. Among them, individuals aged 18‑29 showed the highest preference, followed by those aged 30‑49, while interest on Hong Kong brands or products dropped significantly among the 50+ age group.

Purchasing Hong Kong Brands or Products in the Last 12 Months

|

Age Groups |

(%) |

|

18-29 |

78 |

|

30-49 |

73 |

|

50+ |

49 |

|

Overall |

69 |

|

N=303. | |

Among Hong Kong products, consumer electronics are the most frequently bought online

The Hong Kong brands and products that respondents reported purchasing most often were consumer electronics (cited by 71% of respondents), fashion (52%) and cosmetics and personal care products (37%).

|

Hong Kong brands/products purchased over the past 12 months |

(%) |

|

Consumer electronics |

71 |

|

Fashion |

52 |

|

Cosmetics and personal care products |

37 |

|

Lifestyle products and houseware products |

29 |

|

Toys and hobby items |

24 |

|

Baby and children’s products |

22 |

|

Luxury goods |

19 |

|

Household groceries |

18 |

|

Sports related products |

16 |

|

Fresh and packaged food products |

15 |

|

Non-prescription medicine and healthcare supplements |

12 |

|

Pet products |

11 |

|

N=209. Top three ranked choices by respondents are highlighted, with darker highlights indicating a higher-ranking choice. | |

Consumers shopping online regard Hong Kong brands as more trendy, less costly and higher quality

When asked about their views on Hong Kong brands or products, 41% of respondents said they are more trendy, 40% considered them less costly, and 35% believed they are of higher quality.

|

Consumer perceptions of Hong Kong brands/products |

(%) |

|

Hong Kong brands are more trendy |

41 |

|

Hong Kong products are less costly |

40 |

|

Hong Kong products/brands are of higher quality |

34 |

|

Hong Kong brands can blend Chinese and Western elements well (such as concepts and technique) |

30 |

|

Hong Kong products/brands are more creative |

25 |

|

Hong Kong products use better material / more durable |

25 |

|

Hong Kong is the window for purchasing limited editions (such as co-branded models, trendy shoes) |

24 |

|

Hong Kong products/brands/companies are guaranteed to be authentic |

23 |

|

Hong Kong products/brands have better safety standards |

21 |

|

Hong Kong is a great place to source rare products (e.g. second-hand cameras) |

19 |

|

Have stronger confidence in Hong Kong products/brands/enterprises |

17 |

|

N=303. Top three ranked choices by respondents are highlighted, with darker highlights indicating a higher-ranking choice. | |

Online shoppers in the Philippines spend more on Hong Kong consumer electronics

The difference in the amount that e‑consumers in the Philippines spend on Hong Kong brands rather than on those from elsewhere is particularly marked in consumer electronics. According to the survey, they spent 43% more on this product category.

|

Median expenditure per purchase (US$) |

All |

HK |

|

Consumer electronics |

60 |

86 |

|

Luxury goods |

86 |

86 |

|

Sports related products |

86 |

60 |

|

Lifestyle and houseware products |

86 |

51 |

|

Household groceries |

86 |

51 |

|

Fresh and packaged food products |

60 |

34 |

|

Baby and children’s products |

34 |

34 |

|

Pet products |

26 |

34 |

|

Fashion |

51 |

26 |

|

Toys and hobby items |

34 |

26 |

|

Non-prescription medicine and healthcare supplements |

17 |

21 |

|

Cosmetics and personal care products |

34 |

17 |

|

All = spending on products from all areas; HK = spending on Hong Kong brands and products. | ||

1 See HKTDC Research (2025) ‑ The ASEAN E-Commerce Marketing Strategies and Tactics: The Experts’ Opinion

2 See HKTDC Research (2025) ‑ Leveraging on Third-Party Marketplace to Sell in ASEAN

3 For example, a levy of PHP52 (US$1) is charged per pack of tobacco of 20 units. Starting from January 2024, the rate will be increased by 5% every year thereafter. See PWC (2025) – Philippines: Corporate - Other taxes

4 Depending on the types of imported goods, import duties can be as high as 150% for products such as spirits and alcohol in some of these countries. Import duties rates listed in the table above typically refer to consumer goods sold via retail e‑commerce.

5 This includes audio & video products, home appliances, computer & related accessories, smartphones, tablets & related accessories, e‑sports products and equipment (such as consoles, accessories and games) and other consumer electronic products and accessories (such as wearable electronic devices, power banks, electronic healthcare devices, etc).

6 See Euromonitor (2025) – Retail E‑commerce in the Philippines

First, please LoginComment After ~