Results of Finnish banks’ stress tests – banks’ resilience good, but a significant weakening of the operating environment would erode buffers

The stress tests for Finnish banks were conducted by the European Banking Authority (EBA), the European Central Bank (ECB) and the Financial Supervisory Authority (FIN-FSA). The stress-testing exercise covers the three years from 2023 to 2025 and includes a baseline scenario and an adverse scenario.

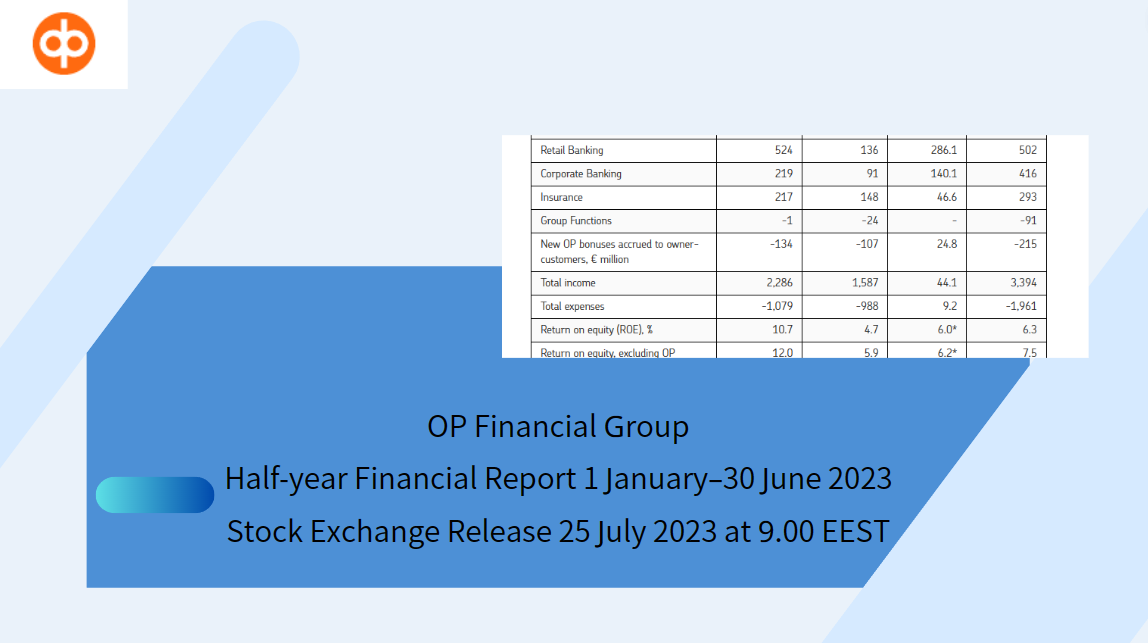

Of Finnish banks subject to European Central Bank (ECB) supervision, OP Financial Group and Nordea participated in the EBA stress test. In the adverse scenario, Nordea's CET1 ratio falls by 3.3 percentage points, to 13.1%, and OP Financial Group's CET1 ratio falls by 5.5 percentage points, to 12.0%.

Parallel to the EBA stress tests, the ECB conducted its own stress test for banks it directly supervises but which are not included in the EBA-led stress test sample. Of Finnish credit institutions, Municipality Finance participated in this stress test. The EBA has published more detailed information on the stress test results of Nordea and OP Financial Group, and the ECB has published some key figures of Municipality Finance.

Capital buffers of smaller Finnish banks reasonable

The FIN-FSA conducted a stress test in Finland covering the eight smaller banks and groups that due to their size are subject to the FIN-FSA's direct supervision. These were Alisa Bank, Aktia Bank, Oma Savings Bank, POP Bank Group, S-Bank, Mortgage Society of Finland, the Savings Banks Group and Bank of Åland.

The results show that the average capital position of the smaller Finnish banks remains good also in the adverse scenario. The average Common Equity Tier 1 (CET1) ratio fell in the adverse scenario by 3.8 percentage points, to 11.4%. However, the capital ratios differed considerably between the banks.

In the baseline scenario, banks improve their capital positions. Banks' profits improve primarily as a result of strong growth in net interest income.

Stress tests conducted with an exceptionally severe adverse scenario and a common methodology

The stress tests measured the impact of an unlikely but plausible strong weakening in the operating environment on banks’ profits and capital ratios. The scenarios included key variables of the real economy and interest-rate markets. The baseline scenario is based on the December 2022 projections from the ECB and the euro area national central banks.

The adverse scenario was exceptionally severe this time. Deglobalisation of the world economy and a new outbreak of COVID-19 were assumed to lead to supply chain disruptions and a decline in GDP growth. Under the scenario, Finland's real GDP contracts by 3.6% in 2023 and by 3.3% in 2024, but returns to growth in 2025 (+1.0%). Inflation is high and is accompanied by lower private consumption, higher interest rates and a decline in real-estate prices.

Under the stress tests, each bank uses a common framework and methodology to assess the impact on its own profits and capital position based on figures at the end of 2022. The scenarios also feature simplifying assumptions and constraints that would not hold in reality.

Supervisory authorities will apply the stress test results as an input to the supervisory review and evaluation process (SREP). The SREP process is designed to ensure that supervised entities have sufficient own funds to cover material risks.

First, please LoginComment After ~