time:

2024-08-27 10:42:53

views:

29447

MAS requires a digital full bank (DFB) to progressively build up its business model and risk management capabilities as it grows.

time:

2023-08-09 16:25:00

views:

74840

Total Bank Deposits increased by 2.8%, rising from AED 2,242.3 billion at the end of February 2023 to AED 2,306.0 billion at the end of March 2023.

time:

2023-06-13 14:58:00

views:

54616

time:

2023-06-07 08:44:31

views:

62281

time:

2023-01-12 08:35:53

views:

64762

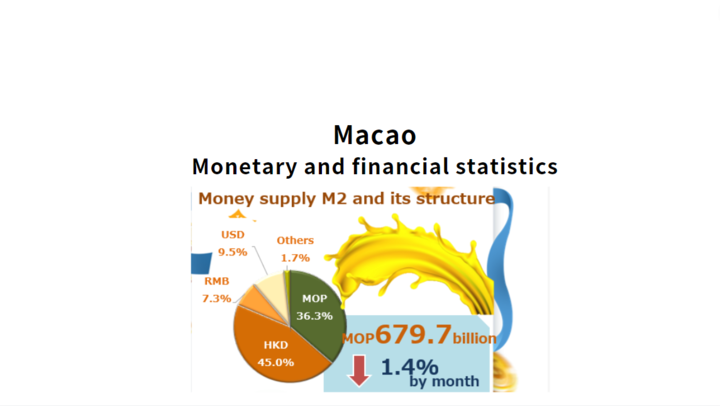

According to statistics released today by the Monetary Authority of Macao, broad money supply retreated in September. Meanwhile, resident deposits fell from a month ago whereas loans to residents posted an increase.

time:

2022-11-04 08:00:00

views:

113495

According to statistics released today by the Monetary Authority of Macao, broad money supply continued to grow in August. Meanwhile, both resident deposits and loans increased from a month earlier.

time:

2022-10-08 08:00:00

views:

89857

The inversion of medium and long-term deposit rates has revealed banks' wish to reduce the cost of liabilities.